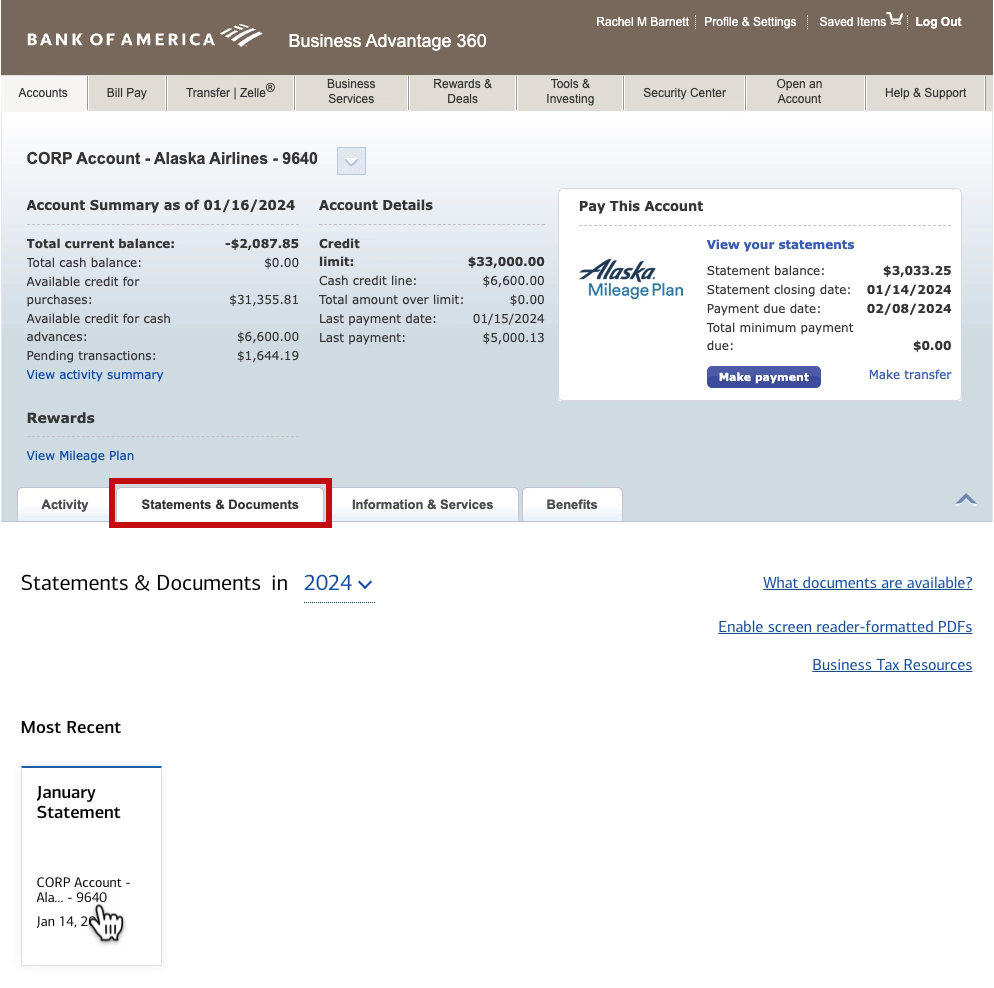

BoA Website & Corporate Credit Cards

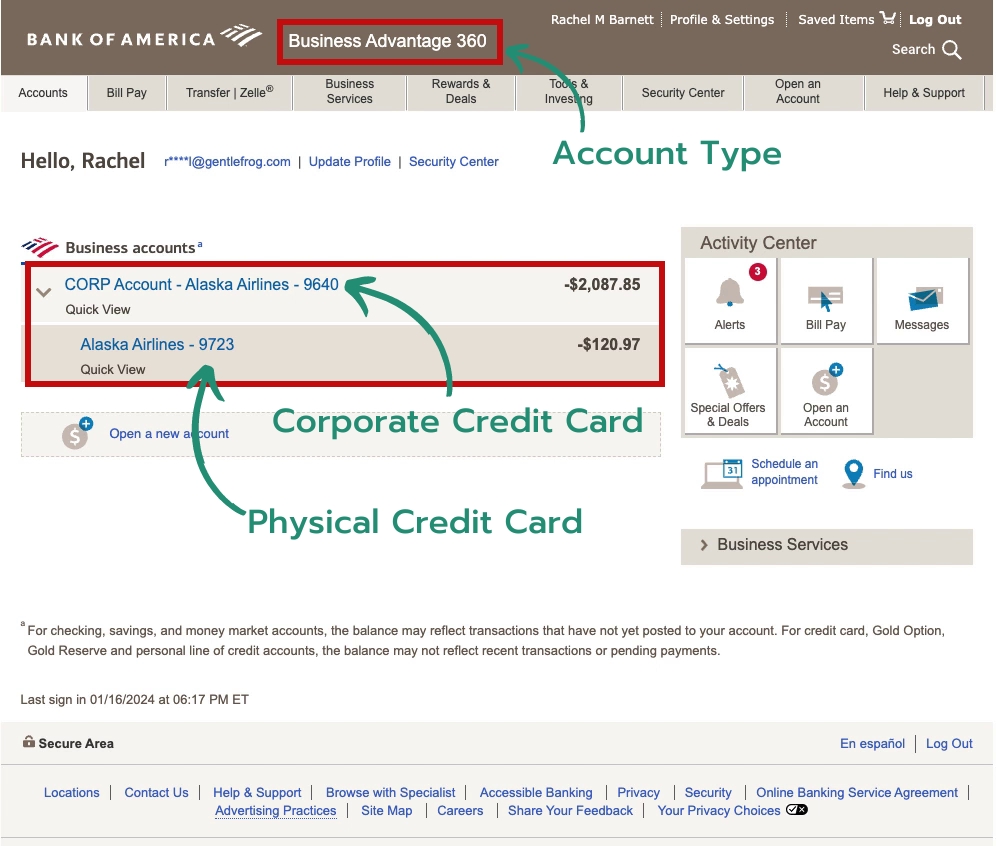

When I log into BoA at the top of the screen it says Business Advantage 360. That’s the type of account I have.

Further down under Business Accounts it lists my Alaska Airlines branded corporate credit card with an account number ending in 9640.

What I have in my pocket is a card ending 9723.

When I make payments they get applied to the corporate account ending in 9640. All charges get applied to the physical credit card, 9723.

Normally these would not have negative values. Let’s take a look at the account summaries to see what’s going on.

Physical CC Account Summary

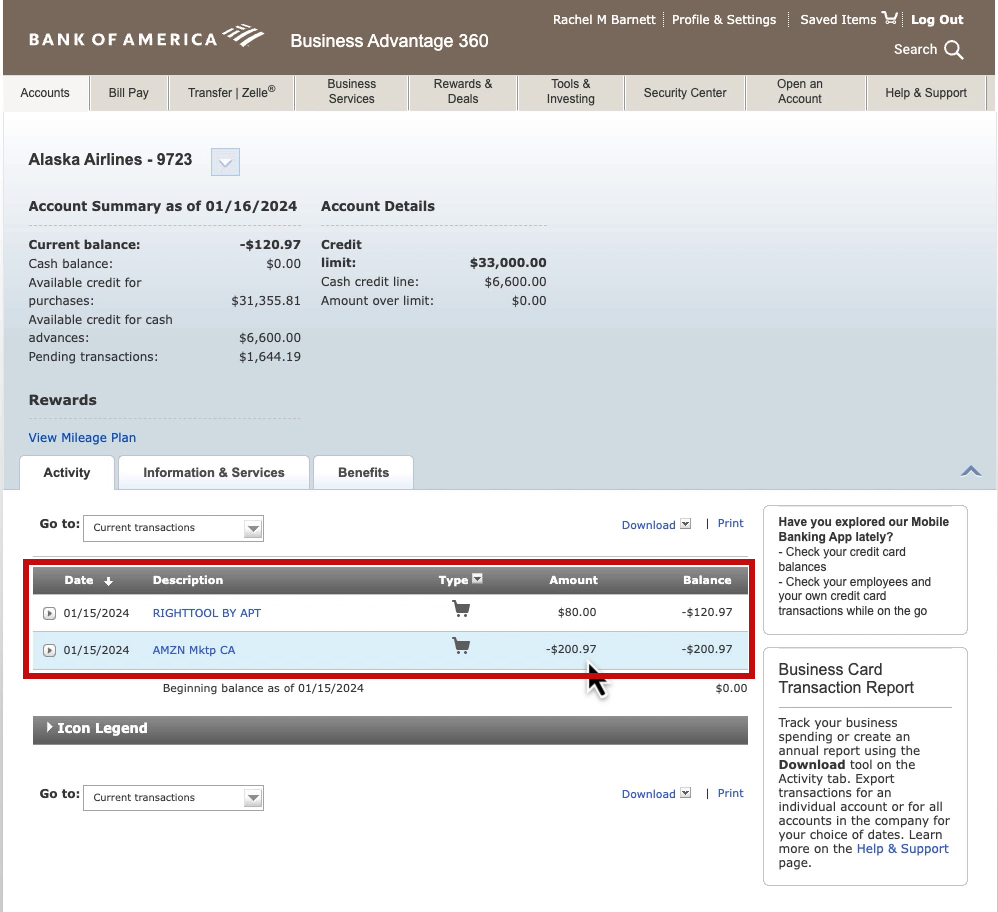

If I click on the card ending in 9723 it opens the Account Summary.

In the Activity tab, it shows a list of transactions.

The first transaction is a charge for the RightTool Chrome extension.

The second transaction is a refund from Amazon. This is why I have a negative balance, because of the refund.

This card has a $0.00 beginning balance. That’s because every month the total, no matter how much, gets rolled into the corporate account.

Corporate Account Summary

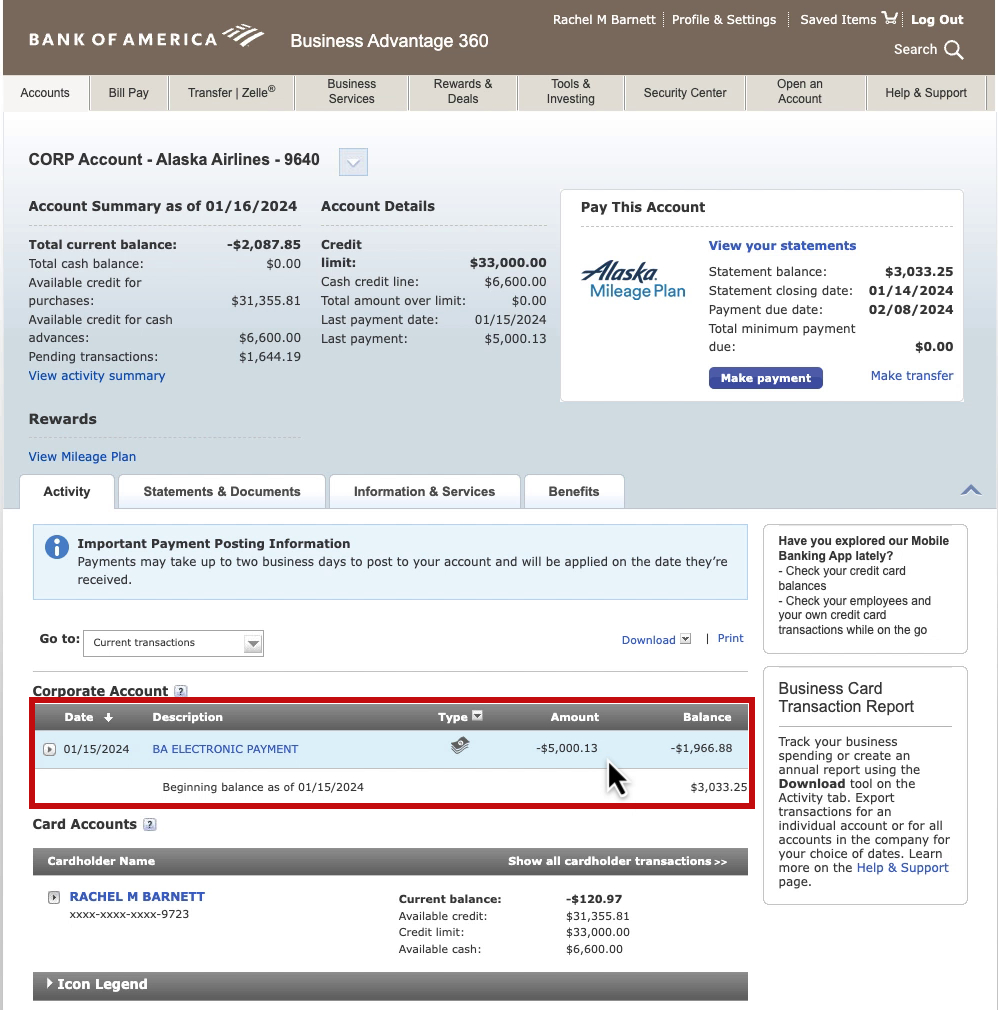

If I switch over to the Corporate account you can see it has a balance of -$1,966.88.

I had a balance of $3,033.25 then I made a payment of $5,000.13.

I didn’t need to make a payment that large. Which is why this account is in the negative. I always prefer to overpay just in case.

Statements & Documents

Statements can be found in the Statements & Documents tab of the Corporate Account Summary.

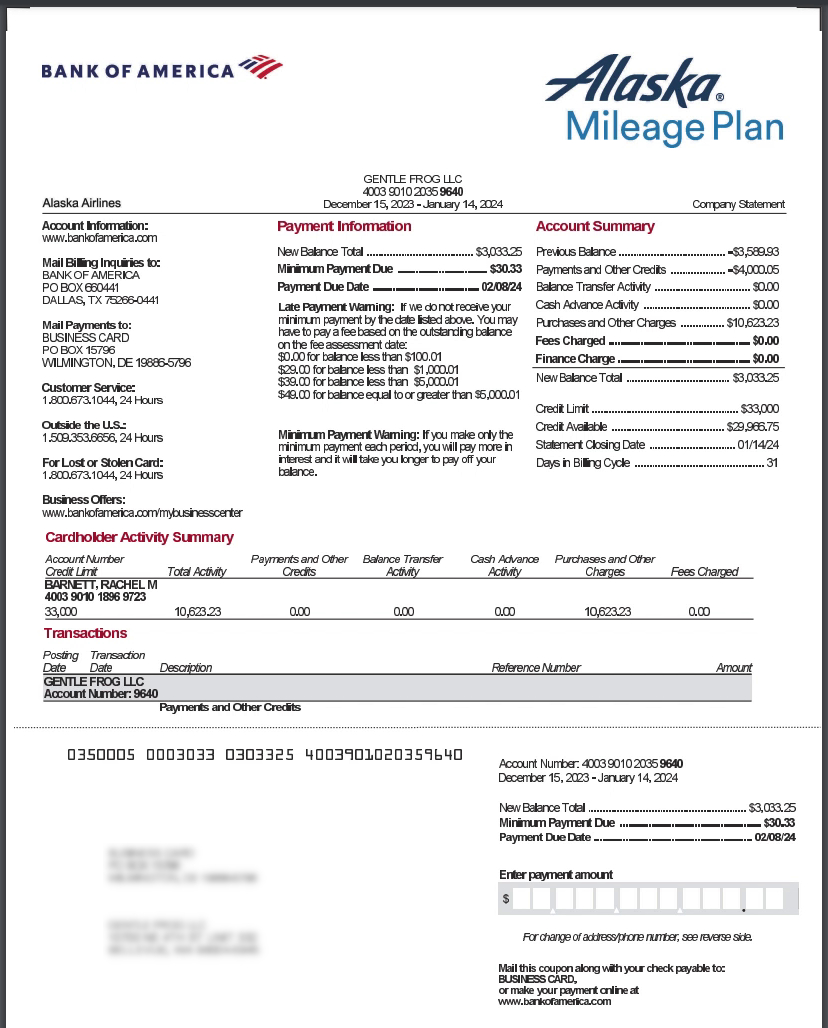

Viewing a Statement

I only have one cardholder card so there’s only the 9723 card activity listed.

Further down on the statement is a list of all the transactions. At the top are the corporate account transactions, which are all payments. Then the transactions from the 9723 card, which are all charges.

In QuickBooks

I only have one register for my corporate credit card in QuickBooks. That’s because I only have the one physical card. If you’d like to see what this looks like check out: Connecting a Corporate Credit Card to QuickBooks Online With Only One Cardholder

If you have multiple cards under a corporate account check out: How to Enter a Corporate Credit Card With Cardholder Accounts Into QuickBooks Online

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

Below is a video if you prefer to watch a walkthrough.

If you have questions about Bank of America credit card bookkeeping click the green button below to schedule a free consultation.