In this tutorial, you’ll learn how to reconcile a corporate credit card with multiple card accounts.

This is not the only way to approach this but it’s the method I prefer.

I like to have individual accounts for the main credit card and each cardholder (NOT sub-accounts). I transfer their balances to the main card account and then reconcile them.

If you’d like to learn how I set this up read the previous blog post, How to Enter a Corporate Credit Card With Cardholder Accounts Into QuickBooks Online.

It’s not as confusing as it sounds, I promise 🙂

Quick Instructions:

- In the left side menu click Accounting -> Reconcile

- Reconcile each of your cardholder accounts

- Click the Credit card register link toward the top of the Reconcile tab

- Select one of your cardholder accounts from the register’s drop-down menu

- Click Add CC expense and select Transfer from the menu

- Under PAYMENT enter the balance of the cardholder account

- Under PAYEE ACCOUNT select the corporate credit card

- Click Save

- Repeat steps 4-8 for each cardholder account

- Click the green Reconcile button on the right

- Reconcile your corporate credit card

Keep reading for a complete walkthrough with screenshots:

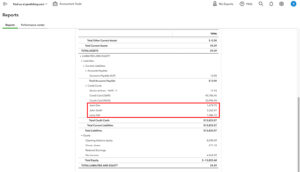

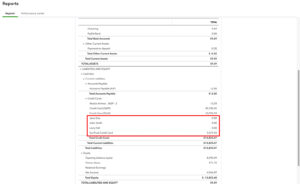

Credit Card Accounts on the Balance Sheet

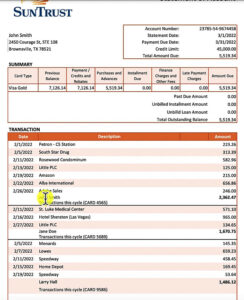

For this example, I’m using a fake Suntrust credit card. With three cardholders, John Doe, Jane Doe, and Larry Hall.

In a previous blog post, I showed how to add accounts for the main card and the three cardholders to the QuickBooks Online chart of accounts. I then imported the transactions for each cardholder.

When I look at the balance sheet I see all three cardholders with total transactions matching what’s on the bank statement above.

Reconciling Cardholder Accounts

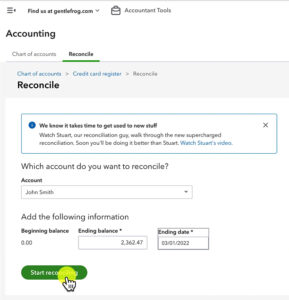

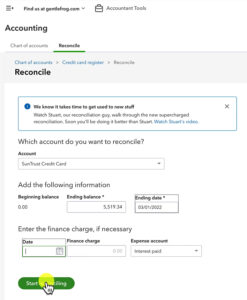

To begin reconciling click Accounting -> Reconcile in the left side menu.

I’ll reconcile each account starting with John Smith.

Because this is a cardholder account of a corporate card the beginning balance is always $0.00. That’s because the balance gets moved to the main card account.

The ending balance is how much John Smith owes at the time the statement was generated. From the statement above that’s $2,362.47. The ending date is the statement date.

When ready click Start reconciling.

Now I’ll go through the list of transactions one by one. Verifying that all the charges on my bank statement are listed and vice versa. EVERY transaction that is on the statement should be in QuickBooks.

Check out my blog post How to Reconcile Your Account in QuickBooks Online if you’d like a more detailed look into this process.

In my example, all the transactions are there. The difference equals $0.00 I’m good to click the Finish now button.

I’m going to repeat this process for the other two cardholders, Jane Doe and Larry Hall.

When I’m finished I can view my Reconciliation summary and see that all three accounts have been reconciled against the statement ending on 3/1/2022.

Reconciling the Corporate Card

Now that the cardholder accounts are reconciled it’s time to reconcile the main credit card account.

If I started reconciling the card now there’d be no transactions as all the transactions are still under the cardholder accounts.

There are a few different ways to move the balances from the cardholder accounts to the main credit card.

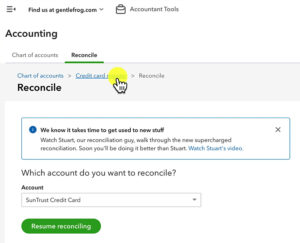

The way I like to do it is to click the blue Credit card register link on the Reconcile screen to navigate to the Credit Card Register in the chart of accounts.

Now I’m going to transfer the balance of each cardholder account to the main credit card account.

To do this I select one of the cardholders from the drop-down at the top of the Credit Card Register screen.

I’ll start with Jane Doe because that account shows up first.

On the left side, it says Add CC Expense. Click that and select Transfer.

The only thing I need to enter is the balance of the cardholder account under PAYMENT. Then, under PAYEE ACCOUNT select the corporate credit card from the Transfer drop-down. Then click Save.

By doing this I’m telling QuickBooks to transfer the balance of the cardholder account to the corporate card account.

I’ll repeat this for the other cardholder accounts.

When I finish I can see the three transfers in the corporate cards register and the balance equals the amount due on the bank statement.

Now I can reconcile this account.

Click the green Reconcile button to get back to the Reconcile screen. Select the credit card from the Account drop-down.

The ending balance for my card is at the top of my statement under Amount Due. It’s the total of all three cardholder accounts.

The three transfers now appear on the Reconcile screen. When they’re all checked off the Difference amount drops to $0.00 and I can click the Finish now button.

In the beginning, we looked at the Balance Sheet and all the cardholder accounts had balances. Now those accounts are all $0.00 and the credit card has the balance.

I prefer to use this method instead of sub-accounts because I like being able to quickly and easily see what’s going on in my registers. If I use sub-accounts I find that I’m more likely to make mistakes and it’s more difficult to pinpoint where the mistakes happened.

You now know how to reconcile corporate credit cards with cardholders, using the method I prefer, in QuickBooks Online.

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

Below is a video if you prefer to watch a walkthrough.

If you have any questions about dealing with corporate credit cards in QuickBooks Online click the green button below to schedule a free consultation.

3 Responses

Does the transfer entered for each add’l credit card holder get reconciled in the next reconciliation? Thanks for the help – very clear and concise video!

Hi Tami, they should get reconciled with the current reconciliation. If you need help Rachel can walk you through it in a 15-minute meeting, https://www.gentlefrog.com/meeting/

-Jess

Thanks so much for the reply! Figured it out!