Freshbooks makes it really easy to track time that you’ve worked. In this tutorial I’ll show you how you can log your time and see all your unbilled time.

Quick Instructions:

- Click Time Tracking in the left-hand menu

- Click the Start Timer button or “+ New Entry”

- Enter the client, service, time worked and any notes

- Click the green checkmark

Keep reading for full instructions with screenshots.

In the main left-hand menu click Time Tracking.

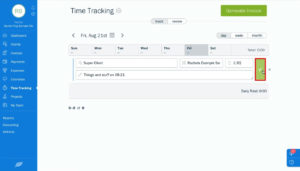

You can click the Start Timer button to track time as you work. Or, click “+ New Entry” to enter time you’ve already completed.

In this example I’ll be using the New Entry option to log time I’ve already worked.

You’ll be able to select the client you worked for, the service you did for them, and the amount of time you worked. You can also enter additional notes.

When you’re done click the green checkmark to the right.

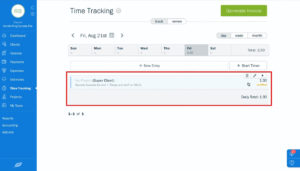

Freshbooks will show you a list of your tracked time. It adds up everything to show you your daily total. It will also show if the time has been billed or not.

You can see in the example below the entry I just created labeled as unbilled.

There’s an easy way to see all of your unbilled time. So you don’t forget to bill for anything.

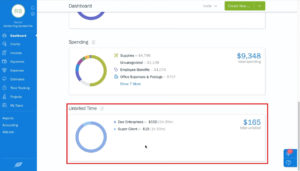

From the Dashboard, which you can get to from the left-hand menu. Scroll down until you see Unbilled Time.

In a previous post I showed how to create an invoice in Freshbooks from the Unbilled Time in the dashboard.

You now know how to track the time you’ve worked in Freshbooks.

☕ If you found this helpful you can say “thanks” by buying me a coffee…

https://www.buymeacoffee.com/gentlefrog

If you’d like to watch me walk through the process of tracking time in Freshbooks check out the video below: