In QuickBooks, distinguishing between Bills and Expenses is important for accurate financial tracking. While both represent money your business spends, they differ in timing and recording methods.

What is an Expense?

An Expense in QuickBooks records a payment made immediately for goods or services.

Use this when you pay at the time of purchase, such as with cash, check, credit card, or online payment.

Example: Buying office supplies and paying on the spot is an Expense.

What is a Bill?

A Bill represents a purchase you plan to pay for later. It’s a record of money your business owes.

This allows you to track accounts payable and manage future cash flow.

Example: Receiving an invoice for services rendered, with payment due in 30 days.

Key Differences

Payment Timing:

- Expense: Payment occurs immediately.

- Bill: Payment is deferred to a later date.

Accounting Impact:

- Expense: Directly reduces your bank account balance upon entry.

- Bill: Increases accounts payable until the bill is paid.

Use Case:

- Expense: For immediate payments like utilities or office supplies.

- Bill: For purchases on credit, such as inventory from a supplier with net 30 payment terms.

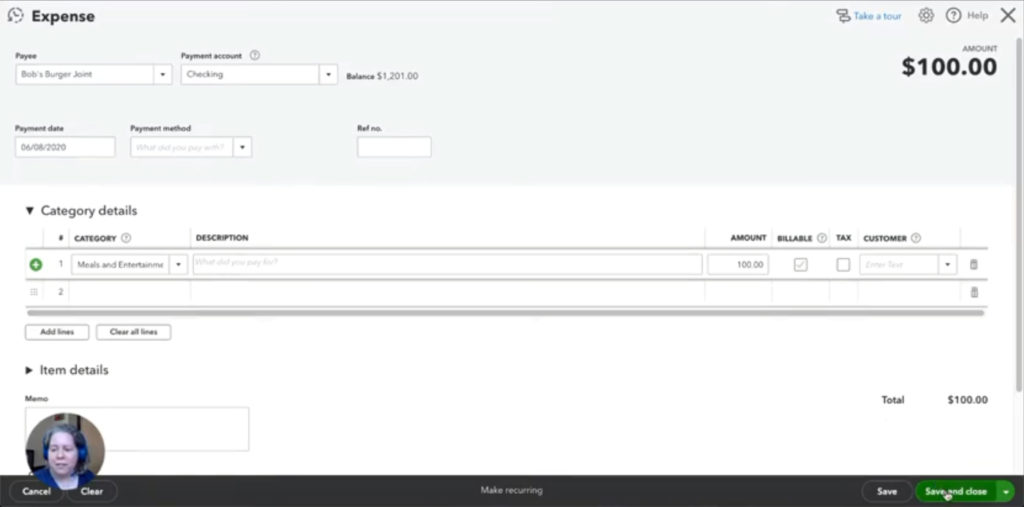

How to Enter an Expense in QuickBooks Online

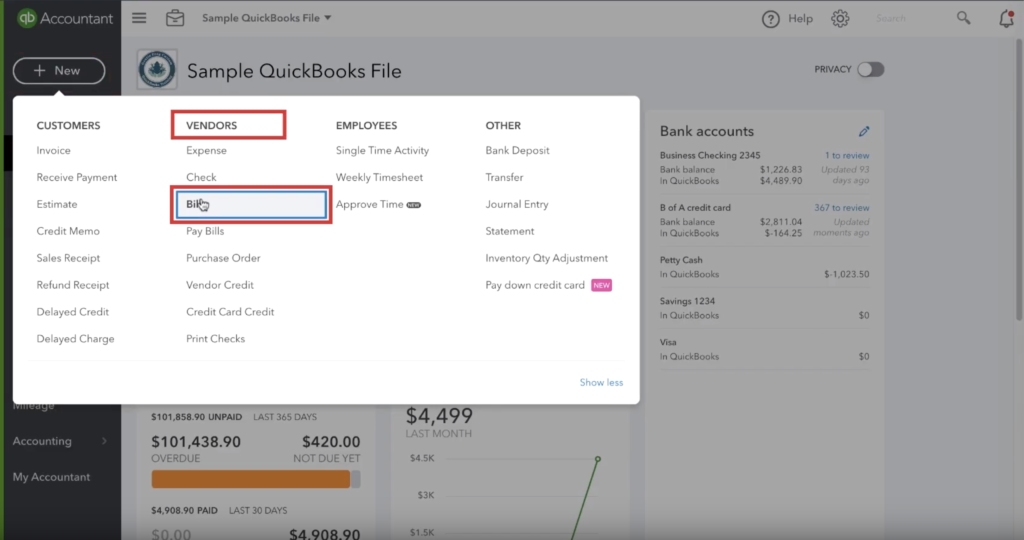

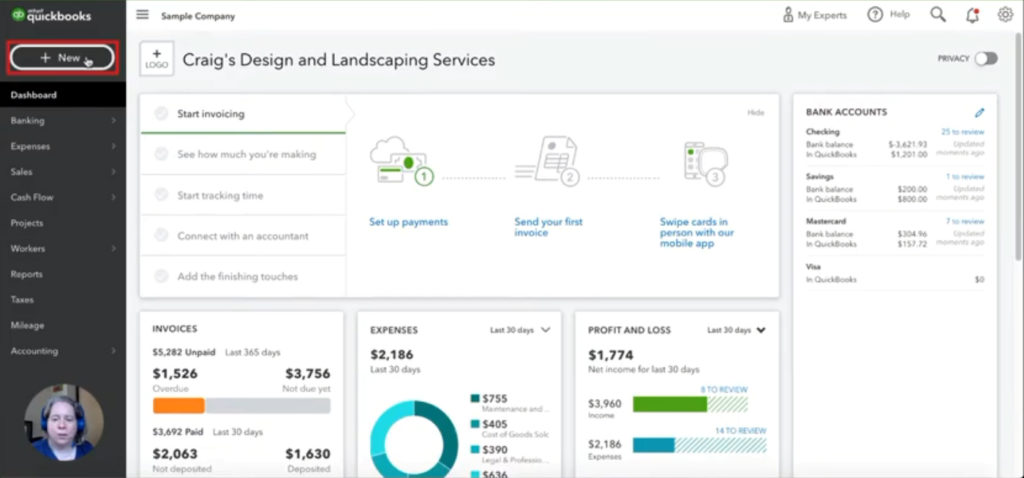

To enter an expense in QuickBooks, click the +New button in the upper left-hand corner.

Under the VENDORS section, select Expense.

Fill in Expense Details:

- Payee: Enter the name of the vendor or service provider.

- Payment Account: Choose the account from which the money was paid (e.g., Checking Account).

- Payment Date: Specify the date of the transaction.

- Payment Method: Select how you paid (e.g., Credit Card, Cash).

- Category: Assign the appropriate expense account (e.g., Office Supplies).

- Amount: Enter the total amount paid.

After entering all details, click the Save and Close button.

In the example below, I created an expense for $100 of burgers purchased at Bob’s Burger Joint. The money was paid from a checking account at the time of purchase.

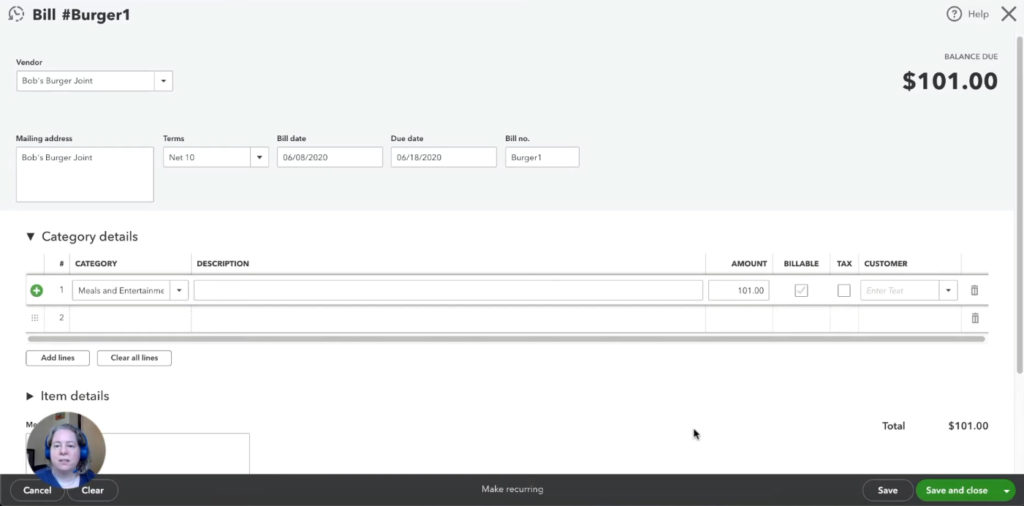

How to Enter a Bill in QuickBooks

To enter a bill, click the +New button in the upper left corner.

Under the VENDORS section click Bill.

Fill in Bill Details:

- Vendor: Enter the name of the vendor.

- Bill Date: Specify the date on the vendor’s bill.

- Due Date: QuickBooks calculates this based on payment terms, but you can adjust it if needed.

- Bill no.: Input the bill or invoice number for reference.

- Category: Assign the appropriate expense account.

- Amount: Enter the amount due.

After entering all details, click the Save and Close button.

Below is a screenshot of the purchase from Bob’s Burger Joint recreated as a bill due in 10 days:

How to Pay a Bill in QuickBooks

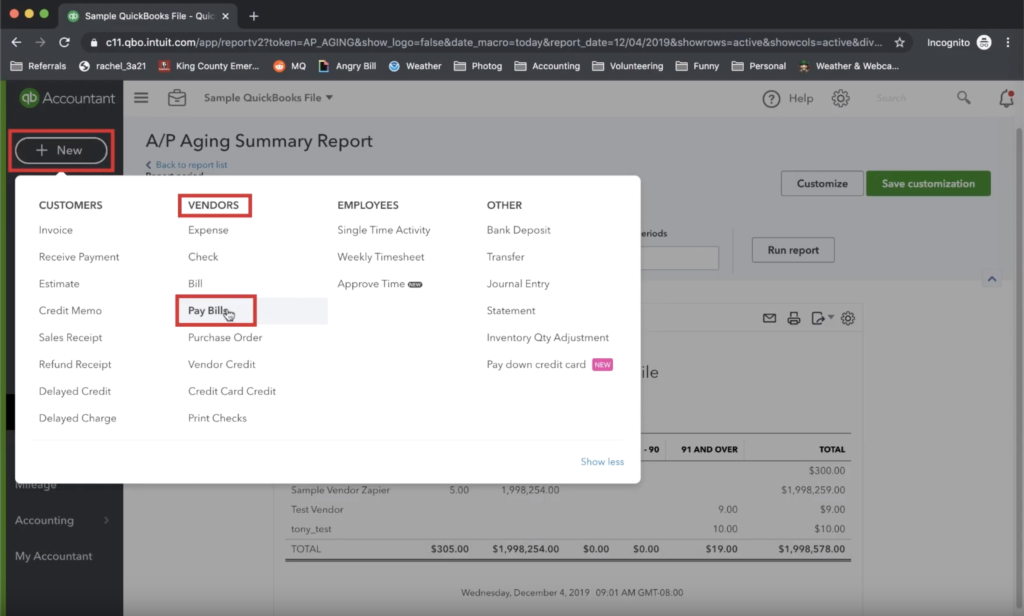

To pay a bill, click the +New button in the upper left corner.

Under the VENDORS section, select Pay Bills.

Enter Payment Details:

- Payment Account: Choose the account from which you’re making the payment.

- Payment Date: Specify the date of the payment.

A list of unpaid bills will appear. Check the box next to each bill you want to pay.

After verifying all details, click the Save and Close button.

Below is the a screenshot of how it looks when I pay the Bob’s Burger Joint bill:

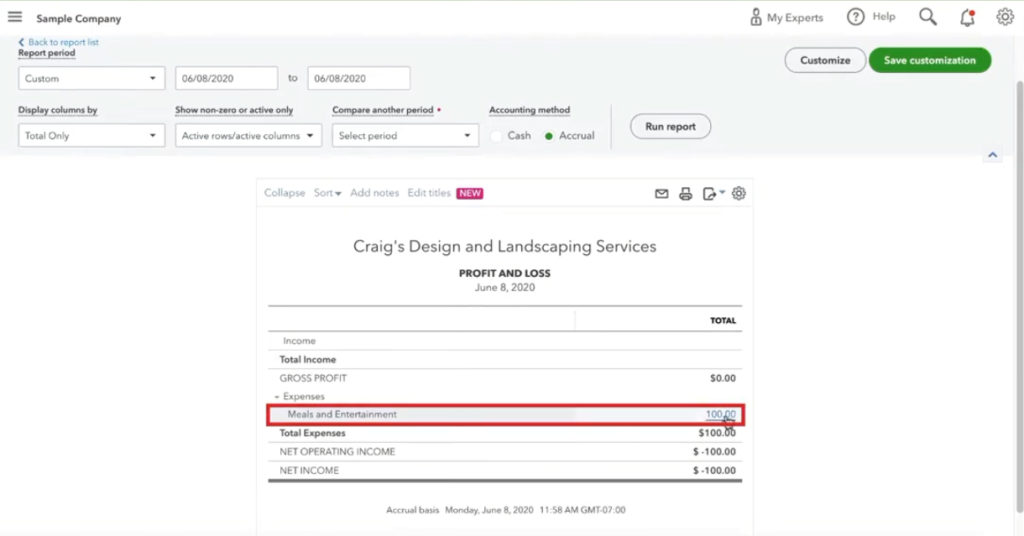

Bill vs Expense: Reporting Differences

Bills and Expenses affect your reports in different ways:

- Expense: Appears immediately, reducing net income upon entry.

- Bill: Appears based on your accounting method:

- Accrual Basis: Recorded when the bill is entered, regardless of payment.

- Cash Basis: Recorded only when the bill is paid.

Accounts Payable Aging Summary:

- Lists all unpaid bills, helping you track what you owe and when payments are due.

Best Practices

- Timely Entry: Enter bills and expenses promptly to maintain accurate financial records.

- Consistent Categorization: Use consistent categories for similar transactions to ensure clarity in reports.

- Regular Review: Periodically review unpaid bills and expenses to manage cash flow effectively.

- ONLY USE ONE: NEVER create an expense for something you’ve already entered as a bill.

☕ If you found this helpful, you can say “thanks” by buying me a coffee…

https://www.buymeacoffee.com/gentlefrog

If you have any questions about when to enter a bill vs expense in QuickBooks, click the green button below to schedule a free consultation.

For a visual demonstration of bills and expenses in QuickBooks Online, you may find the following video tutorial helpful:

18 Responses

Hi Rachel,

I am new to the company I work for I’m trying to understand why they have a loan as a BILL vs an Expense in QB. I don’t have the old bookkeeper to ask and the owners don’t know either. Is this a mistake or is there a good reason for this?

Hi Deb, that’s an approach that can get you where you need to go but it’s convoluted, clunky, and NOT a common practice. If you’d like Rachel would be happy to meet with you for 15 minutes to take a look at it, explain what’s currently happening and what you’re options are, https://www.gentlefrog.com/meeting/

Hi Rachel

I am new to Quick book online, Before that i am user of QuickBooks Desktop version since 2002. i have few queries

1. if i am just starting my new business it means i didn’t have any transaction in my bank Account. if so than how i upload my Bank Account file for my future transactions.

2. Secondly is there any option in online Quick book for customers whose payable amount is overdue and system intimate me or didn’t generate further invoice for said customer until he cleared his due amount or Generate Invoice after getting permission from me.

Looking for positive and prompt response from you

Hi Kashif,

1) If you’re starting with a new business bank account that has no transactions you’ll connect your account following this video: https://youtu.be/9DLsgIUMbfc Then when you do finally have some transactions you’d click Banking in the left-hand menu. It will likely already have transactions in the list but if not you can click the “Update” button and it will sync with your bank accounts.

2) I’m not sure what you’re asking for here, could you please reword your question?

-Jess

hi!

I’m trying to track a loan which I used to pay for a bill. I have the bill already set up but now I can’t see any option to tag the bill payment as paid from my liability account in Quickbooks. Is there any workaround for this?

Thank you!

Hi Mio,

It’s best not to use a bill for the loan, it works but makes the whole thing a lot more work. The best method is to just write a check (or enter an expense) and apply it toward the loan (and interest if applicable).

-Jess

Hey there,

What happens if expense is used instead of bill payment? How does that change records? This has been done a lot at my work and I’m wondering what mixing up bank feed withdrawals between bill payment and expense reflects for the payee and books.

Thank you so much!

Hi Trista,

If you are on a cash basis (most of our readers are), you will be okay. The key will be to make sure that you don’t have any unpaid bills that are actually paid. Check your reports for “accounts payable aging summary”, review this report for mistakes. If you need help, please feel free to book a call. We should be able to walk you through it in a 15-minute session: https://www.gentlefrog.com/meeting/

-Jess

My question is about Credit Card bills. We use two credit cards for our drivers gas and tolls. I have connected my bank account and categorize them as they come in to the QBO program via banking. When I pay the bill, QBO wants me to categorize the check I am writing. The money has been spent on “credit” but we don’t carry a balance. Our former bookkeeper used QB Desktop. She allocated all the expenses in categories BUT we didn’t have the banking connected. Its hard for me to wrap my brain around how I categorize THE PAYMENT. All the expense on the card have been categorized already.

Hi Sam,

A credit card payment is a transfer from checking to your credit card. It should not be entered as a bill. However, QB Desktop would prompt people to make a bill for the balance owed after reconciling. This is an old-school way of doing things and is incorrect, your credit card payments should not be entered as bills.

This can be confusing. If you need additional help you can schedule a meeting and we’ll be happy to walk you through what you need to do: https://www.gentlefrog.com/meeting/

-Jess

Hello, Thank you for the article on Bill vs Expense in QBO – it was very helpful.

I would be so thankful if you were able to tell me how I enter the expenses on my clients CC statement that took place before the QBO company file start date (when I started working for them) and after my clients old bookkeeper stopped working for them. The gap is a month of transactions that were not entered in old system/file before handing everything over to me, so they were not included in Sales Tax filings, etc, and are wreaking havoc on my account reconciliations.

Thank you in advance!

Hi CJ,

There are several ways you can enter missing transactions. You can manually enter them which Rachel explains how to do here: https://youtu.be/1-4woWHr8zo?t=283

Or if you have a PDF bank statement for the missing month you can convert it to a QBO file and upload it into QBO using software like Money Thumb or Propersoft.

If you’re still not sure how to go about entering these missing transactions you can schedule a 30-minute Zoom meeting with Rachel or Erica and they would be happy to walk you through the process: https://www.gentlefrog.com/meeting/

-Jess

Hello-

I just migrated (today!) my sole-proprietorship in QBO to better manage my books. I’m using cash accrual due to my simple business needs and don’t need QBO bill pay as my most of my service payees prefer paper checks. I linked my business checking account to QBO so QBO can see when the checks are debited from my account. My question is: If I ‘pay’ for a service expense today by placing a check in the mail from my business account, can I enter that expense at a later date (2 weeks into the future) so I can then match that expense to the debited amount in my checking account when the check is actually cashed? Or should I not enter the expense today and just wait for the check to clear and the amount to be debited from my account and then categorize that debited amount as the actual expense when QBO sees it? I know I’m trying to get around the proper use of Bills and Expenses in QBO but I’m just a very small business without need for detailed business reporting. I’m just trying to record expenses at the same time I write checks so I don’t forget I ‘paid’ those bills.

RAE

Hi RAE,

It’s best to enter the check into QBO on the date that it’s written. If you’d like to discuss how to best use QBO for your business Rachel or Erica would be happy to go over it with you in a 15-minute meeting: https://www.gentlefrog.com/meeting/

-Jess

Hi Jessica,

I have confusion regarding the bill and expense. As above you booked 2 bills of burger, one was paid on cash basis and other would be paid after 10 days. then don’t you think it would impact dual? because we have booked two bills

Hi Adarsh,

Yes, if you enter an expense and a bill, it will record it twice. The intent of the blog post is to show multiple ways to record something so that you (the watcher/reader) could see these in action and make determinations about what works best for your situation.

-Jess

I work as a bookkeeper and wondering what to do if a bill is entered as such into QB to be paid in the future and then paid via a credit card. So the original invoice is entered as a bill and then paid via a credit card (much later when the cc is due). How do you treat the credit card transaction? (The bill was categorized at the time it was entered and so I don’t think it would be done again (in the credit card account), just not sure how to treat the credit card transactions in QB, credit card payments). Thank you!

Click the +new button, select “Pay bills.” On the Pay Bills screen under “Payment account” select the credit card as the method of payment, it will magically work 🙂 The credit card balance goes up and the bill is paid.