There are times when you look at the QuickBooks Online and you see the “bank balance” doesn’t match the “QuickBooks balance” and you don’t know why. I’d like to help you troubleshoot this.

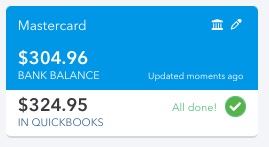

In this example, the bank says the balance is $304.96 and QuickBooks says the balance is $324.95. Normally this difference is because there are pending transactions waiting for me to process them but in this case there is a checkmark and the words “all done”.

We need to look at the register, this is often caused by data being entered twice by mistake. Even when you have your banking connected and you’re not manually entering data.

To get to the register, click on the right side of the banking screen.

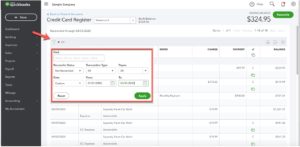

This brings you to your register showing all of the transactions for this account. Click on the funnel in the upper left corner of the register and change the filters: the reconcile status should be “not reconciled” and the date range should start a long time ago (I used 1/1/2000) and the ending date should be the same as the date the account was last reconciled. (Hint: the last reconciliation date is just above the red box.) Click apply.

In this example there are no transactions. But in your QuickBooks you might have transactions, if you do, look at the transactions and ask yourself “is this something that will show up on a bank statement in the future or is this a mistake?”. That Starbucks charge is probably a mistake (a duplicate) but the check you wrote may be on someone’s desk and they haven’t cashed it yet.

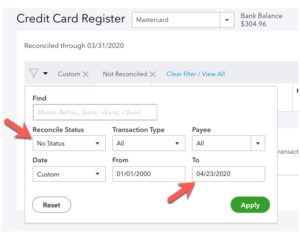

For our example, we need to keep troubleshooting so we carry on… Click on the filter and change your parameters. We’ve determined that the difference between QuickBooks and our bank is not an old transaction that hasn’t cleared. Change the reconcile status to “no status”, change the ending date to be today’s date.

Doing this will show you the transactions that are not linked to downloaded data. This doesn’t automatically mean it’s wrong, it’s just one more method of troubleshooting. We can see there are two transactions that are not linked to a downloaded transaction from the bank. One is a deposit of $900 and the other is an expense of $19.99. If we scroll back up, we can see the difference between QuickBooks Online and the bank is $19.99. We just found a $19.99 transaction. This is a duplicate transaction and it can be deleted.

☕ If you found this helpful you can say “thanks” by buying me a coffee…

https://www.buymeacoffee.com/gentlefrog

As you’re going through your QuickBooks, if you find that you’re having trouble identifying or correcting your mistakes, I’d love to help you! You can book time with me by clicking the green button below.

One Response

Hi Rachel,

This was so helpful. Thank you. This was the most practical and easy to understand, straight forward help I’ve seen online. Thank you. I still have some other issues so I am going to schedule a free consultation.

Thanks again and happy new year!

Lacy