Bank of America Credit Card Monthly Statements

Your bank may be different. But when I log into my Bank of America credit card to get statements it labels the statements by month.

However, you can see that each statement has the date of the 14th.

What does that even mean? Is that the start date, the end date? Let’s open the December Statement to see.

December Statement

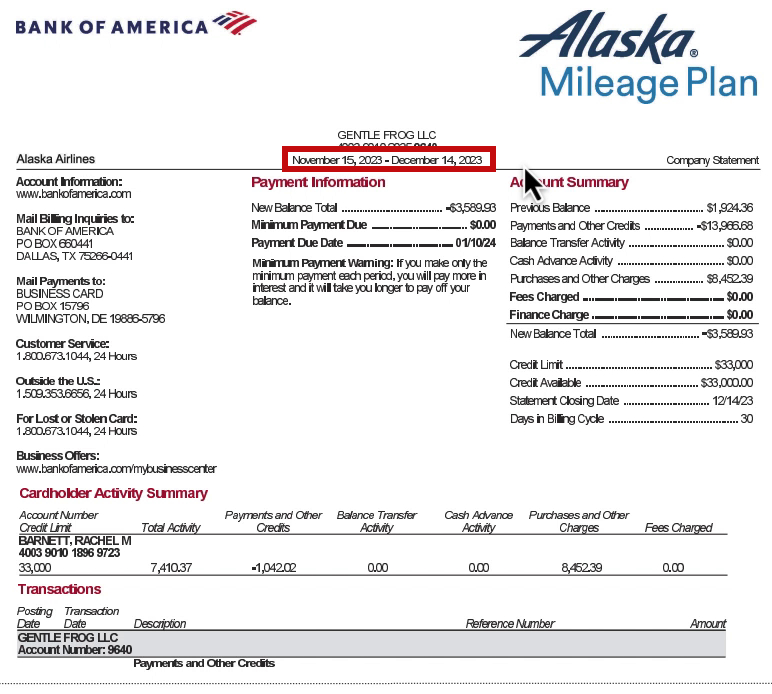

At the top of the statement are the dates. This December Statement covers November 15th – December 14th.

That’s more November than December!

If your bookkeeper asks for the December Statement you don’t know if they want ALL the December transactions. Or, if they want the statement that ends in the middle of December.

If your bookkeeper isn’t clear you can always ask them for clarification but your best option is to send them both the December and the January statements so they get the full December coverage.

I hope this was helpful if you’d like to see some more statement examples scroll down to watch the video version.

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

If you have questions about understanding bank or credit card statements click the green button below to schedule a free consultation.