Tips Account

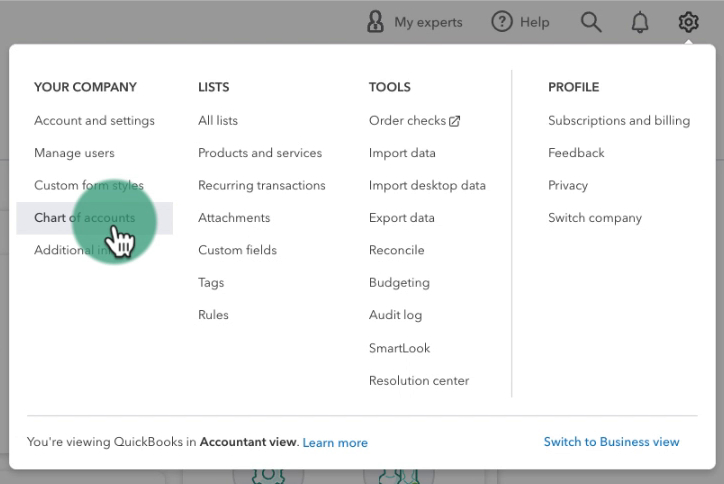

Let’s see what the tips liability account looks like in the Chart of Accounts.

To navigate to the Chart of Accounts click the gear in the upper right corner. Select Chart of accounts under YOUR COMPANY.

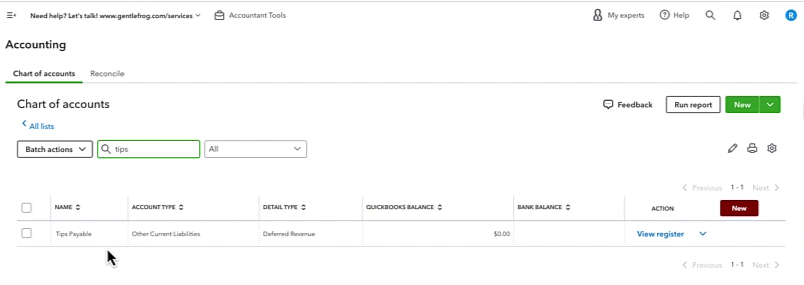

I have an account named Tips Payable. I searched for “tips” to find it quickly.

The Account Type is Other Current Liability. Click View register under ACTION on the right to see the transactions.

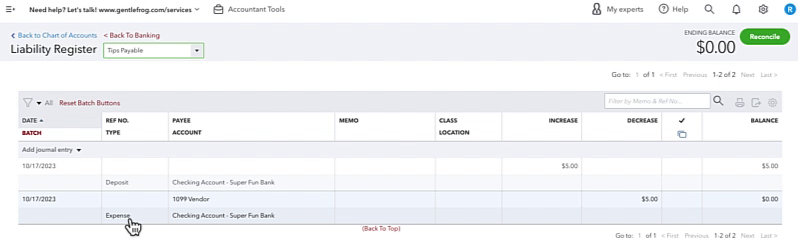

On 10/17 there was a Deposit of $5 into my checking account. Then later there’s an Expense showing the money leaving the checking account.

That Expense doesn’t mean it’s a “business expense” that’s just the form type that’s used (I know that’s a little confusing).

Let’s take a look at each of these to get more details on what’s going on.

Deposit

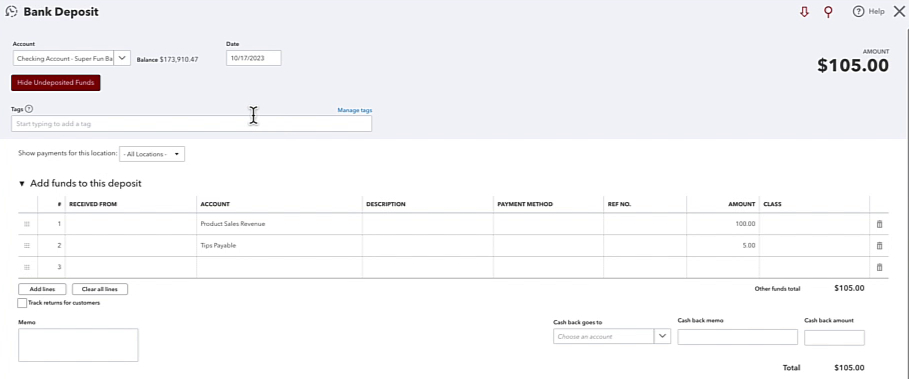

When I Edit the Deposit it opens a Bank Deposit.

$105 got deposited into my bank account, $100 of that was Product Sales Revenue and the other $5 as Tips Payable.

This is just one method, you could also do this with a sales receipt or an invoice.

At the end of the day what I need is to tell QuickBooks to increase the Tips Payable account by the $5 that was collected as tips.

If you’re ever unsure you can view the Transaction Journal by clicking More at the bottom of the transaction. Then select Transaction journal.

This is showing that $105 went into my checking account, $100 went to Revenue, and $5 went to the Tips Payable account.

Let’s go back to the register and take a look at the Expense.

Expense

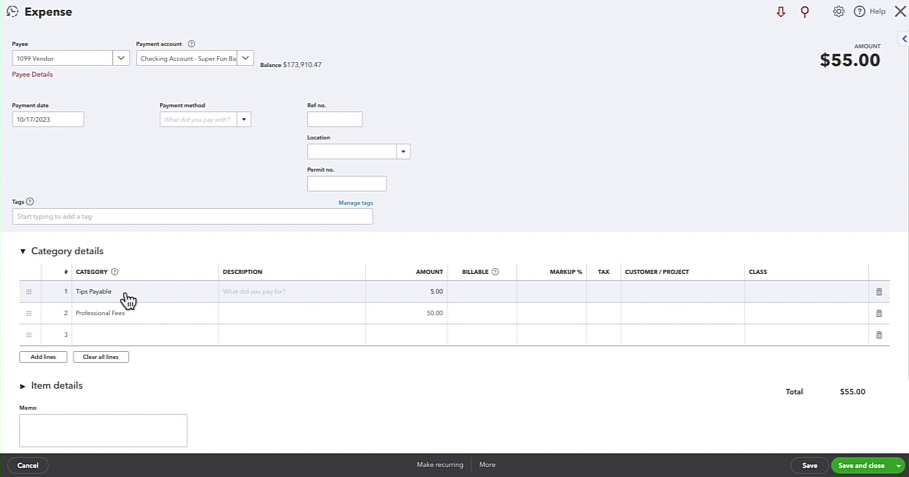

When I Edit the expense it shows a $55 payment I made to my contractor:

You can see the $5 coming out of the Tips Payable account. Then $100 is going into my Professional Fees expense account.

The way you do this in your QuickBooks may look different than I’m showing here. I want to focus on the logic behind the liability/tips account.

When you collect money on behalf of a contractor it’s NOT your income. And when you give that money to your contractor it’s NOT an expense. You’re just a go-between for that money, which is why we use an Other Current Liability account.

If I take a look at the Profit and Loss report for 10/17 I see the Product Sales Revenue and the Professional Fees but no Tips Payable. That’s because Tips Payable is NOT an income or expense!

I hope this overview of how to deal with tips was helpful. If you prefer you can scroll down to watch a video version.

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

If you have questions about handling tips in QuickBooks Online click the green button below to schedule a free consultation.