Do you pay your sales tax before it’s due? Do you make multiple payments?

I had someone ask me about this situation. They made multiple sales tax payments before the due date.

I don’t have a perfect solution but I do have one that works.

Quick Instructions:

- Wait until your sales tax status is Due

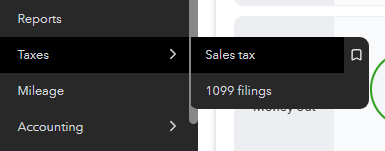

- Click Taxes -> Sales tax in the left side menu

- Click View Tax Return for the period you’re paying

- Click Record payment button

- Record a payment

- Repeat steps 3-5

Keep reading for a complete walkthrough with screenshots:

Open Sales Tax

To navigate to the Sales Tax screen in QBO click Taxes in the left side menu. Then Sales tax in the pop-out menu.

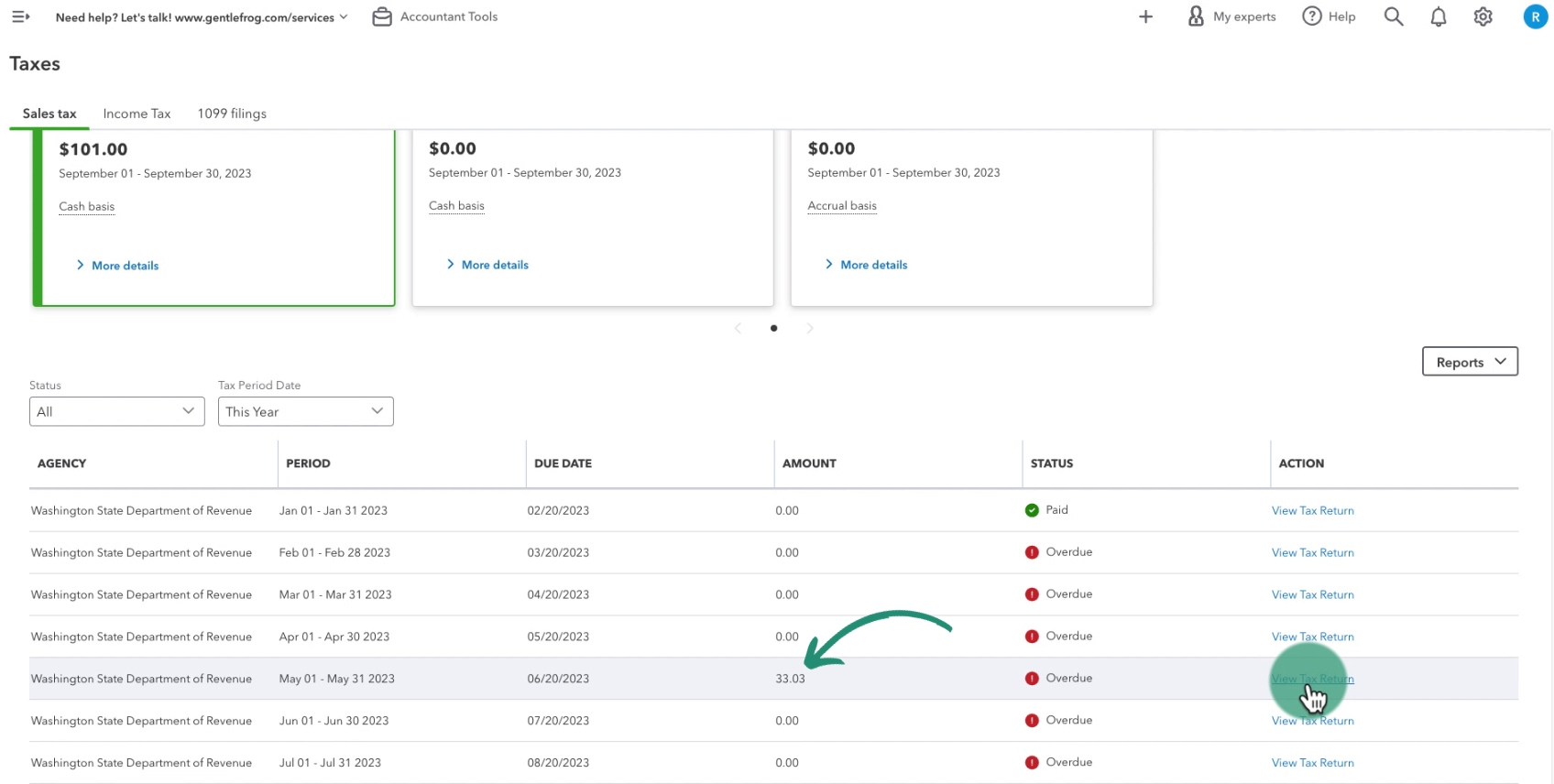

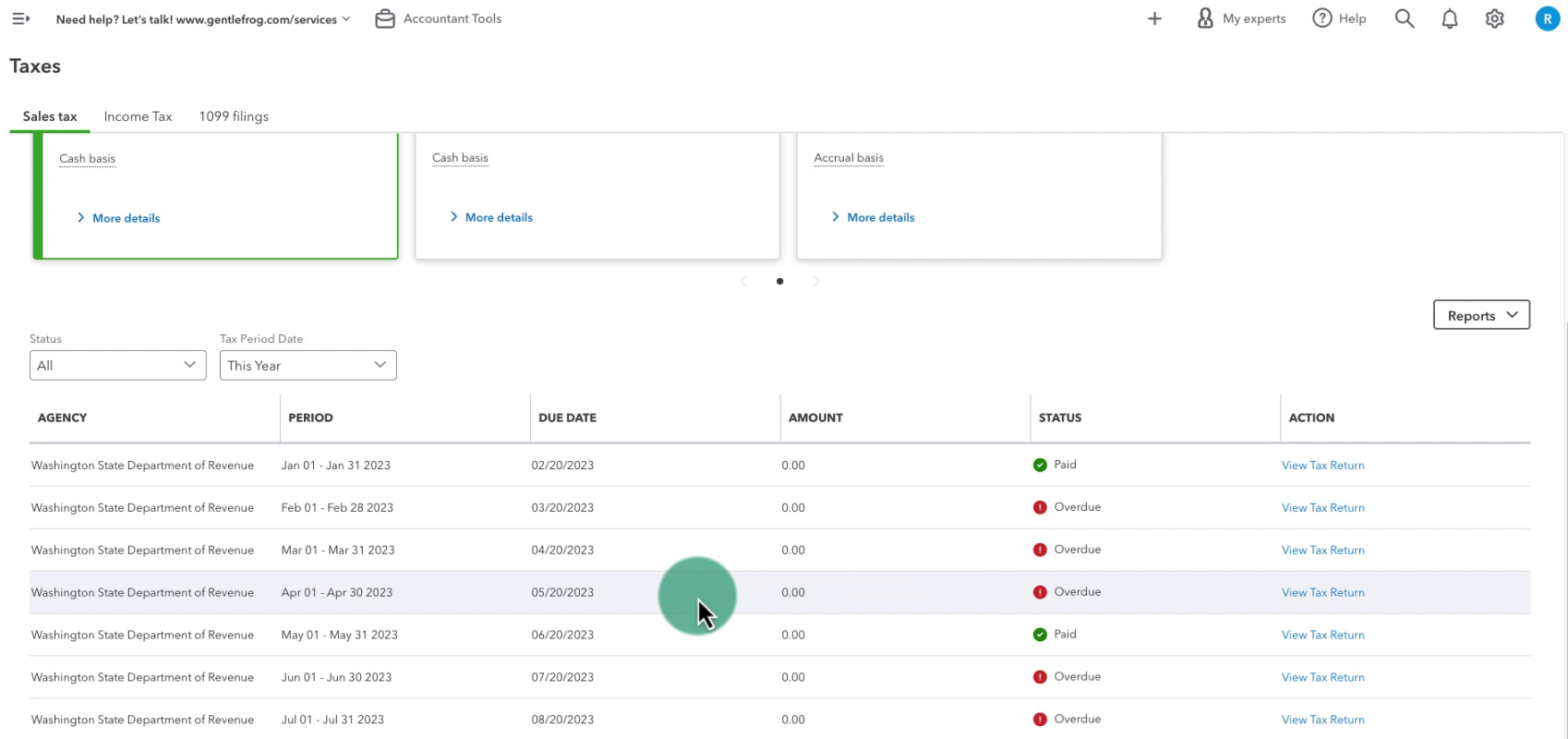

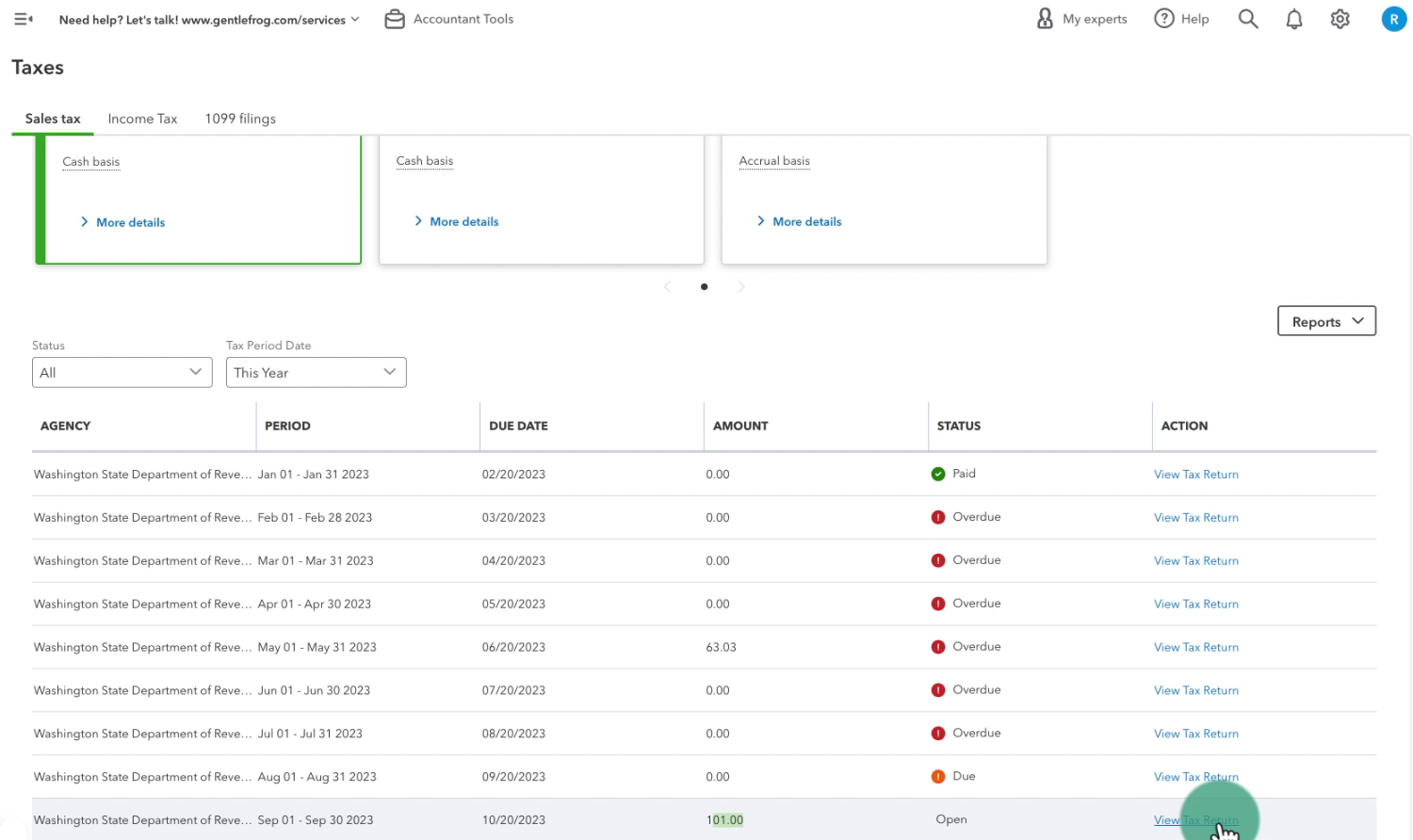

I have Paid, Overdue, and Open sales tax.

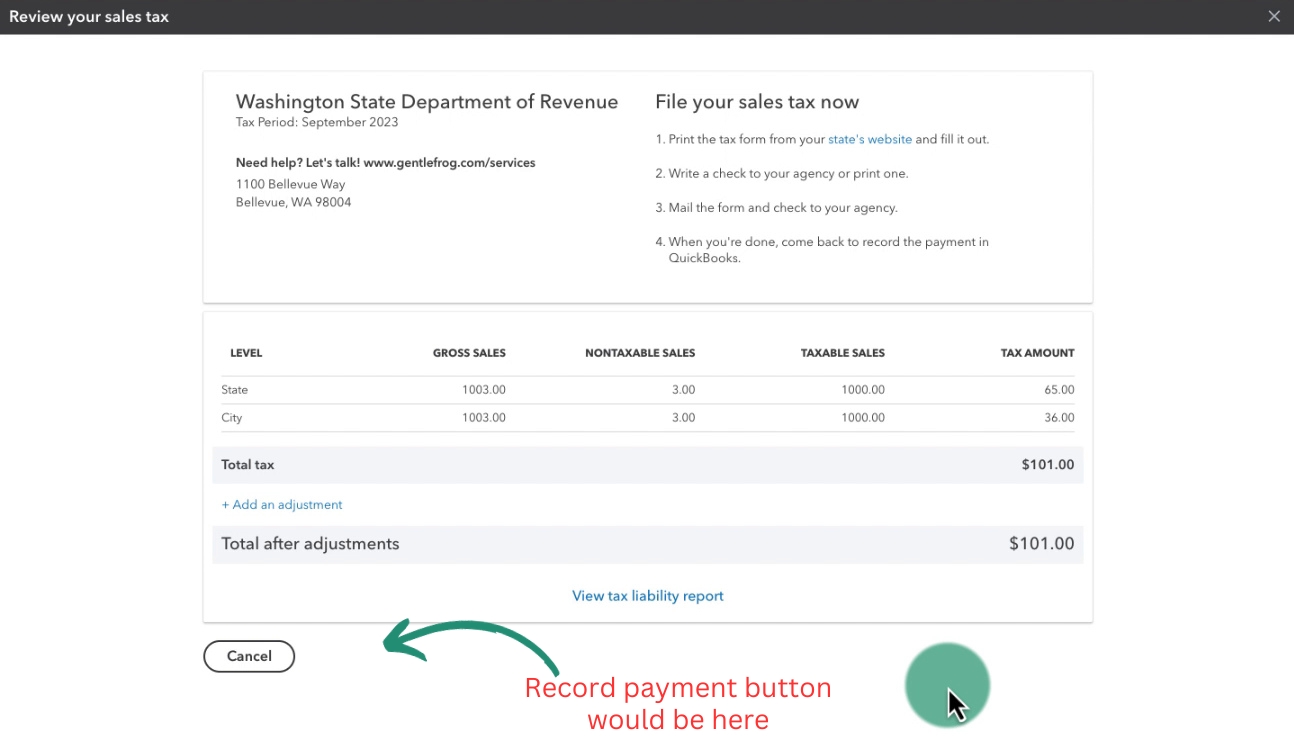

I’ll click View Tax Return for the most recent, Open, sales tax.

When tax is due you’ll see a green Record payment button. But this tax is open so there’s no option for recording a payment.

You’ll have to wait until the status is Due or Overdue to record the payments within QuickBooks.

Once the status is Due or Overdue you can record multiple payments to a single sales tax period. Let me show you how.

Record Multiple Sales Tax Payments

In the list of sales tax periods above it shows that I’m overdue in May and owe $63.03. I’m going to record multiple payments for that period.

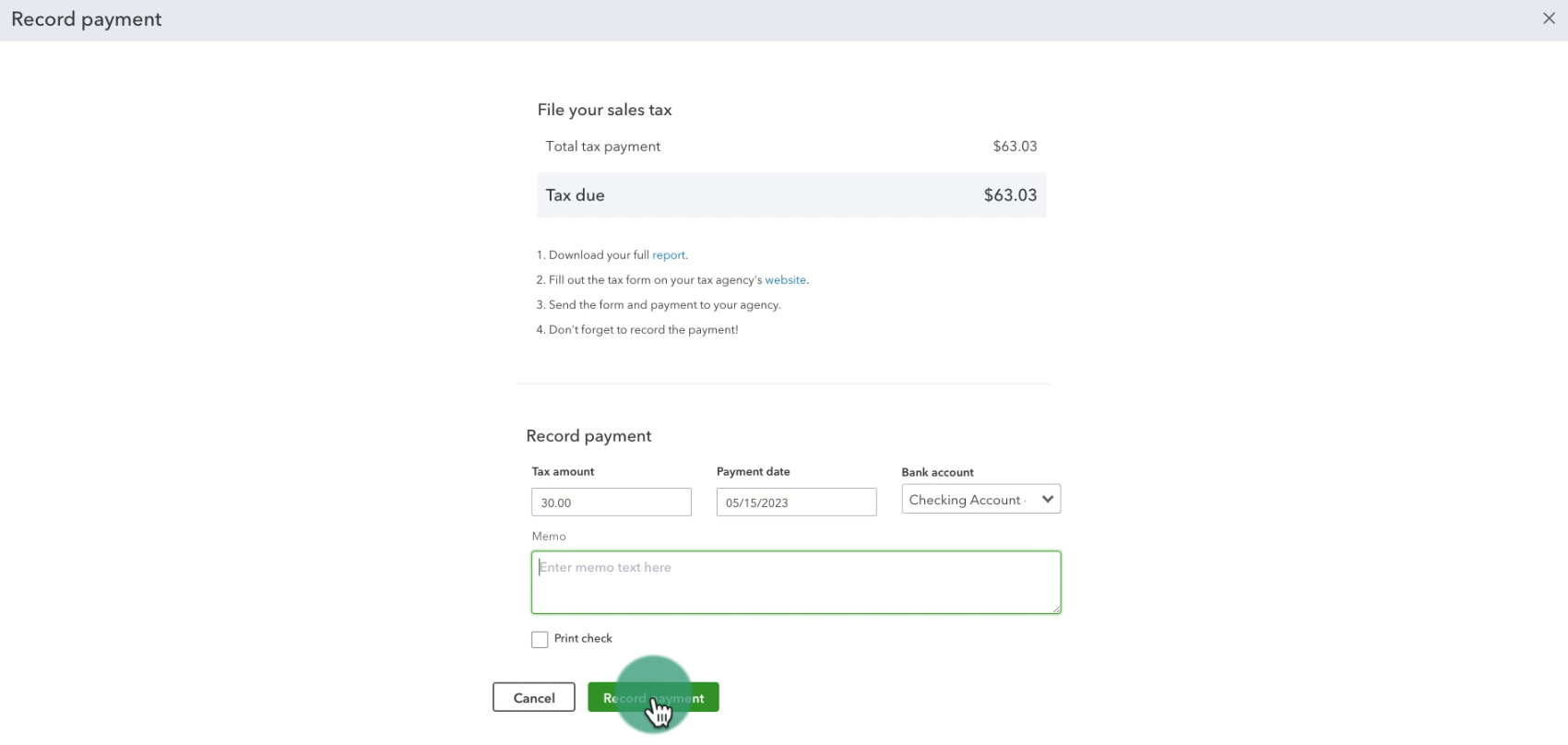

This time when I click View Tax Return the Record payment button is there.

I’m recording a payment of $30. I enter $30 in Tax amount, enter a payment date of 5/15/23, and select the bank account the money came out of:

May now shows that I owe $33.03:

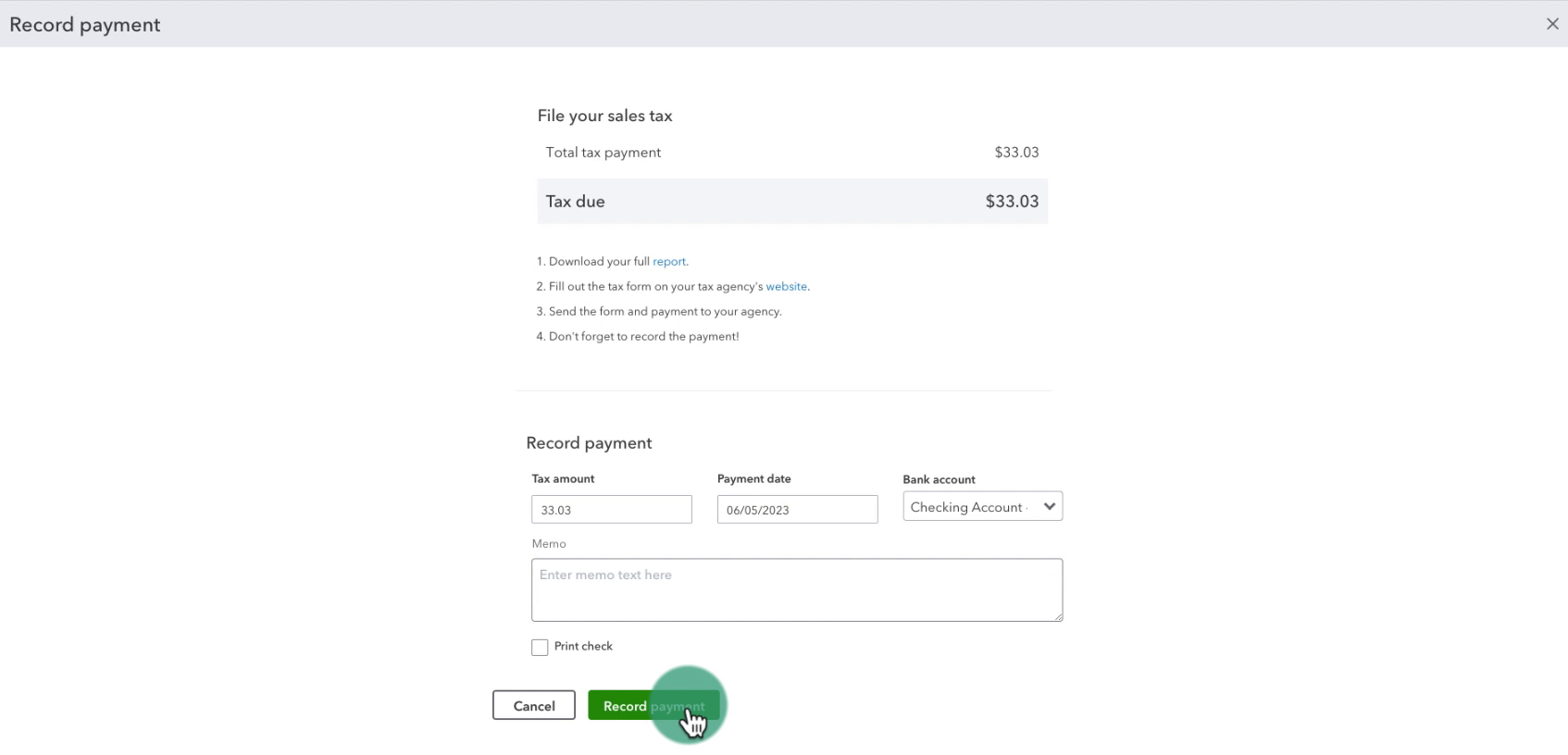

I’m going to repeat the process and record a second payment of $33.03 paid on 6/5/23:

The May period status is now Paid:

The downside to this is that you won’t be able to reconcile until these payments are recorded. The upside is that you CAN record multiple payments.

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

If you have questions about sales tax in QuickBooks Online click the green button below to schedule a free consultation.