Expenses Screen

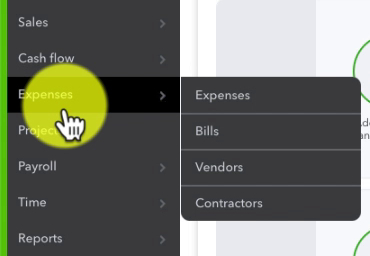

First, let’s navigate to the Expenses screen and see what we find there. To get there click on Expenses in the left-side menu.

This screen has several tabs across the top:

- Expenses

- Bills

- Vendors

- Contractors

Expenses

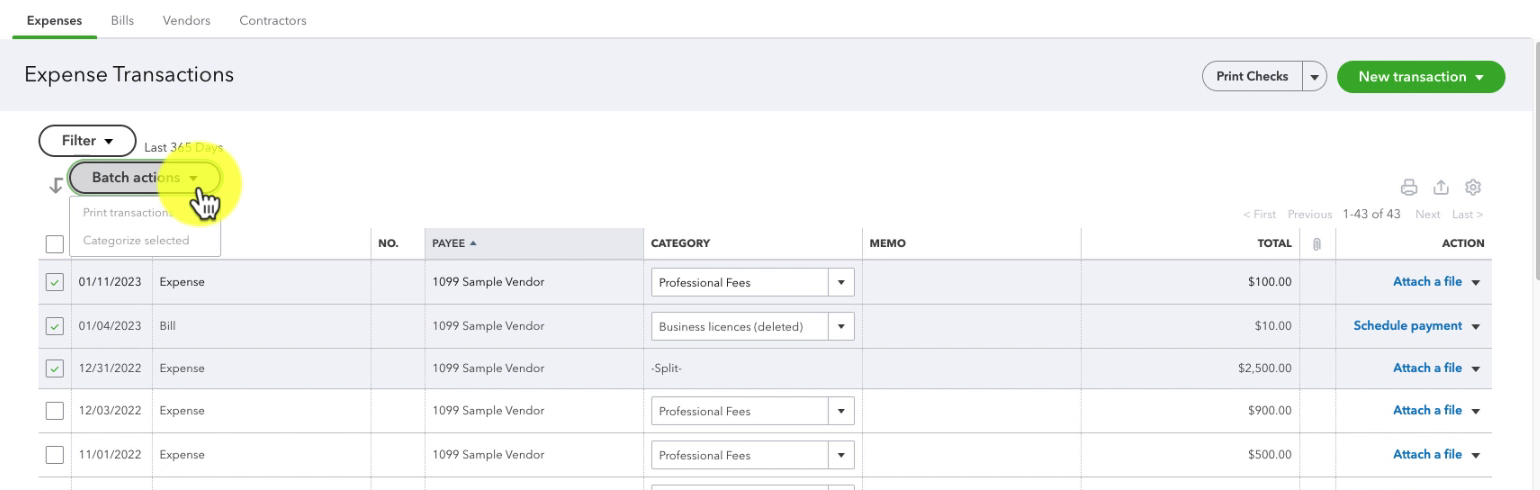

This is where you’ll find yourself when you open Expenses. It’s a list of all your expense transactions over a selected period of time. Usually 365 days but you can change the date range.

Across the top of the list are columns that you can sort by. For example, if you want to group together your POs, bills, etc. you can sort by TYPE. You’ll see a little arrow, pointing up or down, next to the column you’re correctly using to sort by.

Batch Actions

You can perform two different types of batch actions:

- Print transactions

- Categorize selected

To do either action check off transactions using the checkboxes to the left. Click the Batch actions button then choose the action you’d like to take.

Bills

On the bills screen you’ll find three tabs:

- For review

- Unpaid

- Paid

Under each of these tabs will be a list of bills similar to the list of Expenses.

These are only bills that have been entered using the bill pay feature within QuickBooks. You may have “bills” that have been logged as expenses.

One of the most useful things to see in bills is the STATUS in the Unpaid tab.

Status shows you how many days until a bill is due. If a bill is overdue it’ll show that in red with how days it’s past due.

If you have trouble keeping up with your bills this is a great place to check to make sure you’re getting bills paid on time.

Vendors & Contractors

Vendors is a list of the people/companies you’ve given money to. For an overview of Vendors in QBO check out my blog post Introduction to the QuickBooks Online Vendor List.

Contractors are people/companies you pay using direct deposit through QuickBooks. When you add a Contractor through QBO it will send them an invite and ask for their W-9 information. For more information on Contractors here’s an article from Intuit: Set up contractors and track them for 1099s

Add Vendor Transactions

There are several different ways to add vendor transactions in QuickBooks.

From the Expense Transactions list you can click the green New transaction button on the right. From here you can add:

- Time activity

- Bill

- Expense

- Check

- Purchase Order

- Vendor Credit

- Pay down credit card

You can also use the +New button in the upper left corner of the left-side menu. You’ll find all the vendor transactions in the VENDOR column.

I rarely enter expenses by hand. Instead, I enter them when categorizing transactions on the Banking screen.

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

Below is a video if you prefer to watch a walkthrough.

If you have questions about the Expenses in QuickBooks Online click the green button below to schedule a free consultation.