Quick Instructions:

- Click Let’s do it in the email

- Check off how you’d like to distribute your tax forms

- Click Continue

- Check the “I agree” box

- Click Continue

- Select to send to everyone or individuals

- Click Save and continue

- Review who is getting forms and the total cost

- Click Submit Order

Keep reading for a complete walkthrough with screenshots:

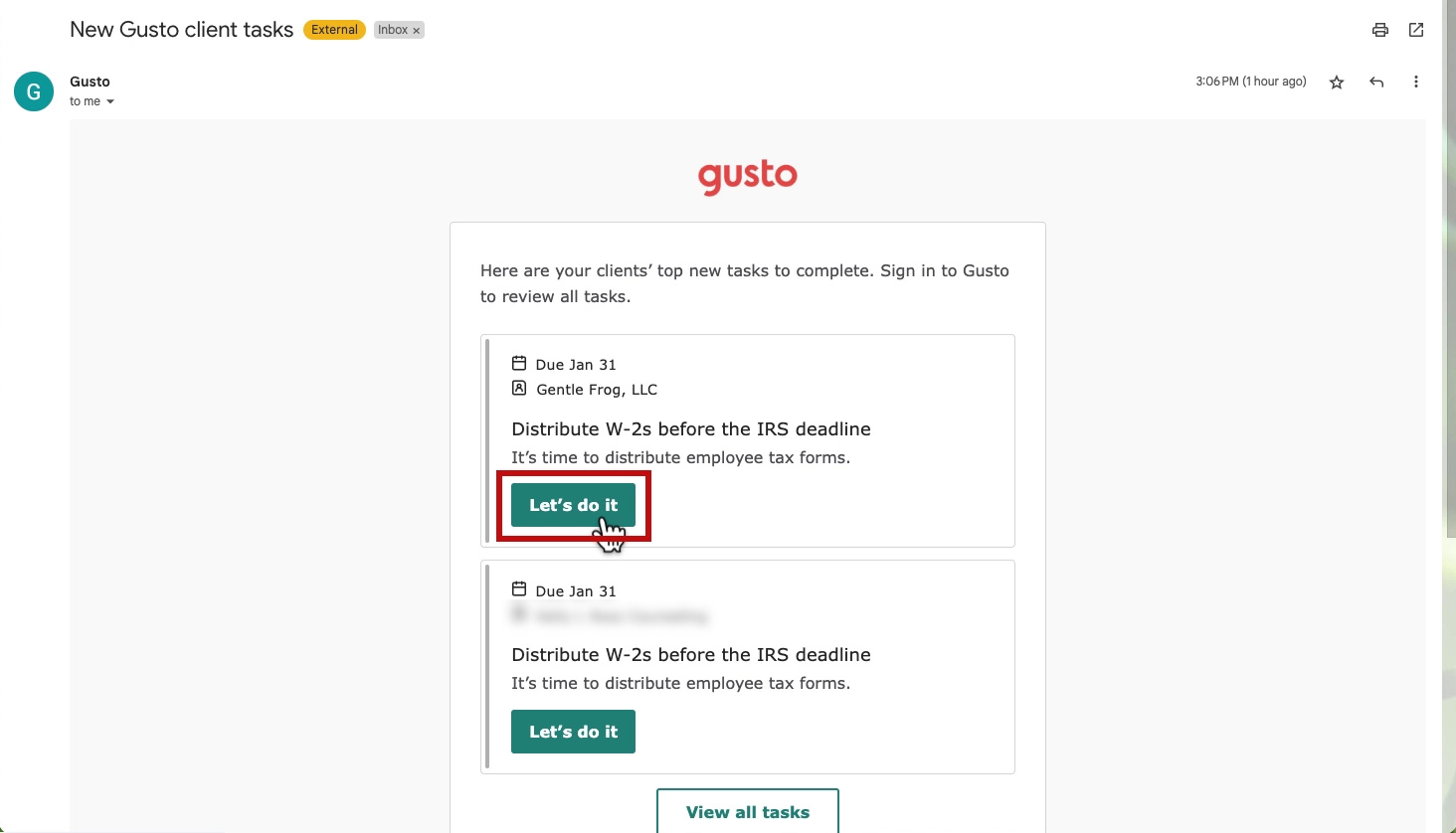

New Gusto Client Tasks Email

Have you received an email from Gusto letting you know that you have “New Gusto client tasks”?

This is what the email from Gusto looks like:

Click on the Let’s do it button to begin.

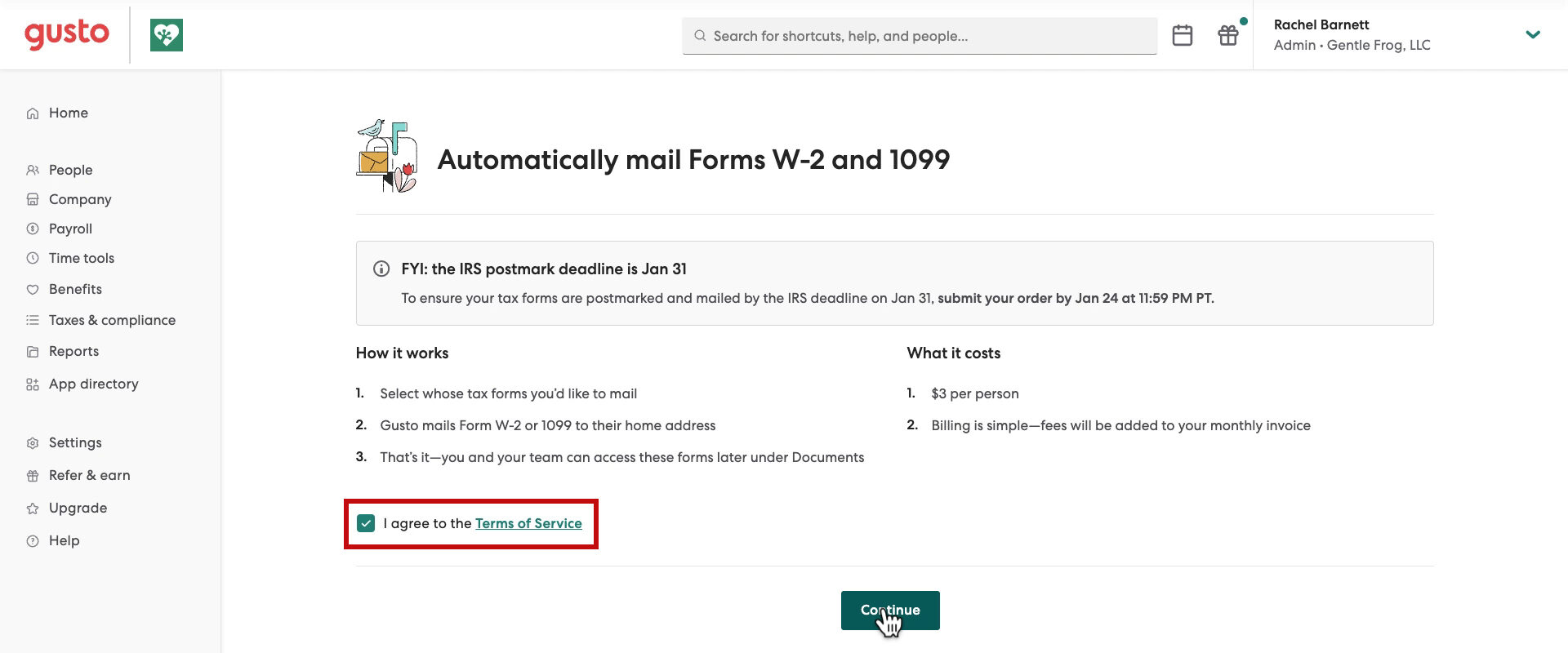

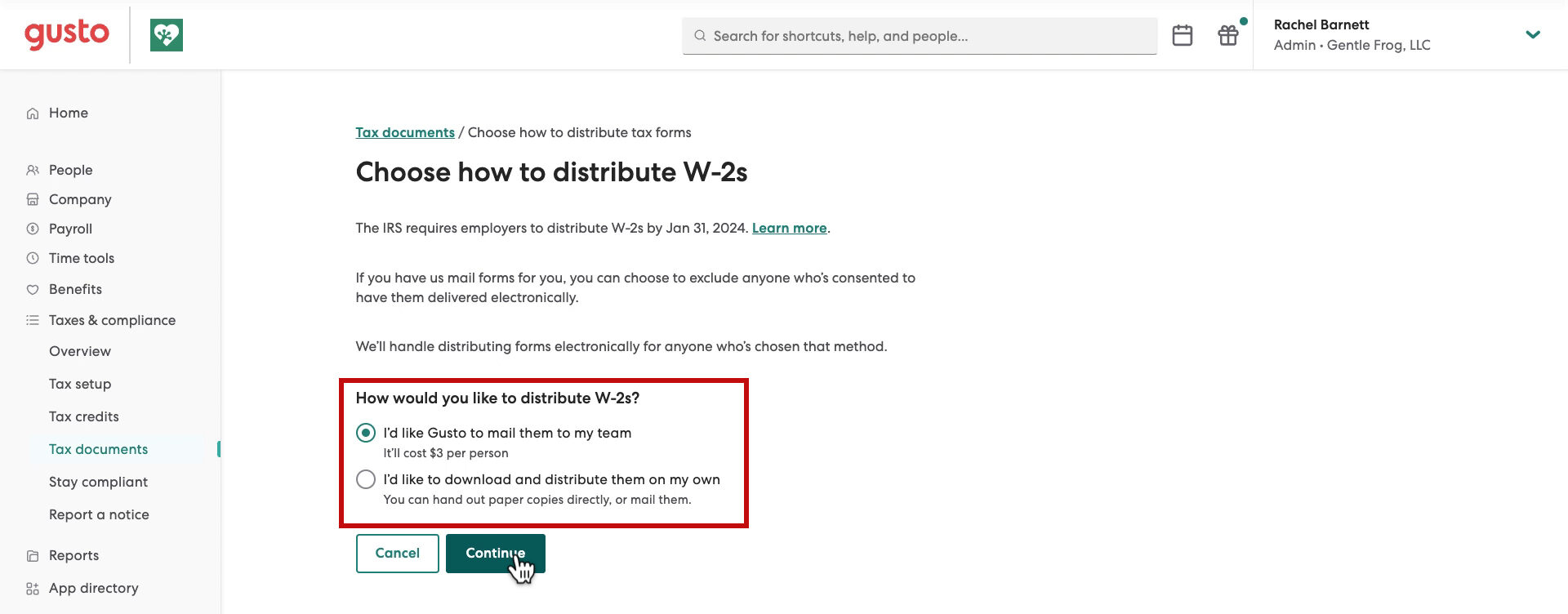

How to Distribute W-2s

You have two options for distributing your W-2s. You can have Gusto mail them, which costs $3/person. Or you can download and distribute them yourself.

I’m selecting the option to have Gusto mail them for me. When ready, click Continue.

I’m selecting the option to have Gusto mail them for me. When ready, click Continue.

On the next screen, Gusto lets you know how the process works. You select whose tax forms to mail, they mail it and the charge appears on your next invoice. It’s that easy.

You have to check the “I agree to the Terms of Service” check box before you can continue.

I didn’t pay anyone through Gusto for 1099s, which is why we didn’t see it mentioned on the previous screen.

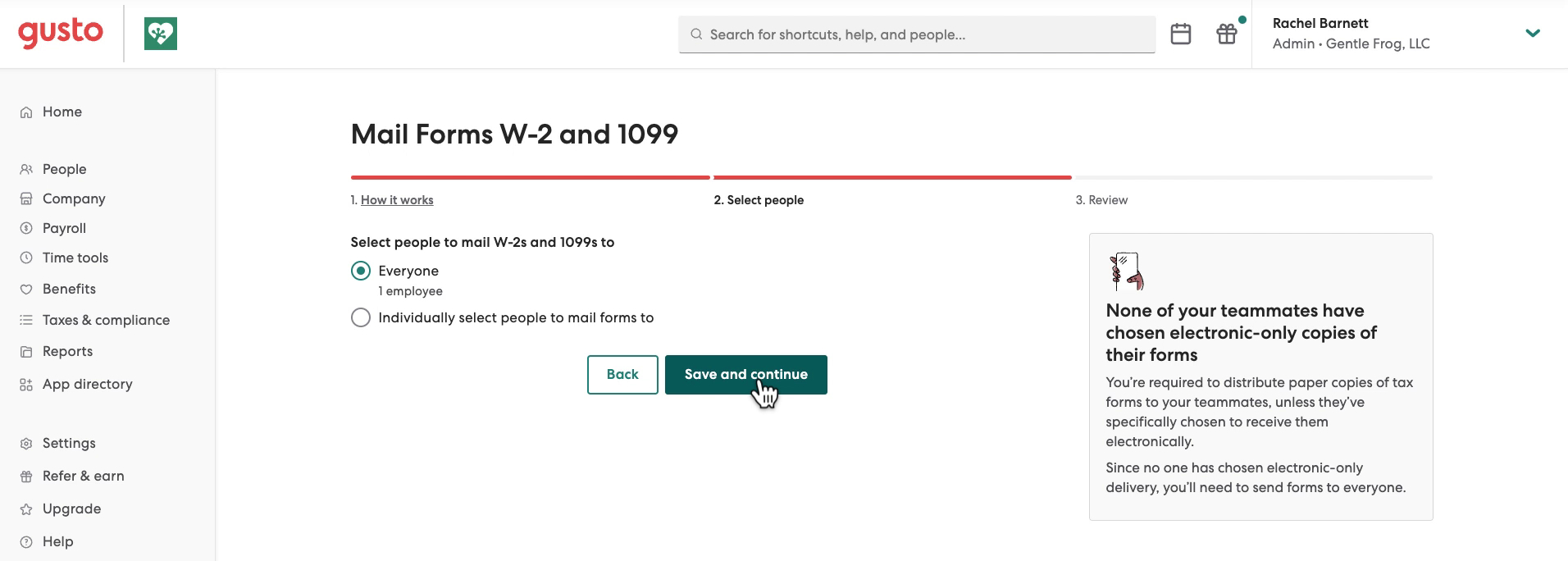

Select People

On the next screen, you select the people to mail tax forms to. You can either select everyone or individually select people.

When ready click Save and continue.

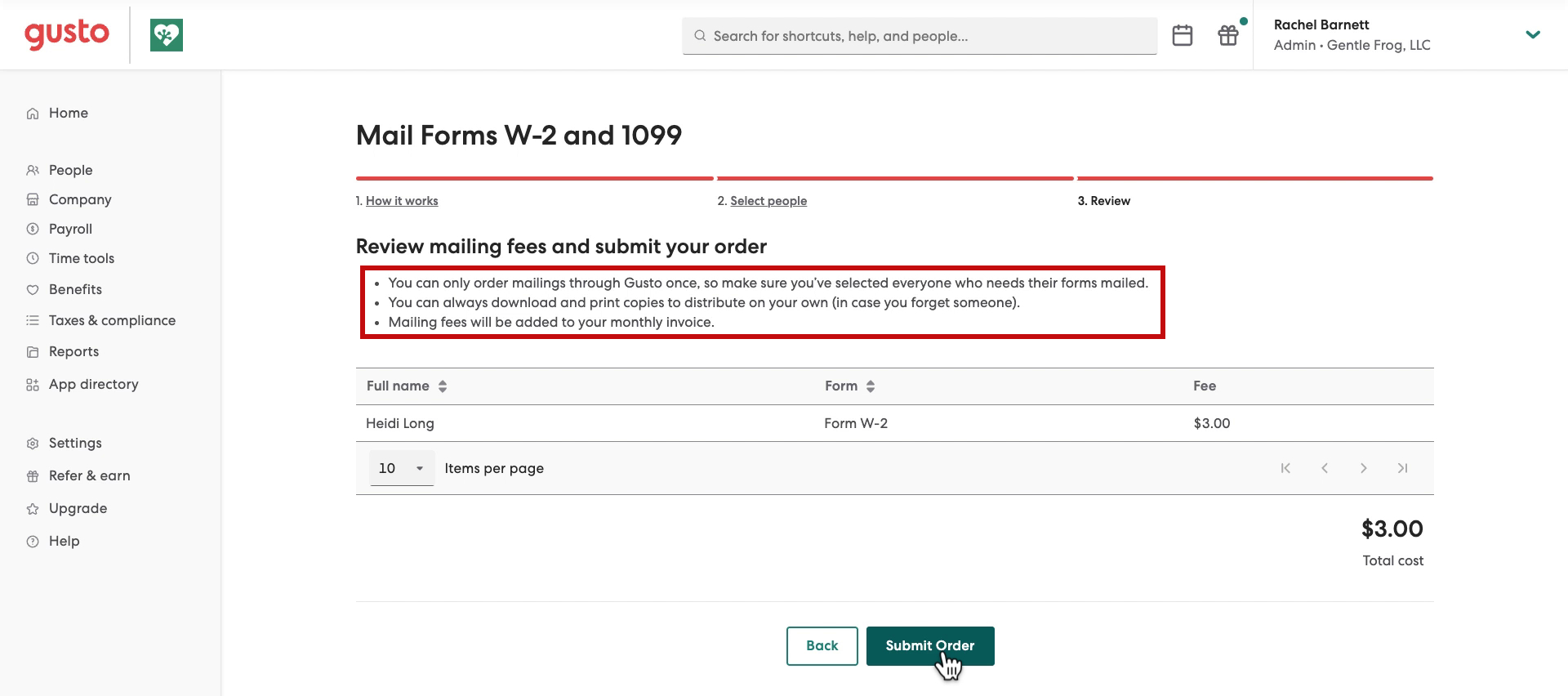

Review Mailing Fees

You get one more chance to review who will be sent a tax form and how much it will cost. Click Submit Order to process.

Note: It states “You can only order mailings through Gusto once, so make sure you’ve selected everyone who needs their forms mailed.”

If you do forget someone you can still download, print, and mail them yourself.

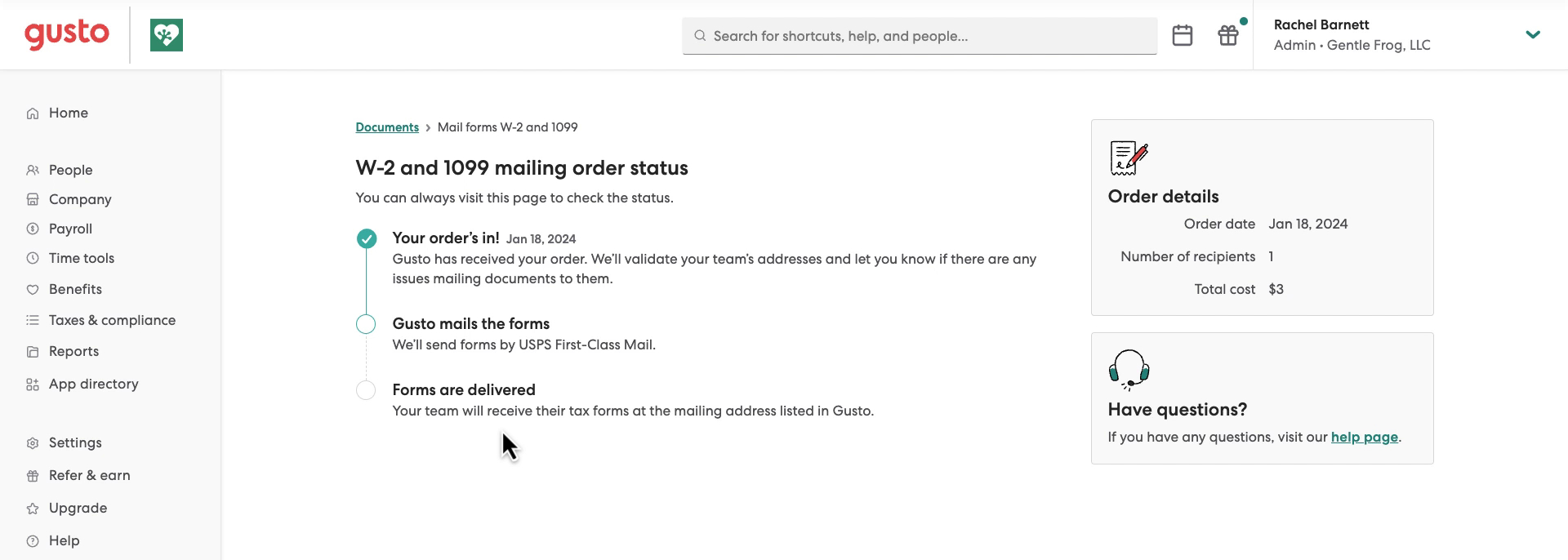

W-2 and 1099 Mailing Order Status

The final page lets you know the status of your order.

Your employees can still log into their Gusto portal and get these forms themselves. But I like to make sure they’re mailed and have it done for me so I don’t have to.

Late Fees

The deadline for filing W-2s and 1099s is January 31st. If you’re filing after that date their are late fees. Check the IRS.gov Information Return Penalties as the late fee goes up the longer you wait.

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

Below is a video if you prefer to watch a walkthrough.

If you have questions about payroll or QuickBooks Online click the green button below to schedule a free consultation.