In QuickBooks Online, you can record expenses using various forms, each serving a specific purpose.

Understanding when and how to use “Bills,” “Bill Pay,” “Expenses,” and “Checks” will help you manage your accounts effectively.

Bills and Bill Pay

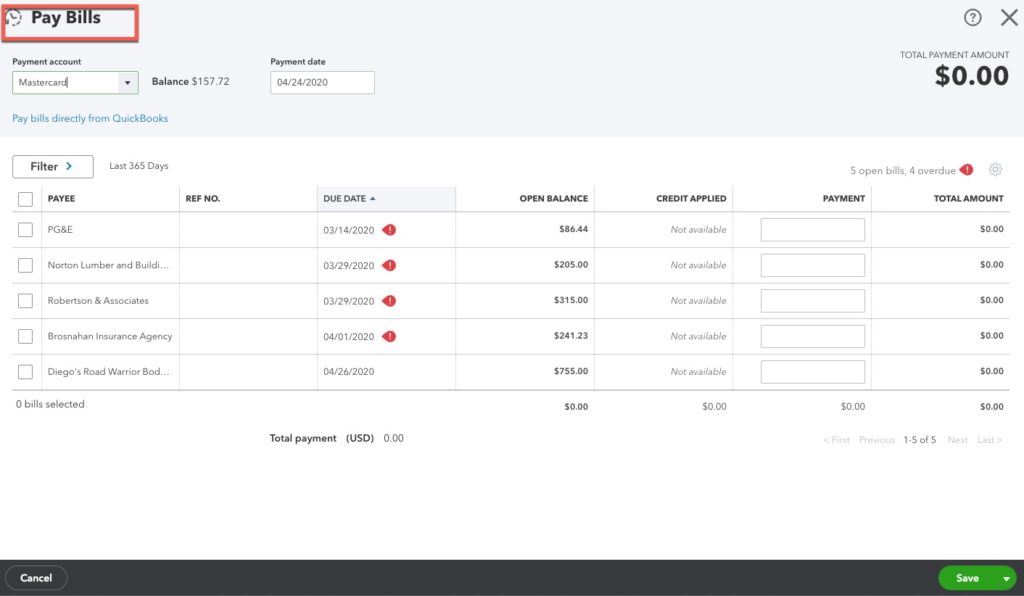

Use the “Bill” feature to record expenses that your business will pay in the future. This method tracks accounts payable, allowing you to monitor outstanding obligations.

Once you’re ready to pay, utilize the “Bill Pay” function to settle the amount due.

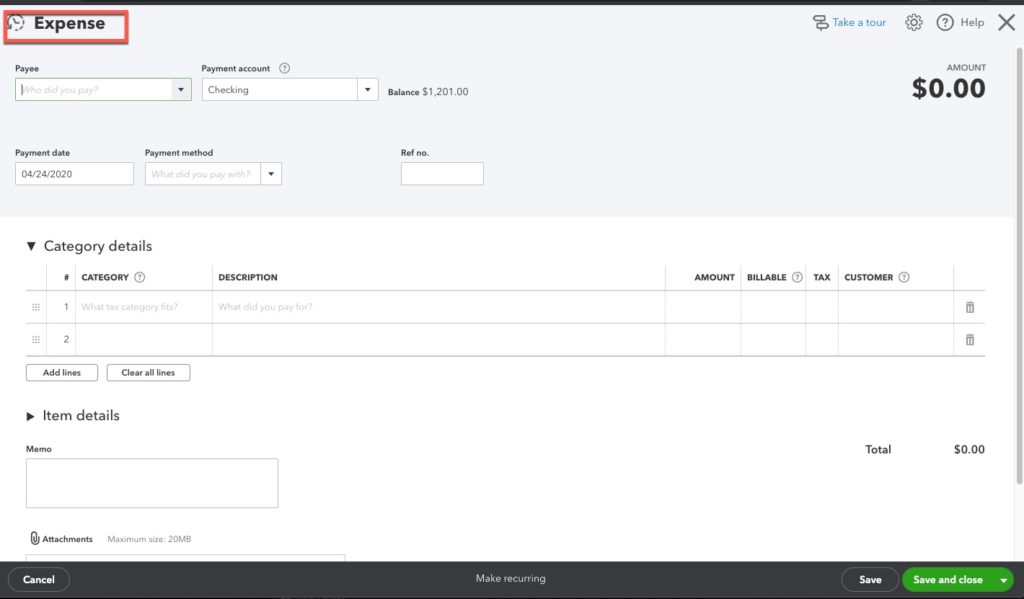

Expenses

The “Expense” form is appropriate for recording immediate payments. This includes transactions where funds are paid at the time of purchase, such as payments to vendors, utility companies, or other services.

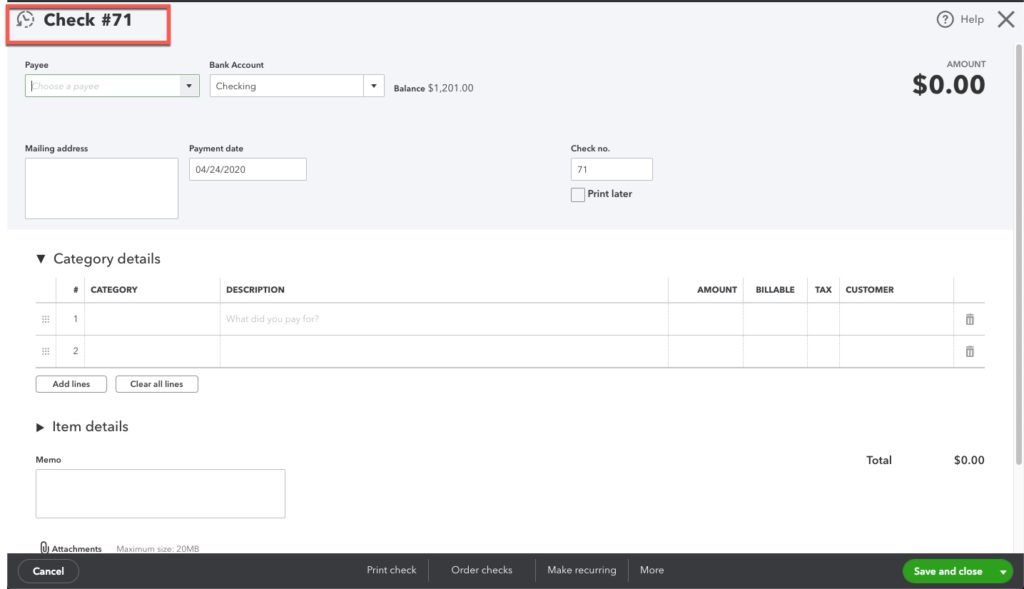

Checks

Similar to “Expenses,” except the “Check” form records payments made by check.

The key difference is that this form includes a check number and allows printing the check directly from QuickBooks.

If you frequently write checks, consider printing them through QuickBooks or using a service like Bill.com to streamline the process.

Best Practices

To maintain accurate records, choose one method for recording expenses to avoid duplication.

For instance, decide between using “Bills and Bill Payments” or “Expenses and Checks” consistently. Additionally, reconcile your bank accounts monthly to ensure all transactions are accurately recorded and to prevent duplicates.

By understanding and appropriately utilizing these features, you can effectively manage your business expenses in QuickBooks Online.

☕ If you found this helpful, you can say “thanks” by buying me a coffee…

https://www.buymeacoffee.com/gentlefrog

If you have questions about the different forms in QuickBooks Online, click the green button below to schedule a free consultation.