In this blog post, you’ll learn how to record a loan you’ve received. Then how to record the payments you make towards that loan.

Quick Instructions:

Record loan:

- Find the loan deposit in Bank transactions

- Change the Vendor/Customer name creating a new Vendor account if needed

- Create an Account for the loan

- Change Account Type to Long Term Liabilities

- Enter a name for the loan

- Click Save and Close

- Click Add

Record loan payment:

- Find the payment in Bank transactions

- Click Split

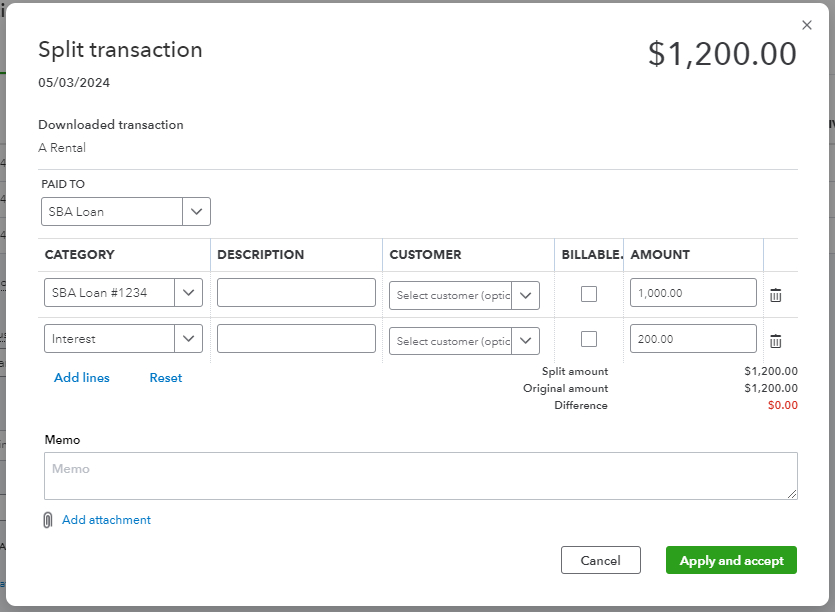

- Enter the amount going towards principal on one line with the Category being the loan account

- Enter the amount going toward interest on the next line with the Category being your Interest account

- Click Apply and accept

Keep reading for a complete walkthrough with screenshots:

Record a Loan From Bank Transactions

In this example, the loan has been deposited into a bank account attached to QuickBooks Online.

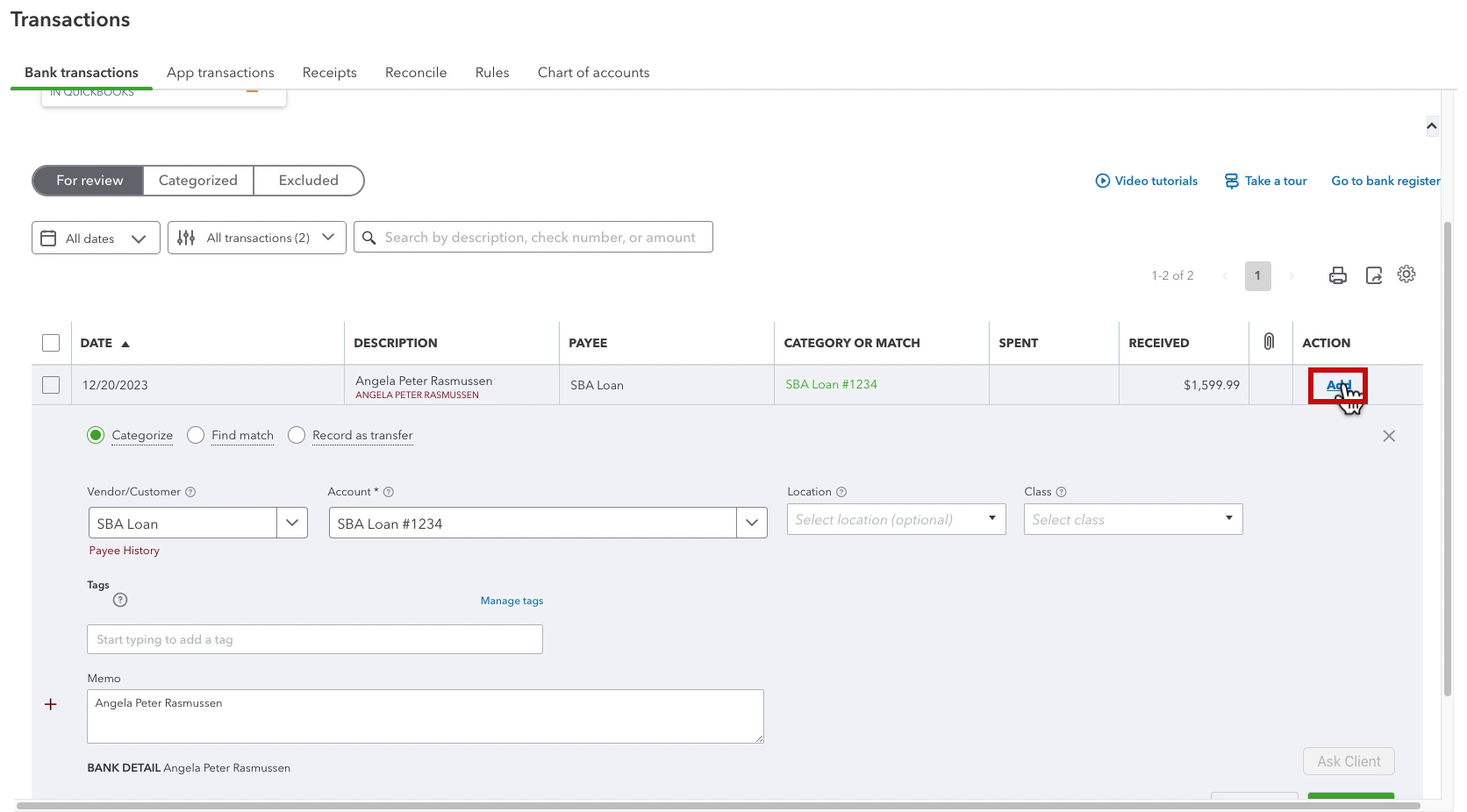

The loan deposit will appear in your bank transactions.

QuickBooks is likely to suggest the wrong Vendor/Customer name. In this example, I’m recording an SBA loan.

In the Vendor/Customer drop-down enter the name for where you got your loan and press enter. This will open the pop-out to create a new account.

Change Content type to Vendor then click Save in the lower right corner.

In the Account drop-down enter the name you want to give the loan account and click +Add new account.

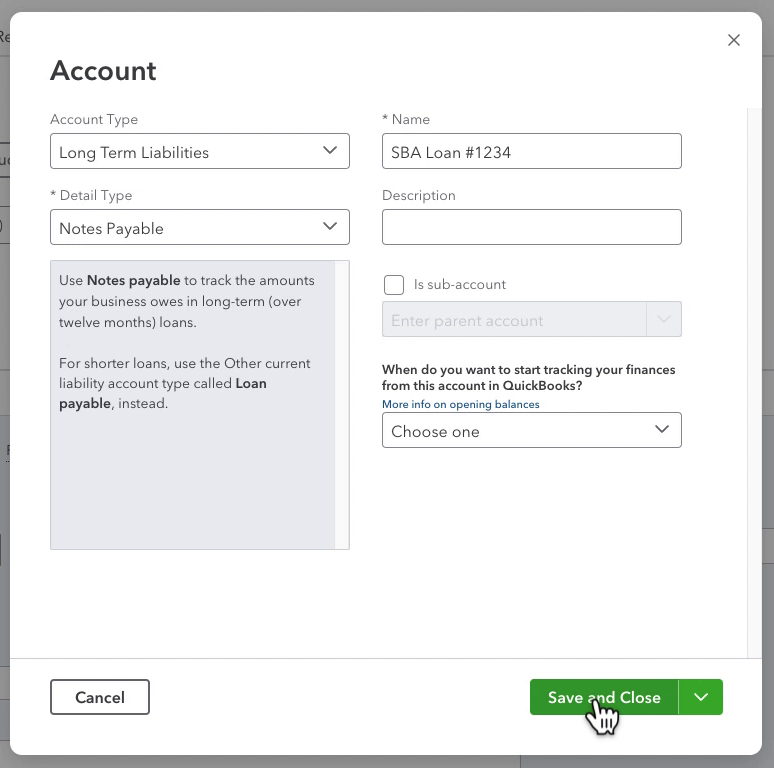

This opens the Account pop-up.

Change the Account Type to Long Term Liabilities.

Change the name to something that will make it clear to you what loan this is for. I like to use where the loan came from plus the last 4 digits of the loan number.

*NOTE: Do NOT do anything with the “When do you want to start tracking your finances from this account in QuickBooks?” drop-down. Leave it alone.

On the bank transactions screen you can now click Add for this transaction.

This will record the deposit of the loan into the bank account AND increase the loan.

Record Loan Payments From Bank Transactions

When you make a payment it will show up in Bank transactions. If the whole loan payment is going towards the principal, you can click Add.

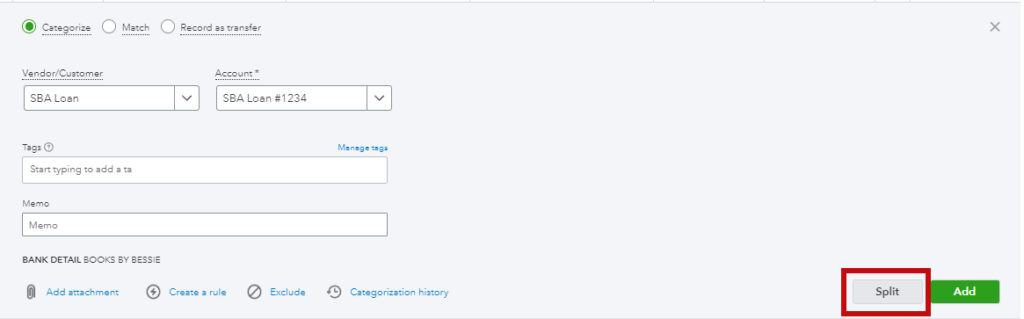

More likely part of the payment is going toward the principal and part of it is going towards interest.

To record that click the Split button.

Enter how much is going towards the principal on one line. The Category should be the loan account. Then on the next line, enter how much goes towards interest with the Category as your Interest account. Click Apply and accept.

You now know how to record a loan and loan payments in QuickBooks Online. Scroll down if you’d like to watch a video walk-through.

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

If you have questions about recording loans in QuickBooks Online click the green button below to schedule a free consultation.