Why Does QuickBooks Make Incorrect Suggestions?

QuickBooks Online uses an algorithm to suggest payee/vendor names and categories based on historical transactions.

It fills in the other fields automatically when it sees a similar amount or description.

However, the algorithm isn’t always perfect and can sometimes make incorrect suggestions, especially if multiple vendors have similar transaction descriptions or amounts.

Additionally, if you’ve previously miscategorized a transaction, QuickBooks may make incorrect suggestions based on that.

Real World Example

I use Wells Fargo for my business checking account.

When transactions are imported from Wells Fargo, they often have the description Business To Business.

QuickBooks will see this and suggest a vendor name and category that looks correct to me, but in reality, it’s completely wrong. What it does is remember the last vendor/category I used and prefill that into all transactions with a description of Business To Business.

Here’s what this looks like:

None of the Business-to-Business transactions are Gusto/Payroll. If there were only one transaction, I would probably not notice, think it’s correct, and click Add.

If this happens, you can use bank rules to fix or flag these transactions.

Using Bank Rules to “Fix” Bad Suggestions

These transactions do include information in the memo that can help identify them. This means you have two options for bank rules you can create:

- You can make individual bank rules based on information in the Memo to fix the bad suggestions

- You can make one generic rule that flags transactions like this

I use option #2 to flag any transaction with “business to business” in the Memo.

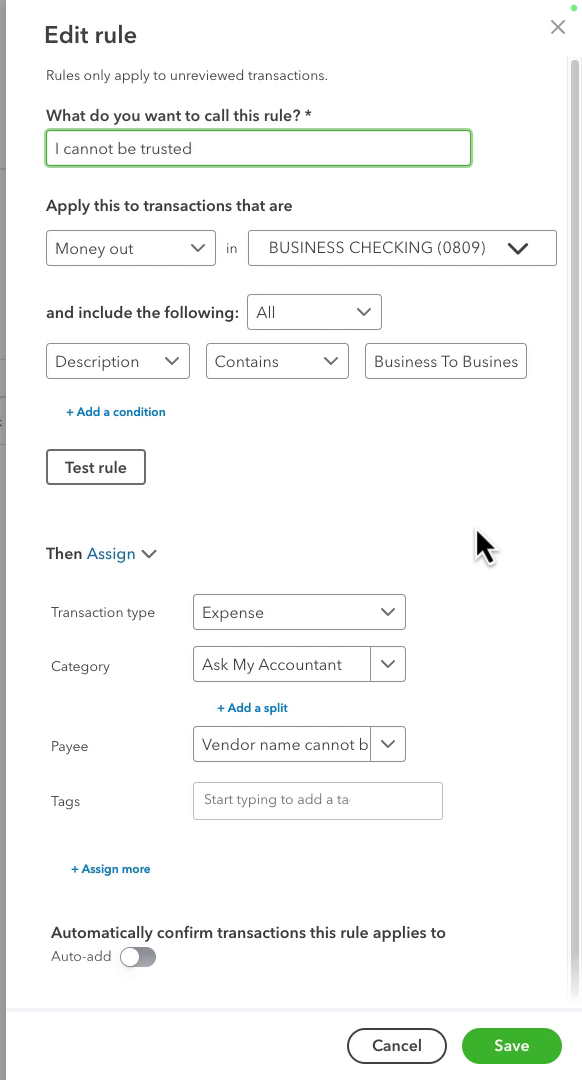

I flagged the transactions by changing the Payee to “Vendor name cannot be trusted – check this” and the Category to “Ask My Accountant.”

This is what my rule looks like:

You can use a mix of options 1 and 2. Create the generic flag rule to catch all transactions like this as they import. Then, use the information in the Memo field to create individual rules for each type of transaction.

Note: The Bank Rules list has a Priority column. Ensure any individual bank rules you create are above the “flag” rule, or QuickBooks will use the flag rule and ignore the others.

Incorrect transaction suggestions in QuickBooks Online can confuse and impact the accuracy of your financial records.

You can ensure that your books stay clean and organized by manually correcting payee names, creating smart bank rules, and regularly reviewing your transactions.

Below is a video if you prefer to watch a walkthrough.

☕ If you found this helpful, you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

If you need more help with managing your bank transactions or setting up rules in QuickBooks Online click the green button below to schedule a free consultation.

I’m here to assist you with any QuickBooks-related questions and help you keep your finances running smoothly.