If you’re in Washington State, you must file your annual DOR excise taxes by 4/15/2024.

In this blog post, I’ll log into the DOR site and show you what you need to do.

Quick Instructions:

- Log into dor.wa.gov

- Enter your SAW User ID and password, click Log in to My DOR

- Get and enter an MFA code

- Click Get Started

- Click your business name

- Click File Return

- Check any boxes that apply

- Add/Delete Tax Classifications if needed

- Click Next

- Enter Gross Amount

- Add Deductions if necessary

- Add/Delete Credits if necessary

- Click Next

- Enter Submitter Information

- Click Submit

Keep reading for a complete walkthrough with screenshots:

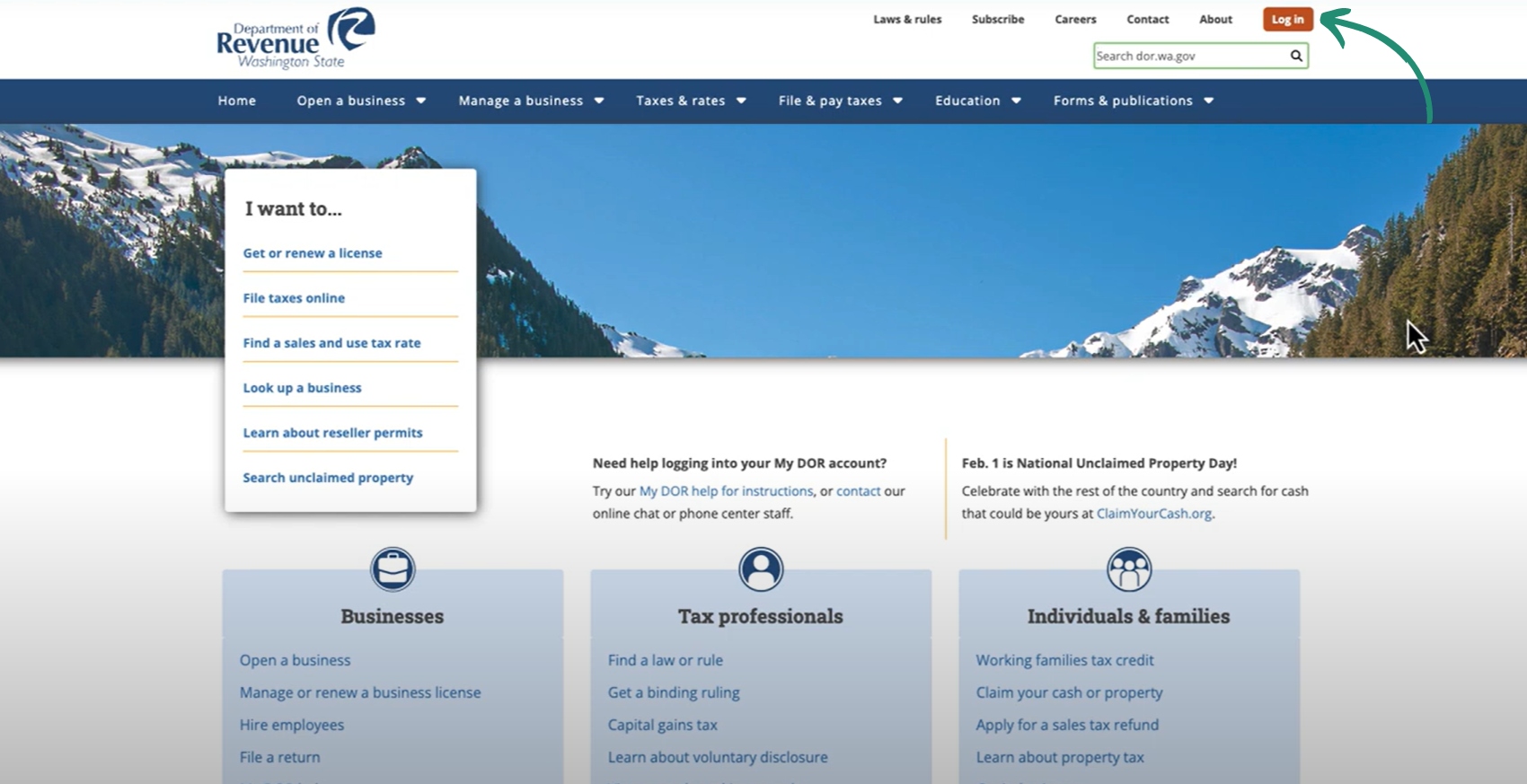

Log Into Dor.wa.gov

Go to dor.wa.gov and click the Log in button in the upper right.

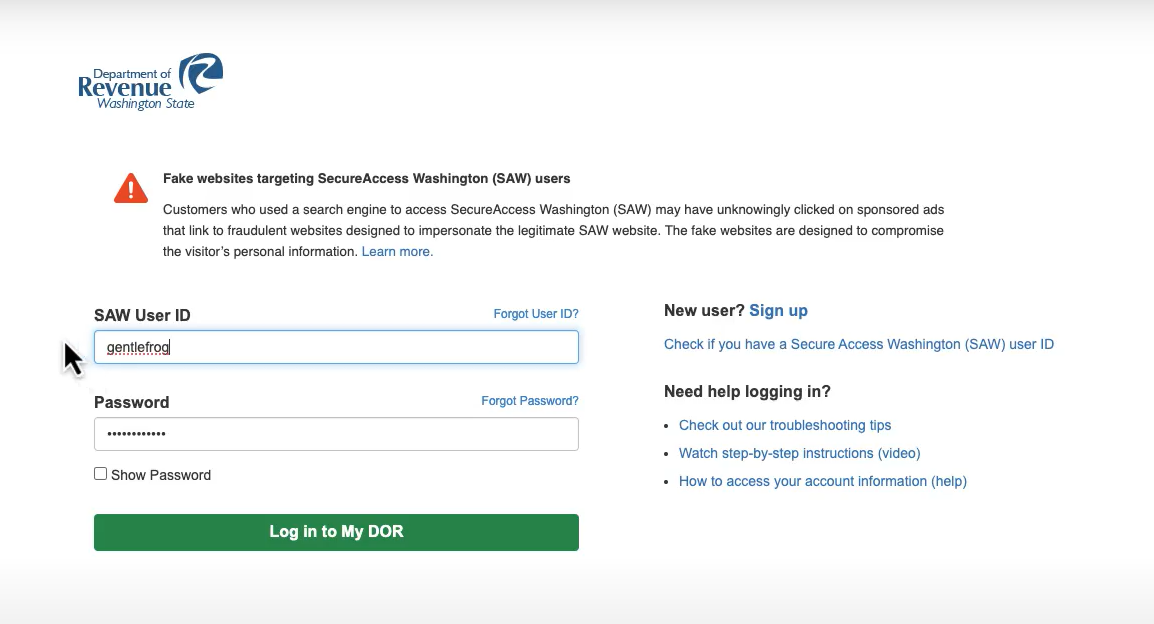

Enter your SAW User ID (Secure Access Washington user ID) and password then click the Log In to My DOR button.

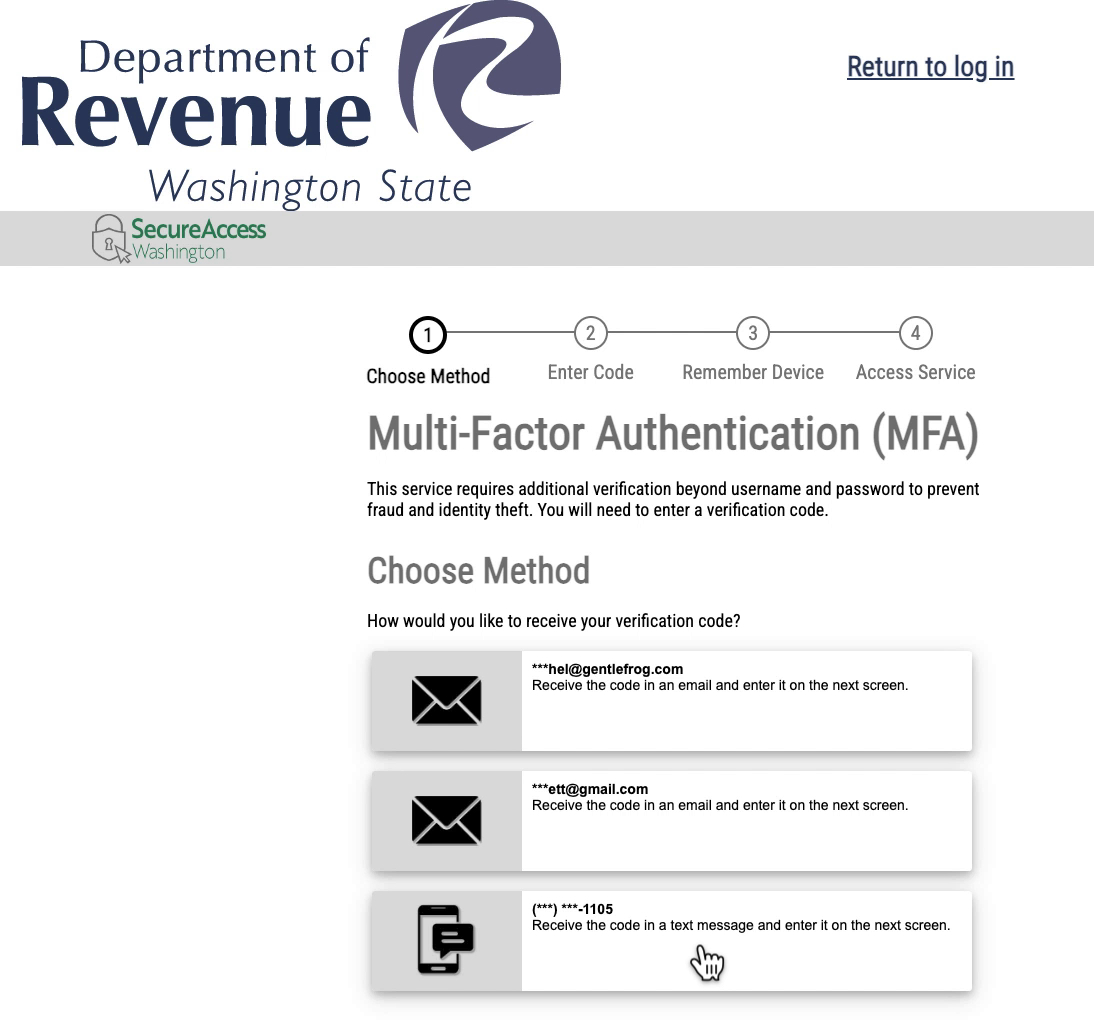

You’ll have several options for multi-factor authentication. Including receiving a code at an email address or your phone.

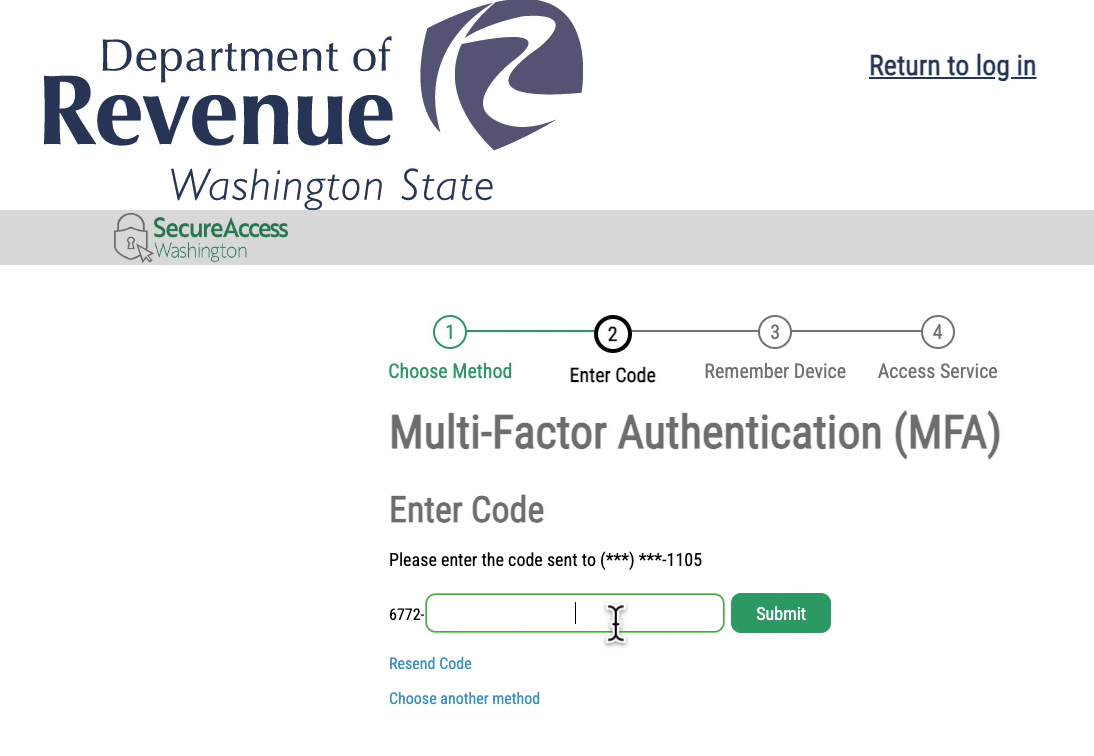

You’ll enter the code and click Submit.

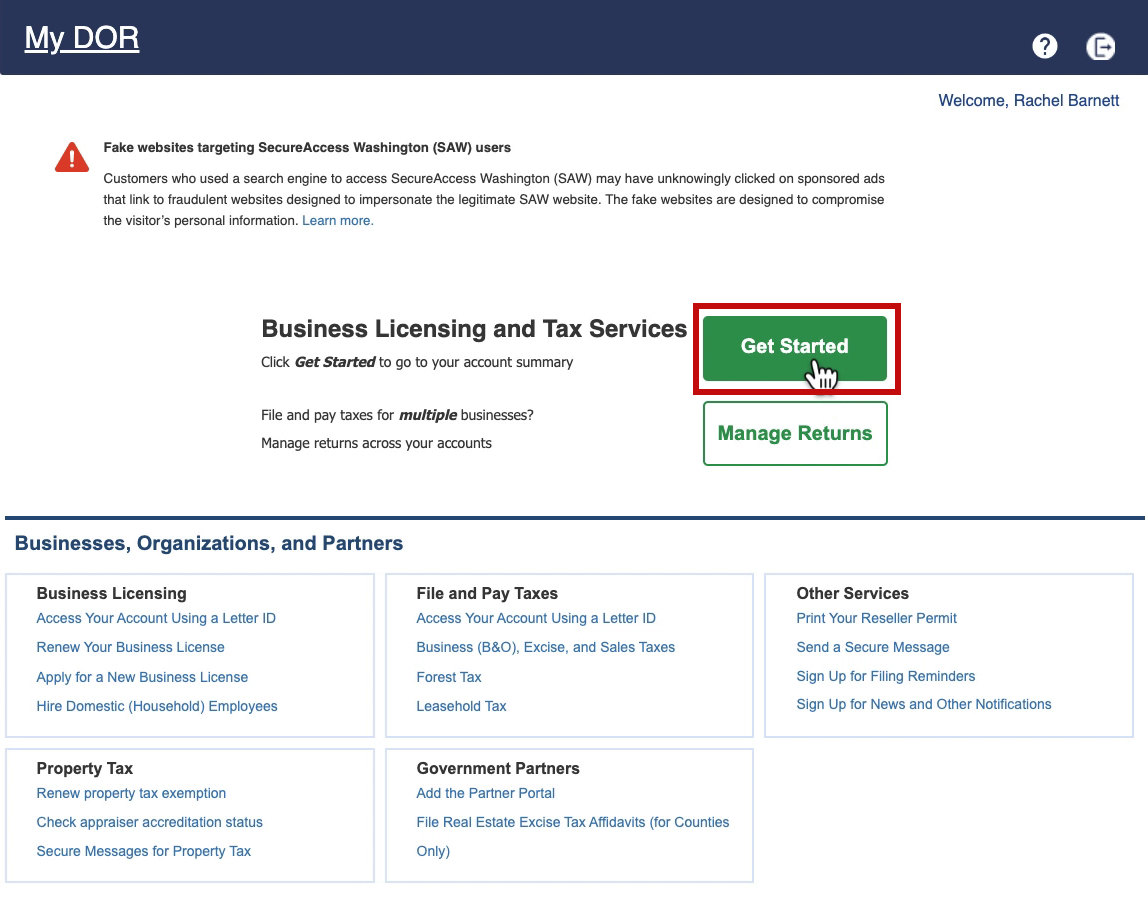

Business Licensing and Tax Services

Once logged in click the Get Started button.

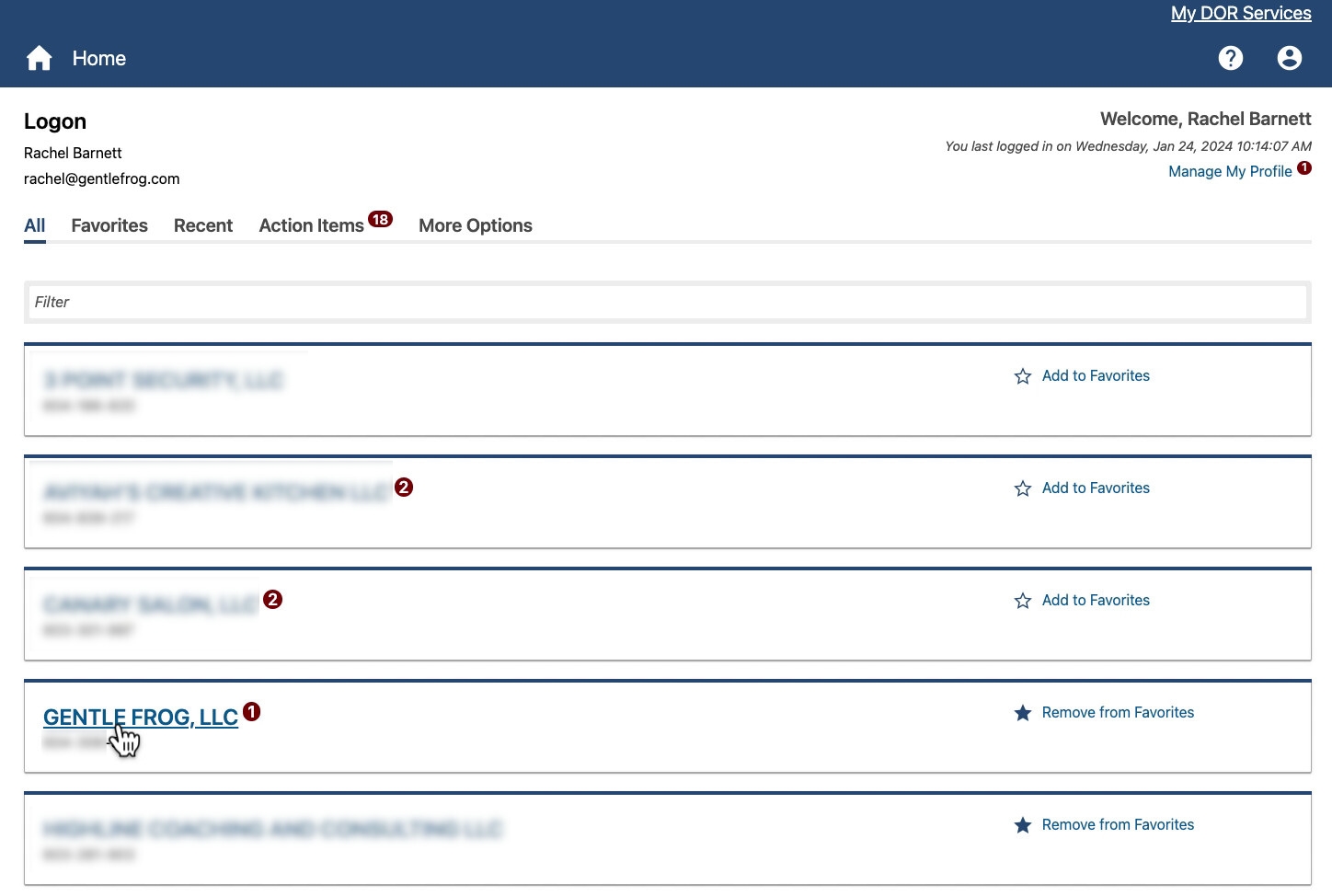

If you only have access to your business I don’t know if you’ll see this screen or not.

As a bookkeeper, I see my own business as well as the client’s businesses I have access to.

If you do see this screen, click on your business name.

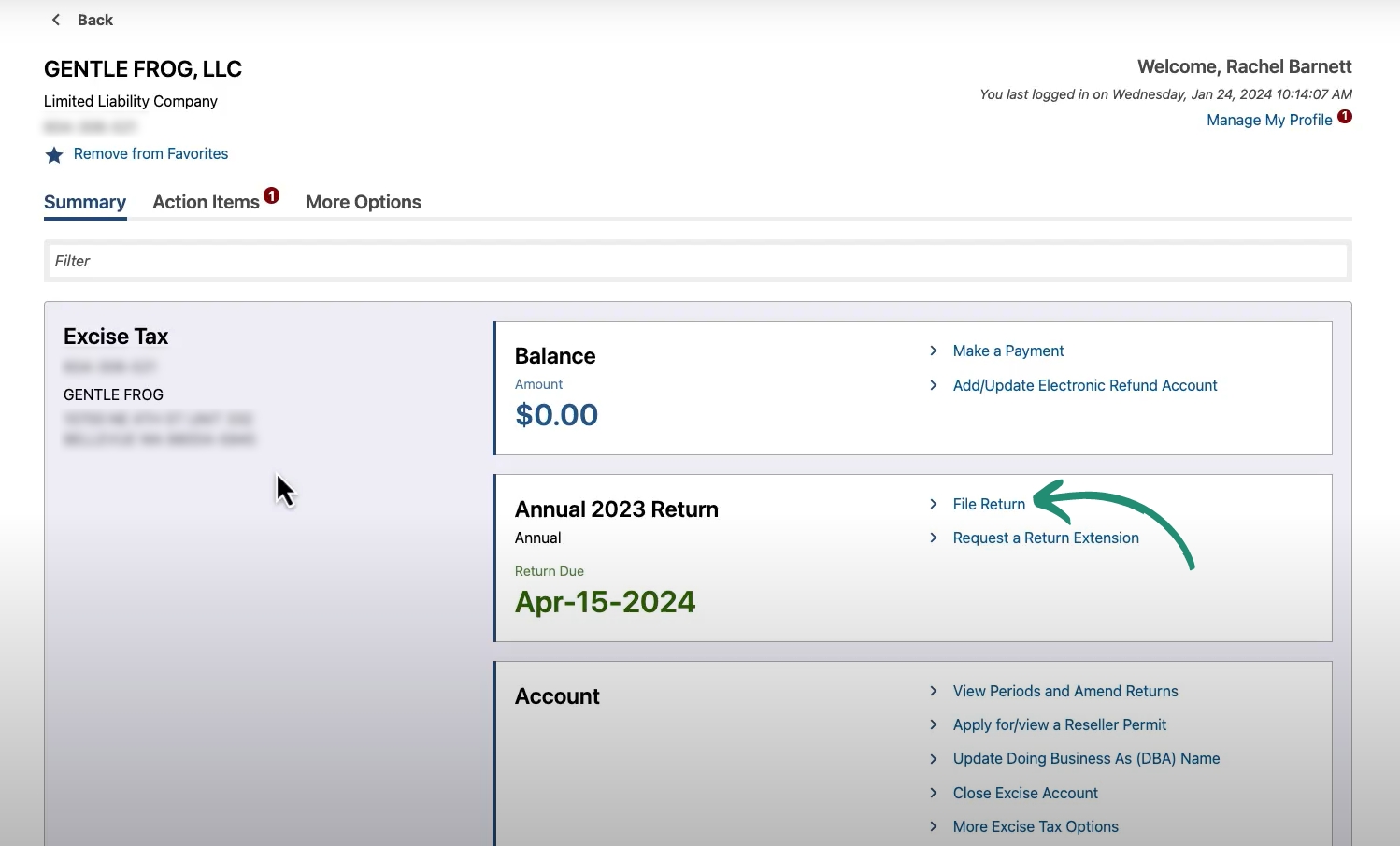

When you’re logged into your business you’ll have several options. Click on the File Return link in the Annual Return box.

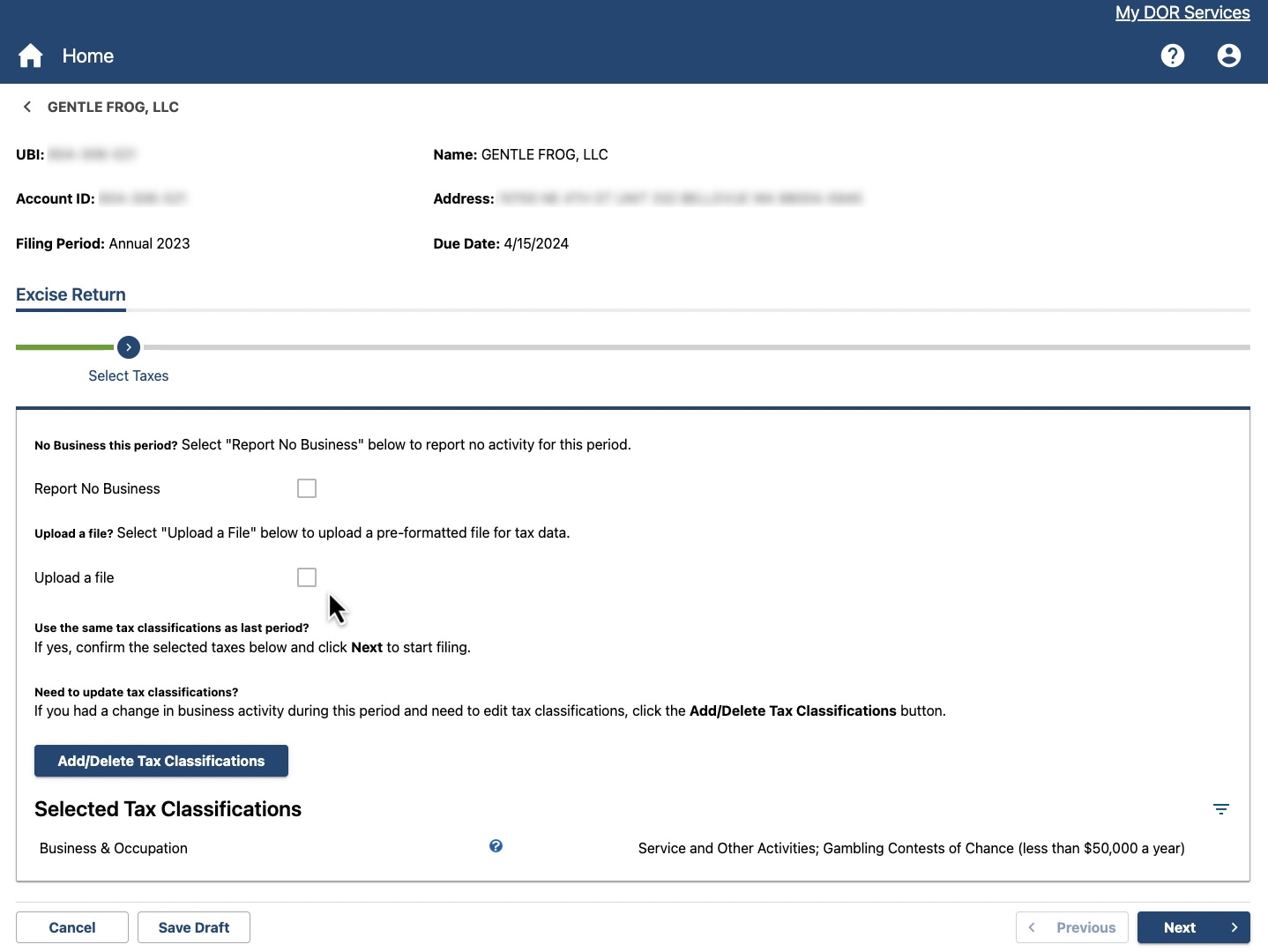

File Excise Return

The first screen is where you Select Taxes. If your business is dormant and you’ve had no business you can check off “Report No Business.”

If you have a pre-formatted file with your tax data you can check off “Upload a file.”

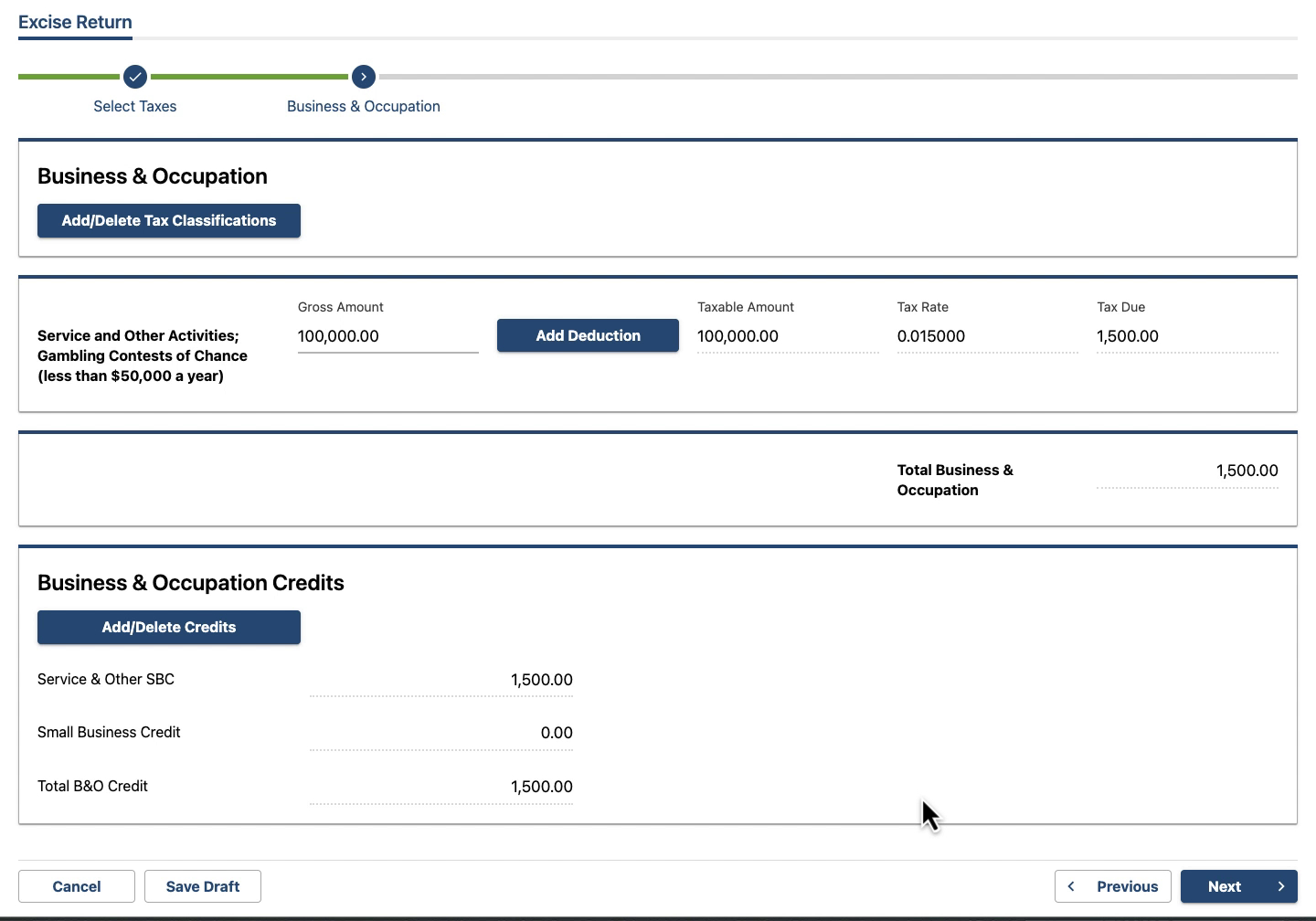

There’s a button to Add/Delete Tax Classifications. Below that it shows the tax classifications you’ve previously selected.

When ready click Next in the lower right corner.

The next screens you see will depend on your tax classifications.

Gentle Frog is in the Business & Occupation category so that’s what I see. I’m not filing my taxes at this time so I’m going to enter made-up numbers.

When you enter a Gross Amount it calculates the tax with the tax rate for your selected tax classification.

In the state of Washington, you do not deduct your expenses. But they do have a list of business-related deductions. You can click on Add Deduction to see that list and check off any that apply to your business.

The credits section automatically calculates any credits that apply to your business. You can click the Add/Delete Credits button to see all the various credit options.

When ready click the Next button in the lower right corner.

Summary

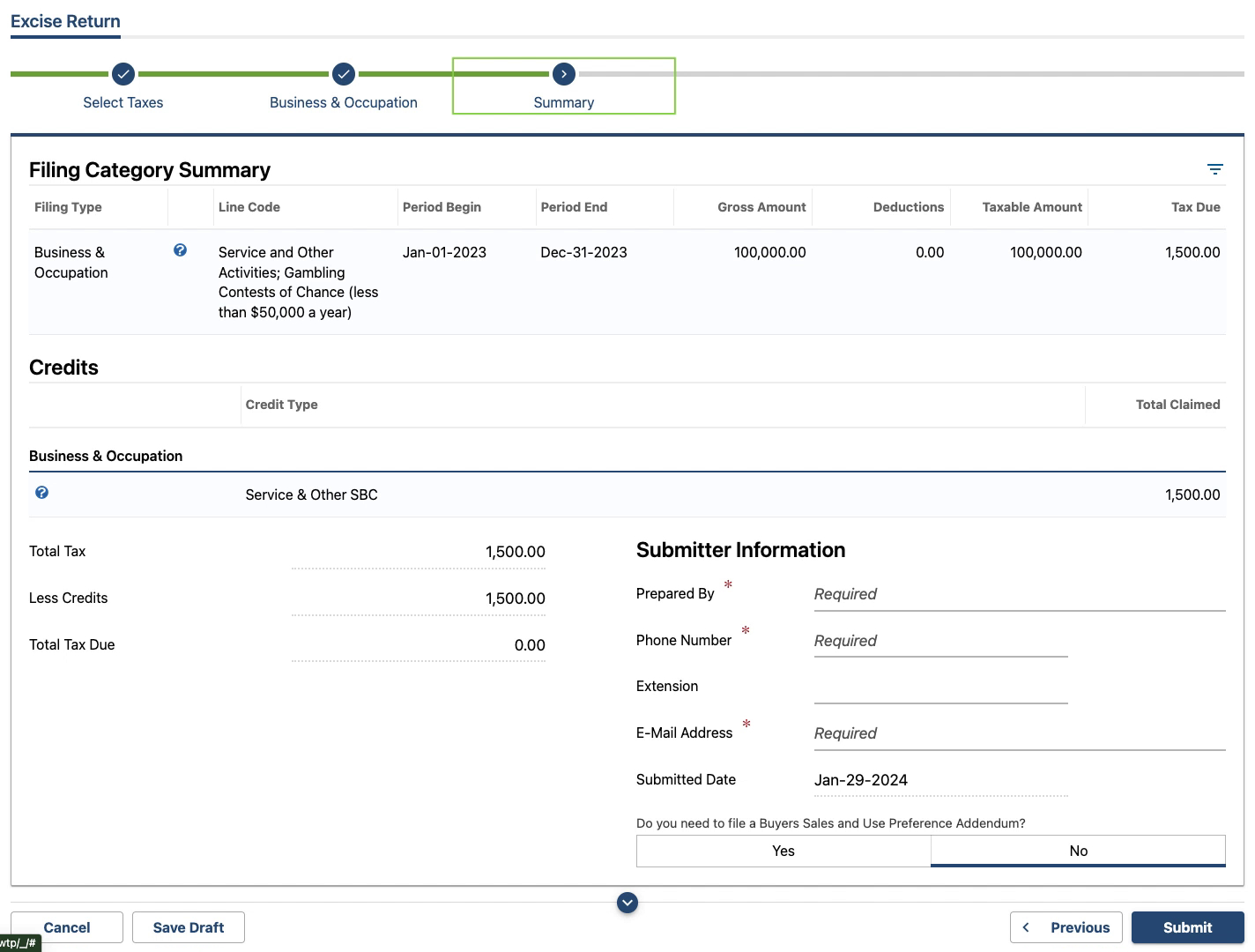

The filing summary gives you all the information previously entered on one screen.

You can see the gross amount, tax due, credits, etc.

In the Submitter Information section, you’ll enter your information.

When ready click Submit.

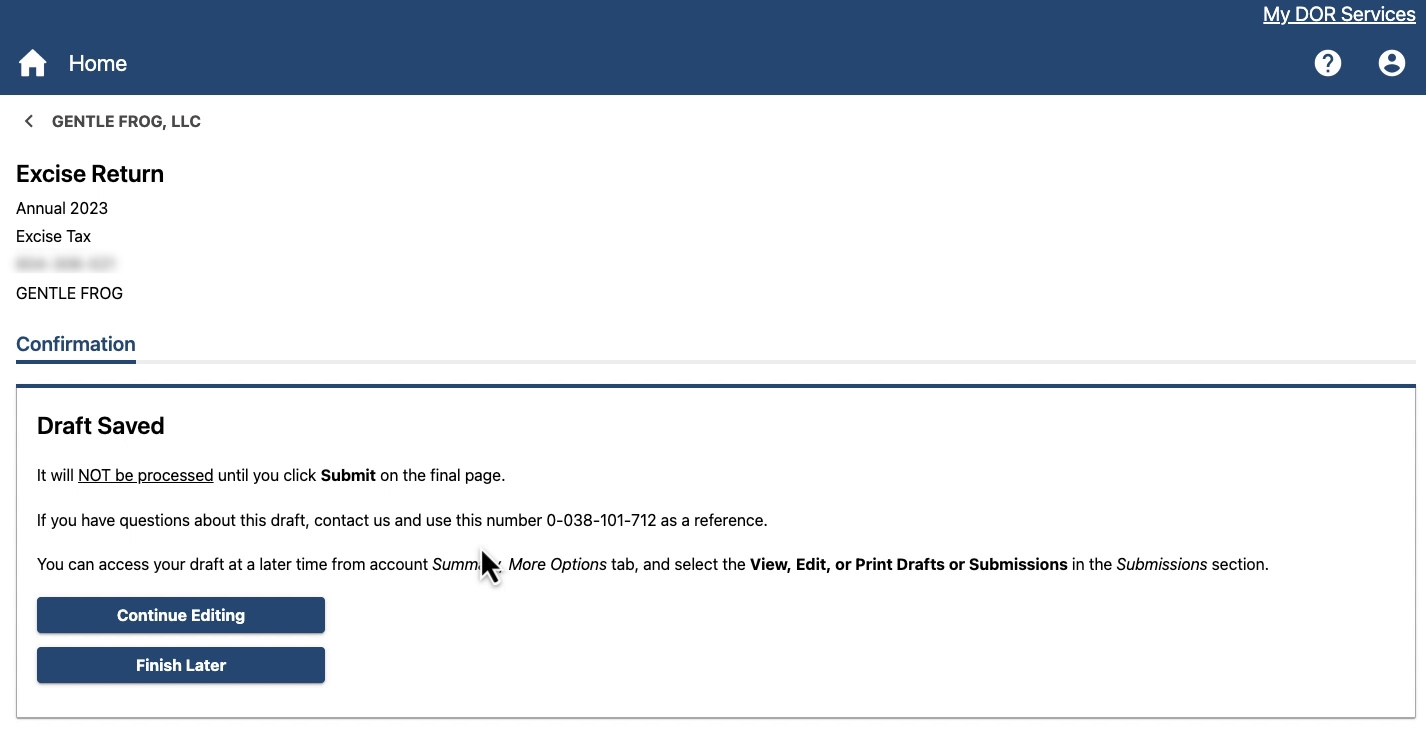

If you’re not ready to submit. You can click Save Draft in the lower left corner and it will save all the information you’ve entered and you can finish later.

If you want to see some more of the details you can scroll down and watch the video walkthrough.

If you have questions about what categories your business falls under you can request a tax ruling from WA DOR at https://dor.wa.gov/contact/request-tax-ruling

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog