In this training, I’ll show you how to find two of the most important bookkeeping reports in FreshBooks. The Balance Sheet and the Profit & Loss report.

Balance Sheet Quick Instructions:

- Click the Reports link in the left-hand menu

- Click the Balance Sheet icon

- Click Reports in the upper left-hand corner of the Balance Sheet to return to the reports page

Profit & Loss Quick Instructions:

- Click the Reports link in the left-hand menu

- Click the Profit & Loss icon

- To send a copy of the P&L as a .csv: Click the green Send Button in the upper right corner

- Enter email address

- Write a personal message (if applicable)

- Click the Send Report button

Keep reading for full instructions with screenshots.

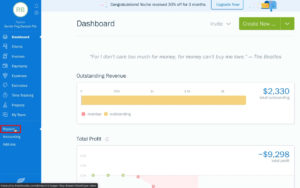

On the FreshBooks home screen’s left-hand menu you’ll find a Reports link.

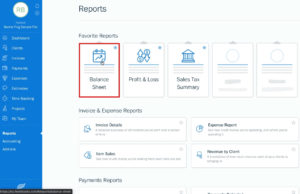

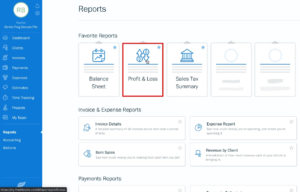

When you click the reports link you’ll be taken to the reports page. This page has all the various reports you’ll need.

Balance Sheet

Let’s start with the Balance Sheet which you’ll find in the Favorite Reports list at the top of the page.

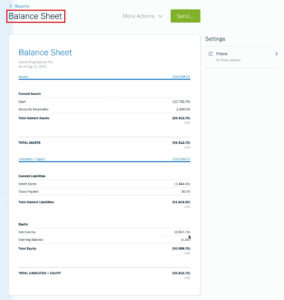

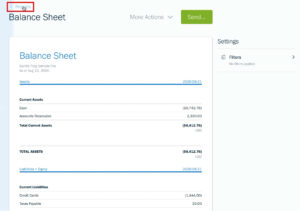

The Balance Sheet report gives you an overview of your business’s finances. It shows your assets, liabilities, and equity.

If you’re not sure how to read your balance sheet I encourage you to take the time to understand financial statements. Your local small business development center or your local SCORE office will often have classes explaining balance sheets and profit & loss reports.

Let’s go back to the Reports page by clicking the reports link in the upper left-hand corner.

Profit & Loss

Back in the Reports page let’s open the Profit & Loss report by clicking on its icon in the Favorite Reports list.

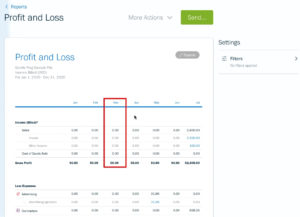

The Profit & Loss (P&L) report summarizes the total income and expenses of your business. The report subtracts the expenses from the income of your business showing you your profit and giving you an overview of the financial health of your business.

The FreshBooks P&L report shows you month-to-month so you can see how you’re doing overtime.

At the top of the report is income.

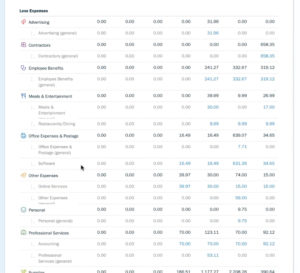

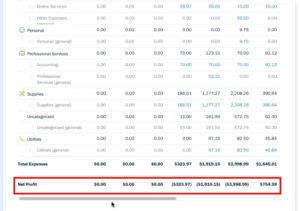

Next is the expenses.

At the very bottom of the report is the net profit/loss.

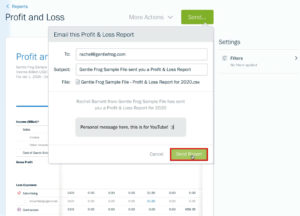

You can send yourself (or your accountant) a copy of this report as a .csv file. To do this click the green send button in the upper right-hand corner.

You’ll enter the email address you want it sent to. The subject will be pre-filled and the file attached. You can also enter a personal message if you’d like and then click the green Send Report button.

I hope this helps you understand where to locate your reports within FreshBooks.

☕ If you found this helpful you can say “thanks” by buying me a coffee…

https://www.buymeacoffee.com/gentlefrog

If you’d like to watch me walk through this process check out the video below:

4 Responses

How do you access the Profit and Loss Report for the previous year?

Hi Dan,

To get a Profit and Loss Report for a previous year you just need to change the date for the report to “Last Year”

-Jess

Is it possible to customize the P&L in fresh books? Specifically, I’d like to exclude expenses I have listed as “Personal” in my P&L. Thanks!

Hi Keith, we’re not Freshbooks experts. But we do know one! We send anyone with Freshbooks questions to our good friend Kate Johnson at https://heritagebusinessservices.com/ Kate can help you out with any Freshbooks questions you have.

-Jess