Choosing the right QuickBooks edition can feel overwhelming, but it’s a crucial step in managing your small business finances effectively.

QuickBooks offers various editions, each tailored to different needs.

This guide will help you understand the options and choose the best one for your business.

Why QuickBooks is Essential for Small Businesses

QuickBooks simplifies your financial management. Making it easier to track income, expenses, and taxes.

Millions of businesses trust it for its versatility and robust features. However, selecting the right edition ensures you get the most value from this powerful tool.

Understanding the Available Editions

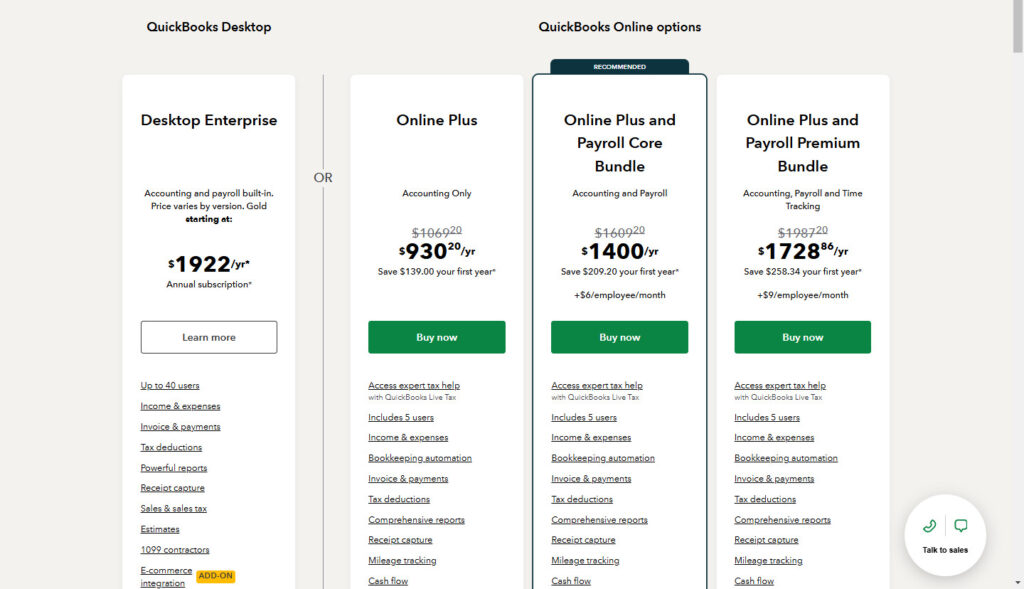

QuickBooks offers several editions, each designed to meet specific business requirements. Here’s a quick breakdown:

- QuickBooks Online

This cloud-based version is ideal for businesses needing flexibility. Access your books from anywhere and collaborate with your accountant in real-time. Multiple pricing tiers ensure scalability as your business grows. - QuickBooks Desktop

Prefer desktop software? This edition provides robust features for managing complex finances. It’s ideal for businesses that don’t require cloud access. Options like Pro, Premier, and Enterprise cater to businesses of various sizes. - QuickBooks Self-Employed

Track income, expenses, and mileage easily, and generate basic reports for tax time. Note: Personally, I DO NOT suggest using this version. - QuickBooks Mac Plus

Designed specifically for Mac users, this edition offers features similar to the Desktop version but optimized for macOS.

How to Choose the Right Edition for Your Business

Selecting the best edition depends on several factors. Here are key considerations:

Business Size and Complexity

Smaller businesses or freelancers might find QuickBooks Online sufficient. Larger businesses may need the advanced tools in QuickBooks Desktop Premier or Enterprise.

Accessibility Needs

QuickBooks Online is the way to go if you need access from multiple devices or locations. For those who prefer offline work, QuickBooks Desktop is a reliable choice.

Budget

QuickBooks editions vary in price. QuickBooks Online has more budget-friendly plans, while Desktop Enterprise requires a larger investment but offers powerful features.

Industry-Specific Features

Some editions of QuickBooks Desktop include industry-specific features, such as for manufacturing or nonprofits. If your business operates in a niche industry, consider these options.

Tips for Getting Started with QuickBooks

- Take Advantage of Free Trials: Many editions offer free trials. Use these to explore features before committing.

- Consult Your Accountant: A professional can provide guidance on which edition best suits your business needs.

- Consider Integration: Ensure the edition you choose integrates with your existing software and systems.

The Right QuickBooks Edition Makes a Difference

Choosing the right QuickBooks edition simplifies your financial processes, saves time, and supports your business growth.

You can make an informed decision by evaluating your needs and comparing the features of each edition.

For more detailed information, visit QuickBooks’ official comparison page or consult your financial advisor. Whether you choose QuickBooks Online or Desktop, you’ll gain a powerful ally in managing your small business finances.

Of course, choosing the version and edition of QuickBooks that’s right for you is only half the battle. In order to keep and maintain your books, you’ve got to have some basic understanding and confidence in using the software or app.

Fortunately, I have a Getting Started With QuickBooks Online course. Designed to quickly and easily get you up to speed with using QuickBooks Online in a way that supports your business and saves you time and money, especially if you’re a DIYer.

I hope you’ll join me so you can take the reins of your books and spend less time fretting over bookkeeping and more time doing what you do best!

One Response

Thanks for the blog, its quite interesting.