When filing 1099 forms in QuickBooks Online, you may notice that the Paypal payments you made to vendors are showing up.

These types of transactions get reported by PayPal on a 1099-K that they issue. You do not need to report them on a 1099-MISC or 1099-NEC.

Quick Instructions:

- Find PayPal Payments

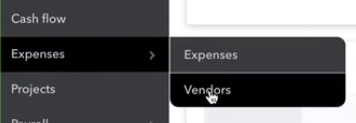

- Click Expenses -> Vendors in the left side menu

- Find or search for the vendor you made payments to using PayPal

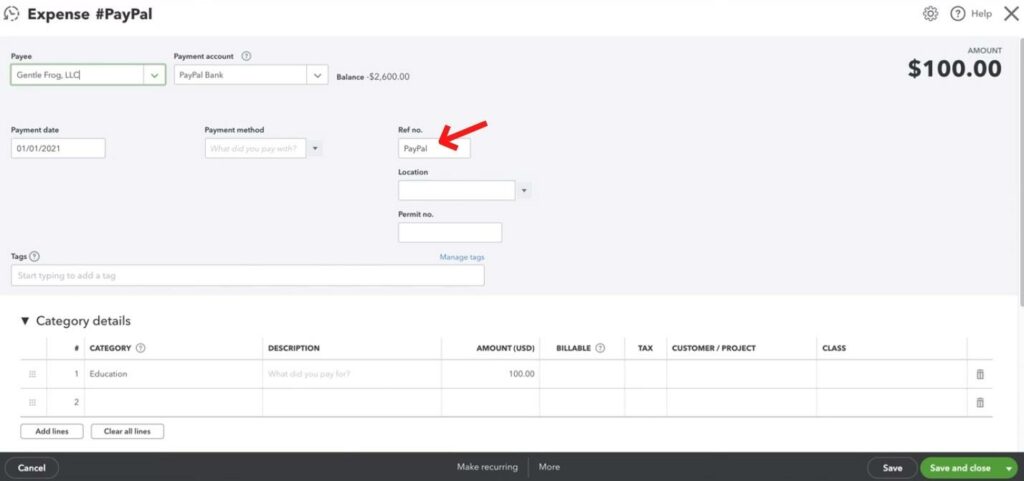

- Enter PayPal in the No. field (Ref. No. within the transaction)

- Track Payments for 1099

- Click Expenses -> Vendors in the left side menu

- Select the vendor

- Click the Edit button in the upper-right-hand corner

- Check the Track payments for 1099 box

- Click Save

- File Your 1099s in QBO

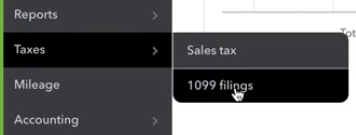

- Click Taxes -> 1099 Filings in the left side menu

- Click the Continue your 1099s button

- Review your company info screen

- Double-check your information matches tax documents

- Click next

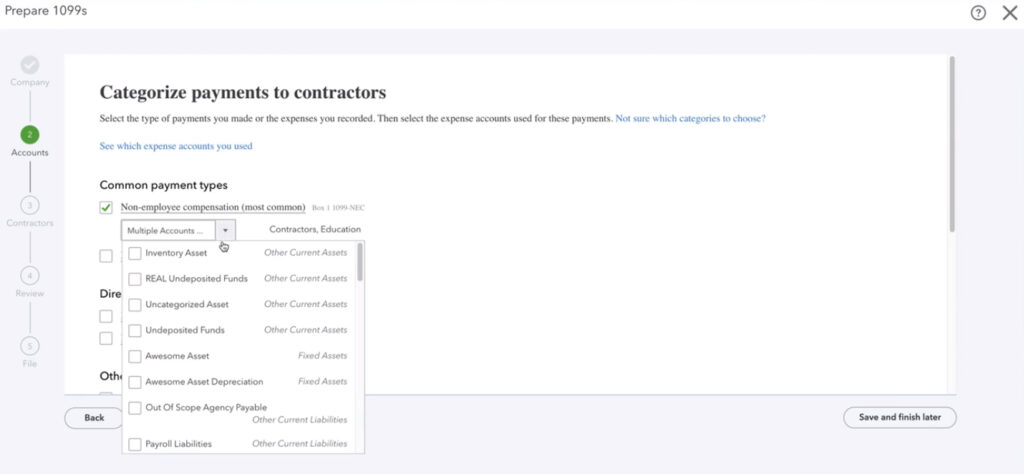

- Categorize payments to contractors screen

- Check off Non-employee compensation

- Select accounts you want included in the 1099-NEC box 1

- Click Next

- Review your contractor’ info

- Click Next

- Check that payments add up

- Double-check the numbers on the screen are correct

- Click Finish preparing 1099s

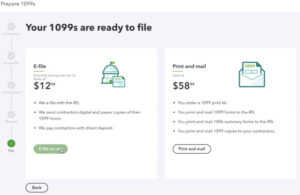

- Select E-file or Mail your forms

How to Find PayPal Payments

To find payments you made to vendors using PayPal, click Expenses in the left-hand menu, then select Vendors.

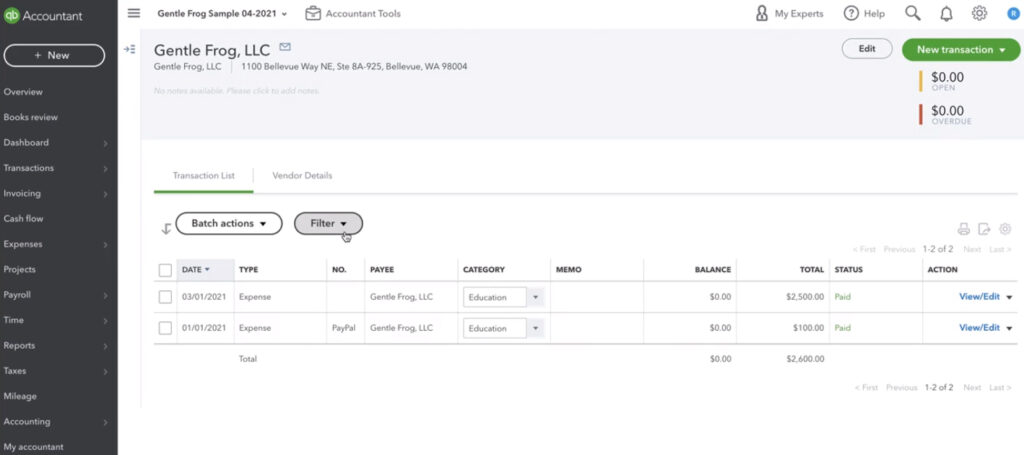

Find or search for the vendor you made payments to using PayPal.

In the list of transactions for that vendor, you’ll want to make sure any PayPal payments have “PayPal” in the NO. field.

In the transaction, this is the Ref. no. field:

Track Payments for 1099

You should also ensure that any vendor whose payments should be included in a 1099 is being tracked.

To do this, in the left side many click Expenses -> Vendors. Select the vendor then click the Edit button in the upper right-hand corner.

Make sure the Track payments for 1099 box is checked. Then click the Save button.

How to File Your 1099s in QuickBooks Online

To file your 1099s in QuickBooks Online, click on Taxes in the left-hand menu and then select 1099 filings.

Click the Continue your 1099s button.

The first screen is Review your company info. Here, you should double-check that all your company information matches your tax documentation. Click the Next button to continue.

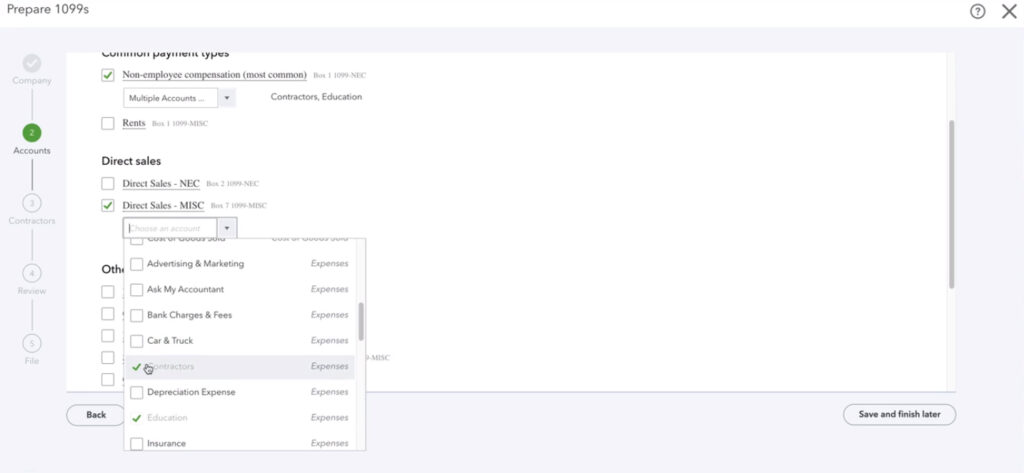

On the Categorize payments to contractors screen check off “Non-employee compensation.” Then select which accounts you want to be entered into the 1099-NEC box 1.

NOTE: Any accounts you select for NEC will not be available for MISC. You can see in the screenshot below that Contractors (which I selected for 1099-NEC box 1) is grayed out:

Click next to continue to the Review your contractors’ info page. This page shows anyone you’ve checked off as having a 1099.

Click next to continue to the Check that the payments add up screen. This page shows you, for the accounts you selected for NEC: the total payments, how much is included in NEC, how much is excluded, and the 1099 total.

If everything is correct, click the Finish preparing 1099s button.

You can then choose to E-file or print and mail your forms.

If you have any questions about whether you should file 1099s or how to file 1099s please refer to the IRS:

Information Return Reporting (if/when you should file)

About Form 1099-NEC, Nonemployee Compensation

About Form 1099-MISC, Miscellaneous Income

☕ If you found this helpful you can say “thanks” by buying me a coffee…

https://www.buymeacoffee.com/gentlefrog

2 Responses

By selecting Paypal does QBO know to exclude that transaction from 1099 or are you as the user supposed to do something else? For example if you paid legal expenses via the checking account via paypal or via debit card. Both the debit card and paypal payments should be excluded from 1099. Then you pay a third legal bill and pay with a check. How does QBO know by entering paypal or debit card in the No section to exclude those payments?

Hi Kim,

This blog post is provided as guidance to help some folks. Your situation requires you to be very careful to ensure it’s done correctly. I would strongly encourage you to export your purchases to excel to make 100% certain that the totals QBO provides are exactly what you need. This will ensure that if QBO does or doesn’t exclude the right/wrong things, you’ll know it before processing 1099s.

-Jess