In this blog post, I’ll show you how to download your PayPal transactions to a CSV file with a running balance.

Quick Instructions:

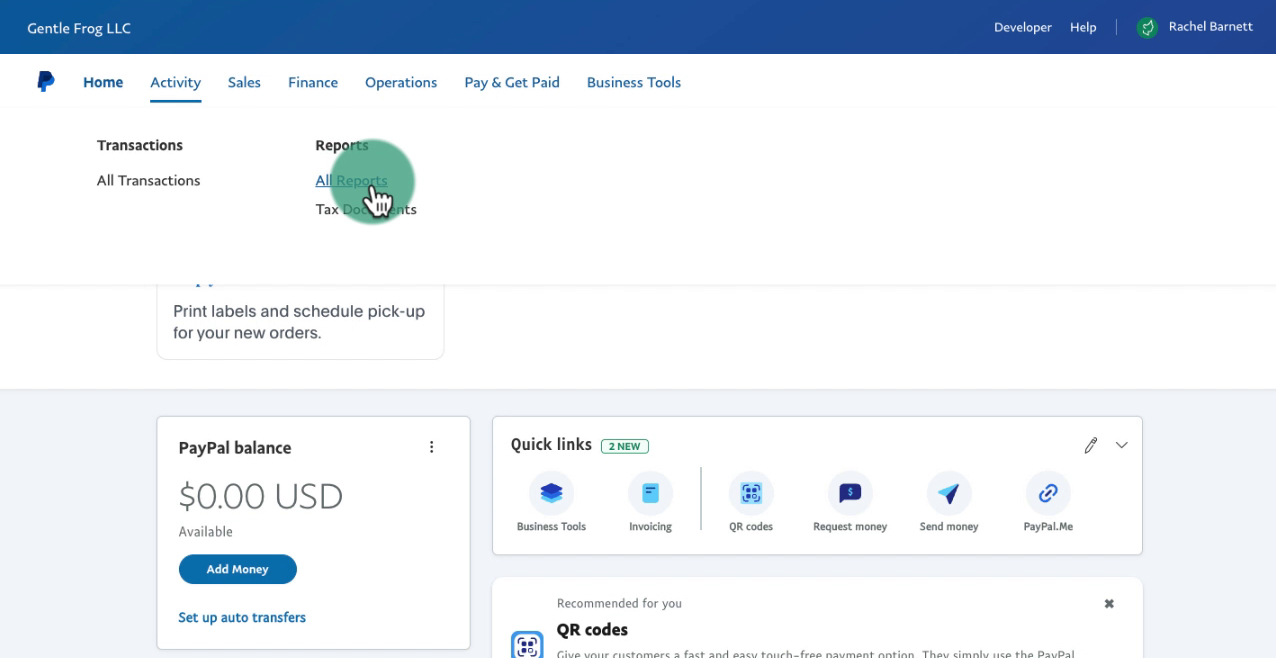

- Click Activity in top menu

- Select All Reports

- Click Activity download in the left side menu

- Select Balance affecting in the Transaction type drop-down menu

- Select a Date range

- Click the Create Report button

- Your report will appear in the Activity reports list

- Click Download in the Action column

- Scroll to the right in the CSV to find the Balance column

Keep reading for a complete walkthrough with screenshots:

Download The Balance Affecting Report

To get our list of transactions we’re going to use the Balance Affecting Report.

To get to this report click Activity in the top menu and select All Reports.

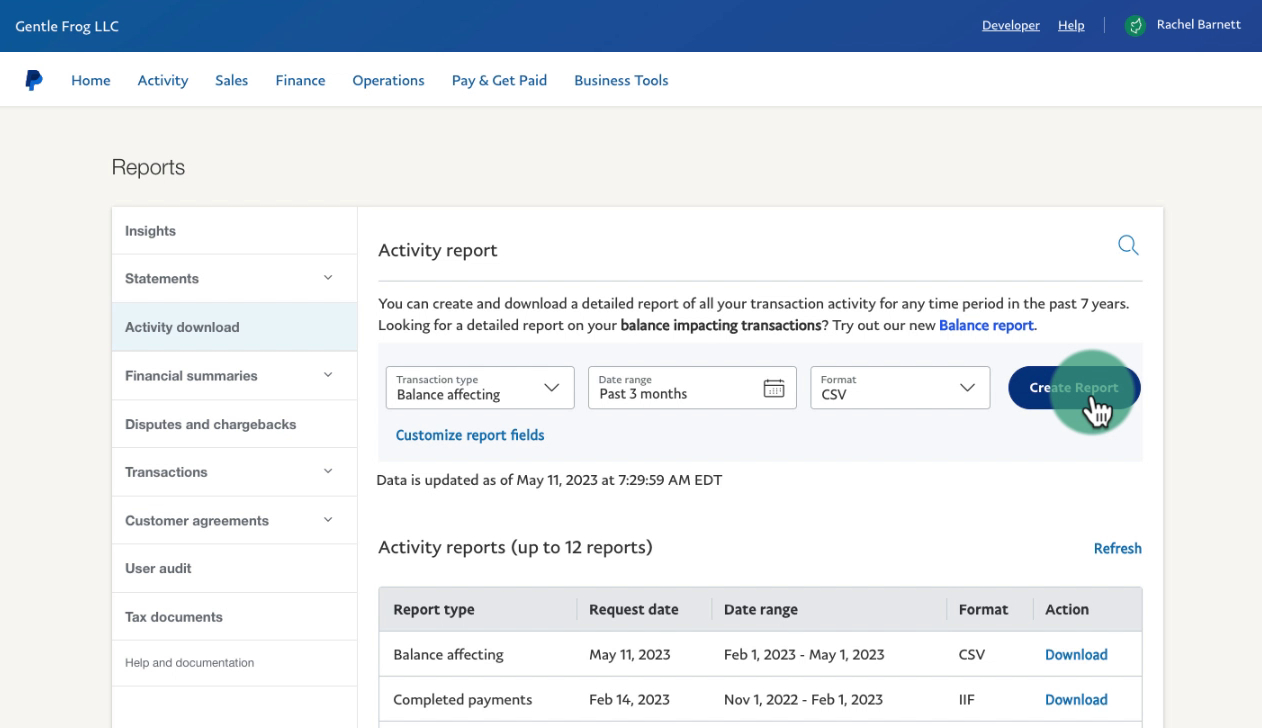

In the left side menu click Activity download.

In the Transaction type drop-down menu select Balance affecting. Select a date range. Leave the format as CSV. Click the blue Create Report button.

The report will appear in the Activity reports list. When it’s available to download a blue Download link will appear in the Action column.

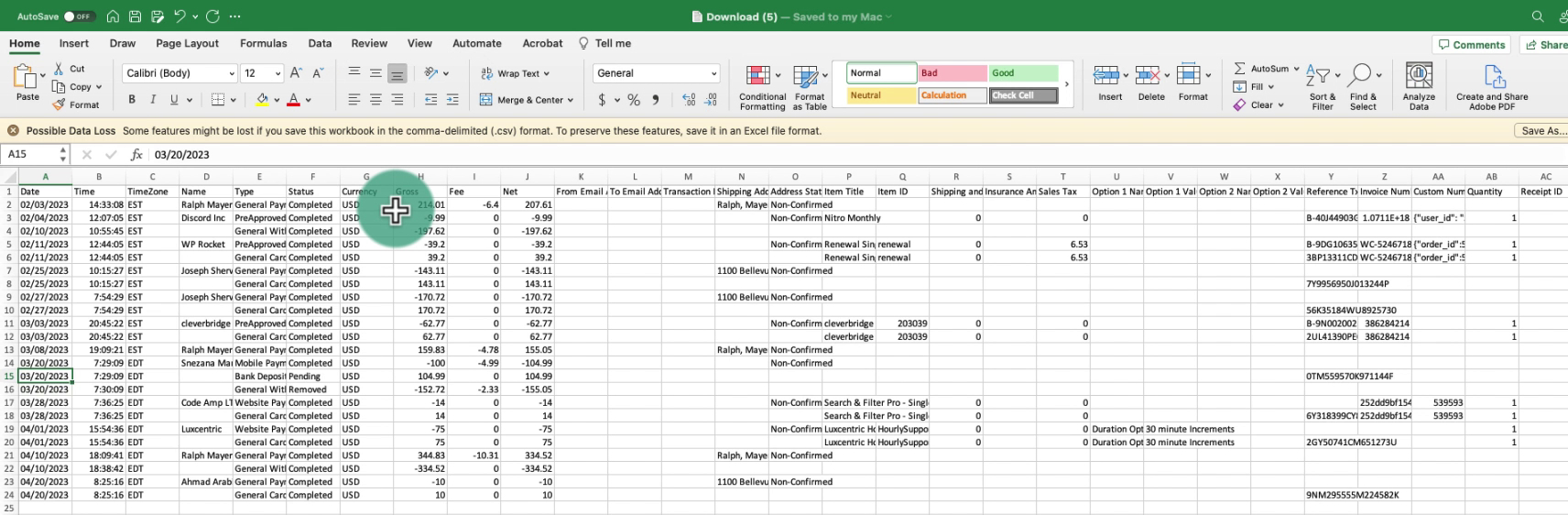

Here’s an example of what it will look like:

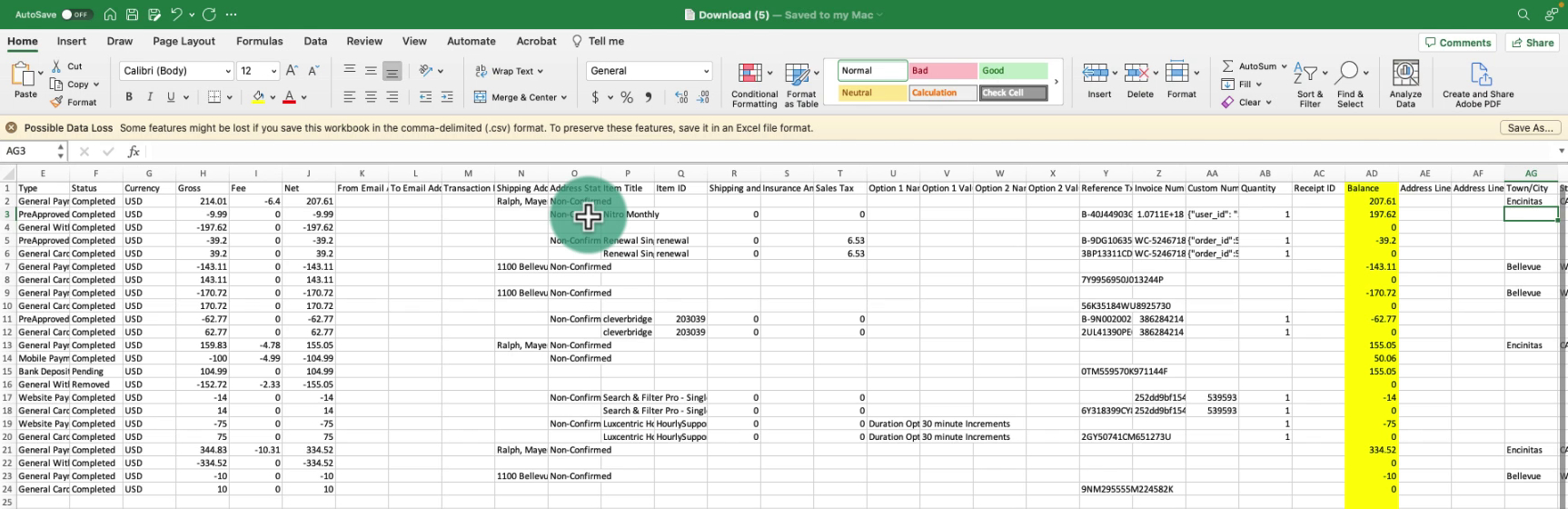

Where’s the running balance? Scroll to the right. I have it highlighted so you can see what it looks like:

You now know how to download a report showing your PayPal transactions with a running balance. Scroll down for a video walkthrough.

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

If you have questions about PayPal reports I suggest contacting PayPal customer service.