Updating Your Business Information

You can edit your business information at the top of an invoice.

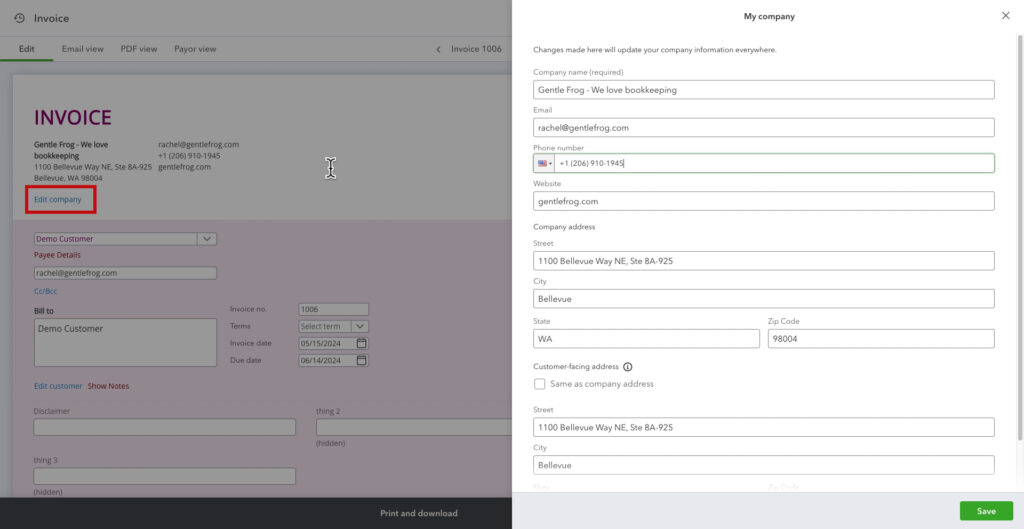

Edit Company

Below the company information, you will find an Edit Company link. This opens the My company pop-out.

Unfortunately, any changes you make here will change your company information everywhere.

Custom Form Styles / Templates

You can also update invoice business information on templates.

To get there, click the gear in the upper right corner.

Then click Custom for styles in the YOUR COMPANY column.

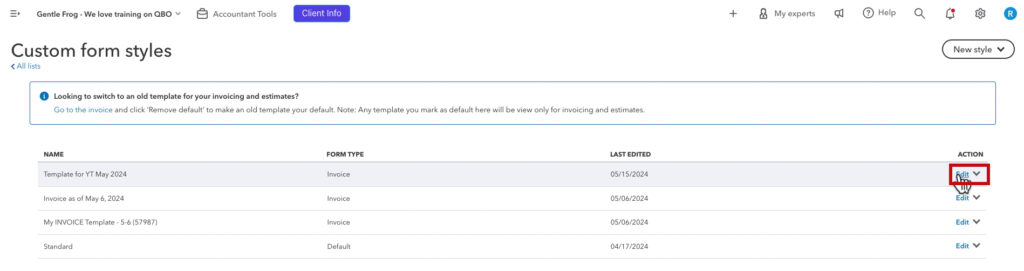

From here, you can create or edit your invoice templates.

To edit an existing template, click Edit on the right.

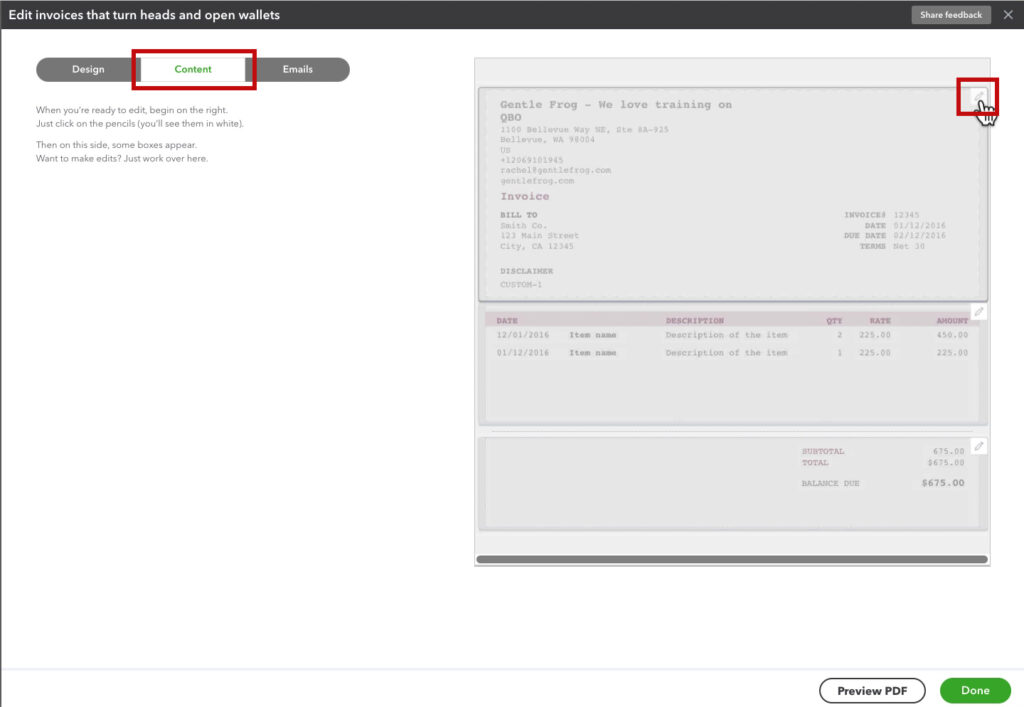

To edit the business information, click Content in the upper left bar. Then click the pencil in the area with your business information.

On the right, you can update your business information, then click Click Done in the lower right corner.

However, once again this also changes the business information everywhere.

I hate to be the bearer of bad news, but you cannot update your business information on individual invoices at this time.

☕ If you found this helpful, you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

Below is a video if you prefer to watch a walkthrough.

If you have questions about the new invoice layout in QuickBooks Online, click the green button below to schedule a free consultation.