Inventory On Hand

“Inventory on hand” refers to the inventory that you have in stock on a specific date.

For tax purposes, you’ll need to know how much inventory you have on hand at the end of the year and the value of that inventory.

This is not how much that inventory is worth when you sell it, but how much it cost you when you purchased it.

Calculating the Value of Inventory On hand

To calculate the value of inventory on hand you’ll want to get a count of all your inventory. Get the purchase price of each item, multiply it by the quantity then add that all up.

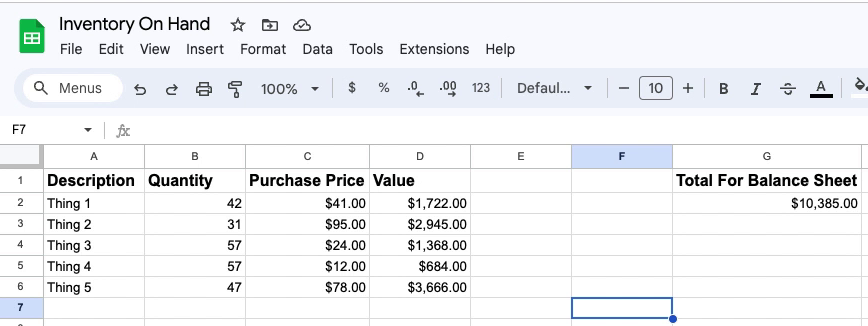

Here’s a screenshot of a simple spreadsheet calculating the value of inventory on hand.

- Description – Each “Thing” is a different inventory item

- Quantity – how many are currently on hand

- Purchase Price – how much the company paid for the item

- Value = Quantity x Purchase Price

- Total For Balance Sheet – Everything in the Value column is added together

When your bookkeeper asks for the value of inventory on hand, they’re asking for that total.

Unless your inventory is broken up into different categories on the balance sheet. For example, here is a QBO balance sheet with the inventory broken out into Floral Inventory and Retail Inventory:

If your inventory is broken out on the balance sheet like this then you will need to calculate the value for each category.

It’s that simple.

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

Below is a video if you prefer to watch a walkthrough.

If you have questions about working with inventory in QuickBooks Online click the green button below to schedule a free consultation.