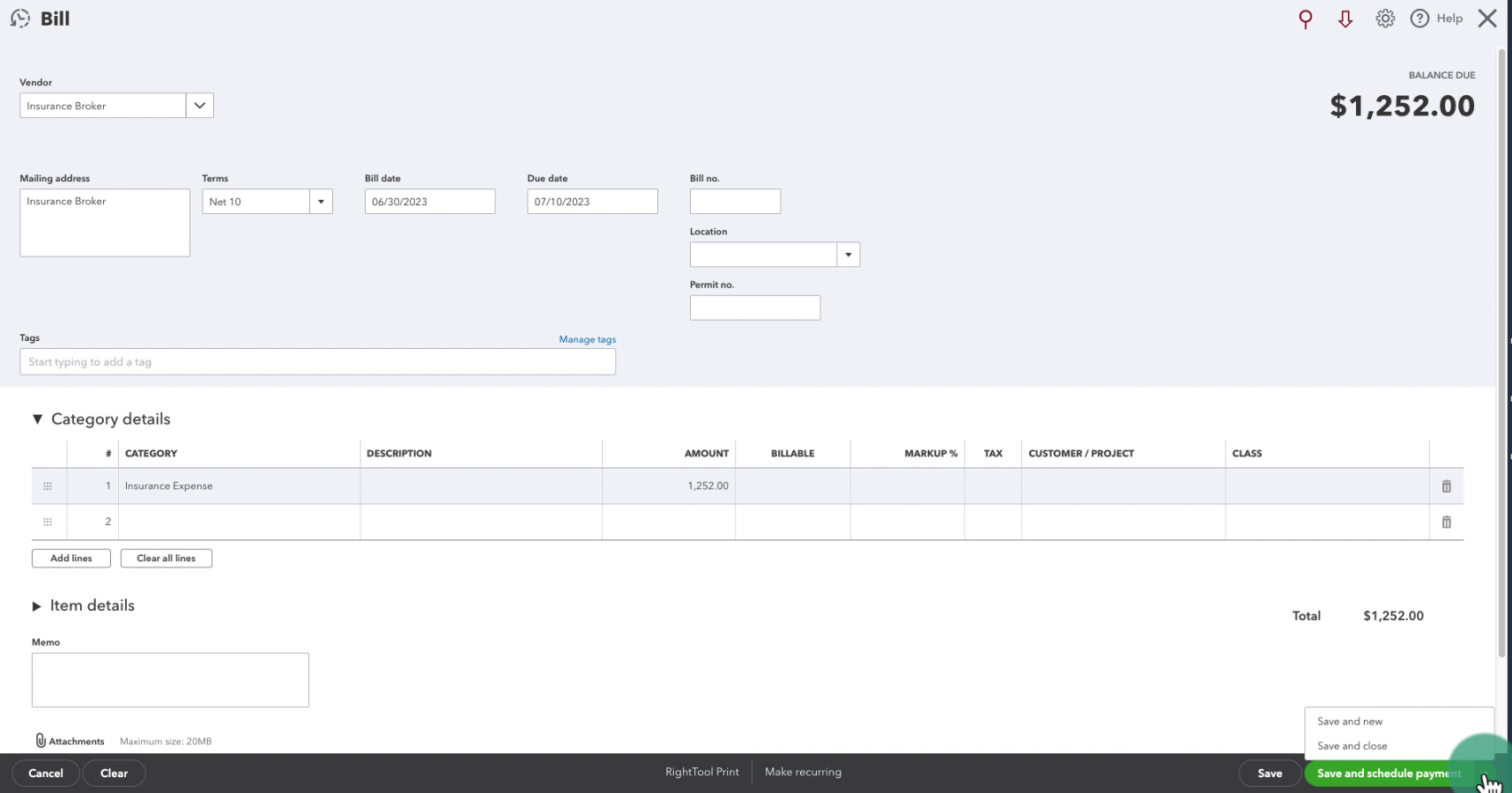

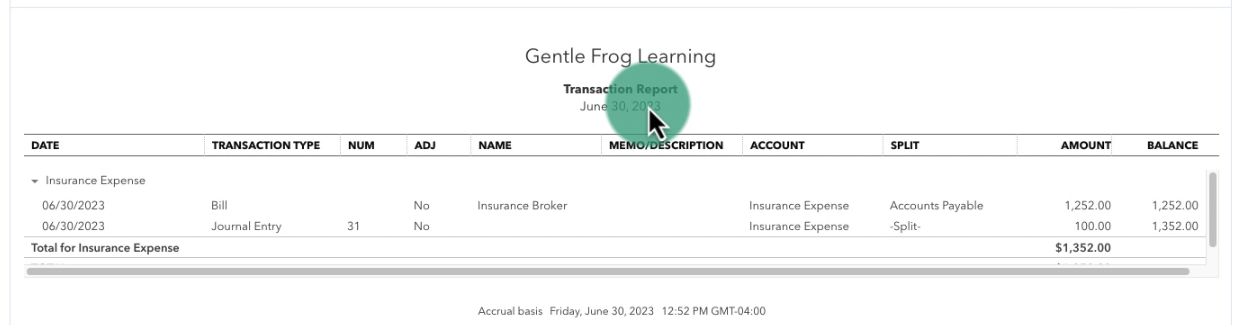

Here’s a $1,252 unpaid bill for insurance that I’ll use for this example:

Accounting Method – Cash vs. Accrual

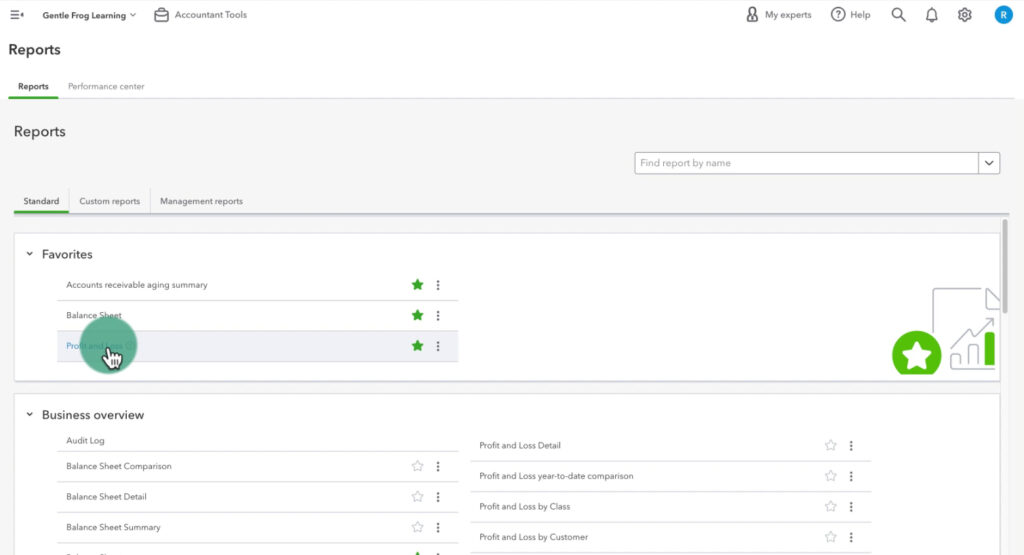

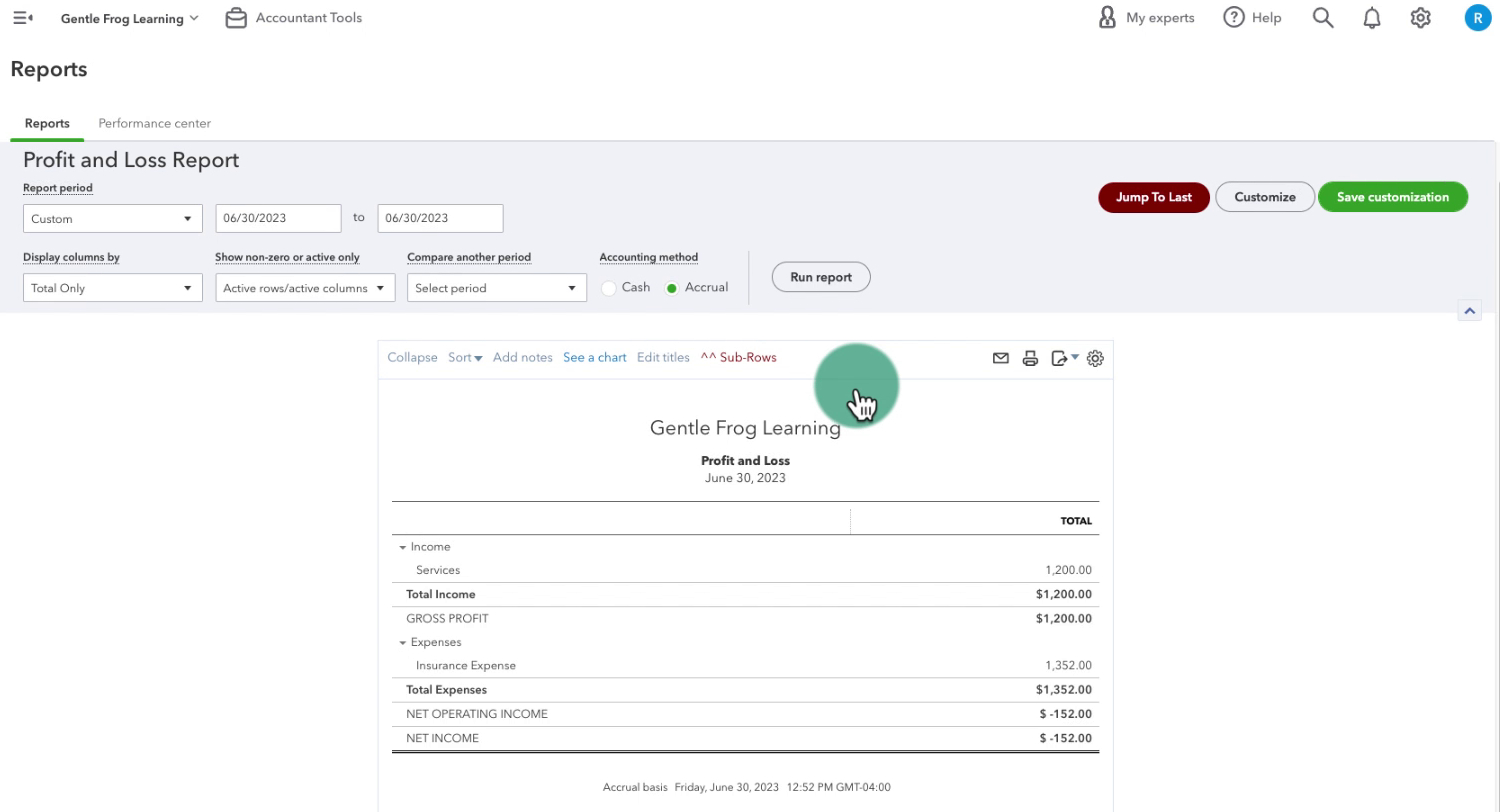

In the example above the bill shows up on the Profit and Loss. But what if it doesn’t? The reason is the selected Accounting method.

My QuickBooks defaults to Accrual. Accrual shows everything that’s been recorded, whether or not it’s been paid. That means you’ll see unpaid bills and invoices on your Profit and Loss.

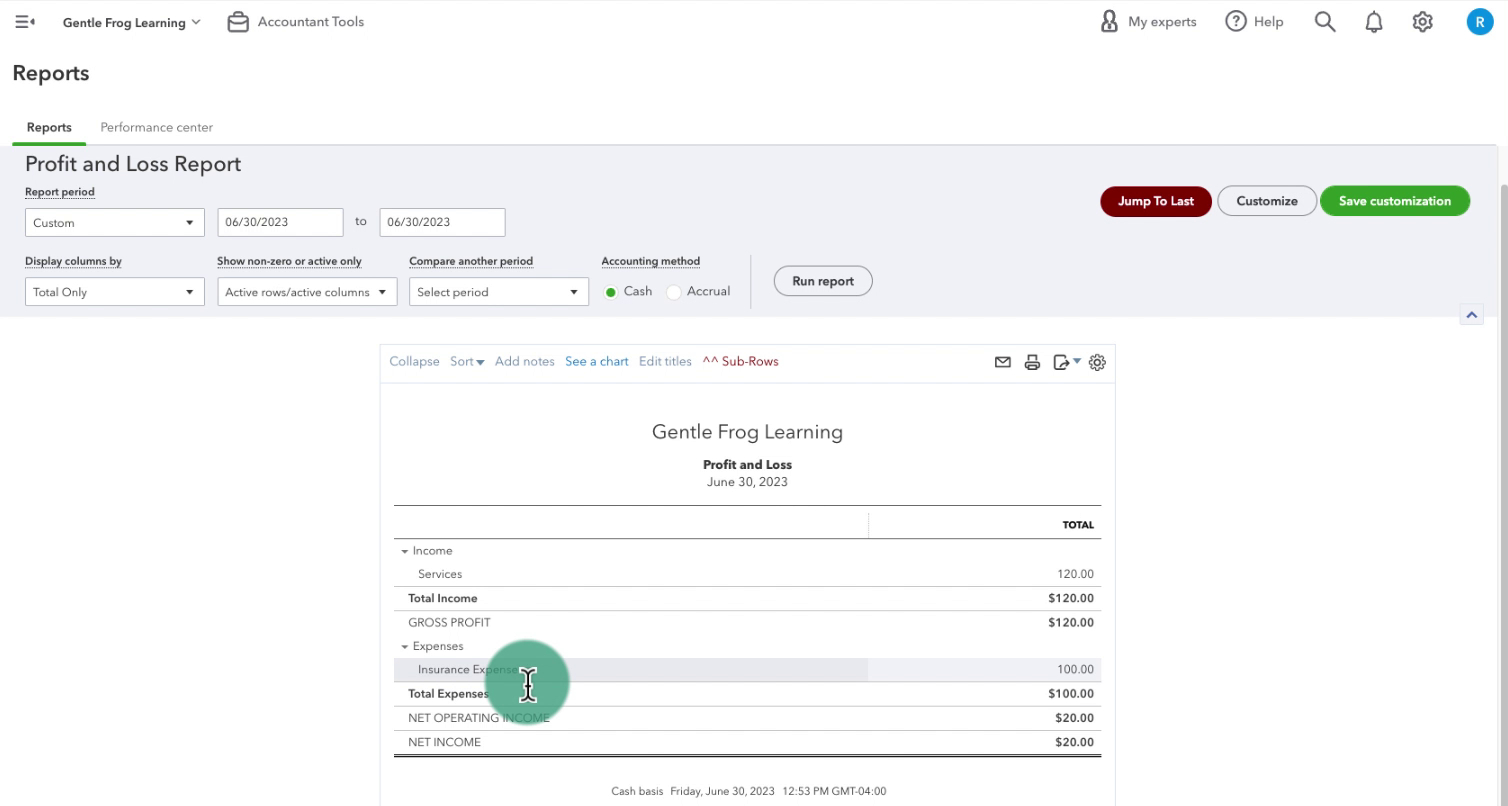

If I switch the Profit and Loss report to Cash that Insurance Expense drops down to $100, the bill no longer shows up.

This is because the Cash accounting method only shows transactions after payment has been sent/received.

If I mark that insurance bill paid it will then show up on the Profit and Loss report for both accounting methods.

You now know why a bill or invoice wouldn’t be showing up on your Profit and Loss report.

If you ever have a transaction that you know was entered but you simply can’t find it, you can check the Audit Log.

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

Below is a video if you prefer to watch a walkthrough.

If you have questions about the profit and loss report in QuickBooks Online click the green button below to schedule a free consultation.