If you’re an accountant or bookkeeper who works with QuickBooks Online (QBO), this might sound familiar: you’ve been removed from a client’s QBO file, yet weeks, or even months, later, you’re still getting emails about their payroll activity.

Frustrating, right?

That’s exactly what happened to me recently. And honestly? It’s something I think a lot of people don’t realize until it starts happening to them.

What Happened

I received a payroll-related email notification from QuickBooks. No big deal, except… I hadn’t worked with that client in months, and I no longer had access to their QBO file.

When I checked, I had been removed from their accountant access. But for some reason, the payroll system still considered me tied to the account.

I knew this wasn’t right, so I reached out to Intuit’s tech support for help.

What Intuit Had to Say

Here’s the short version of what I learned:

Removing an accountant user from QBO does not remove them from payroll notifications.

There’s a separate process the business owner needs to follow to remove your email from the payroll system.

Yes, you read that right. It’s not something the accountant can fix.

The client has to log in and make the change.

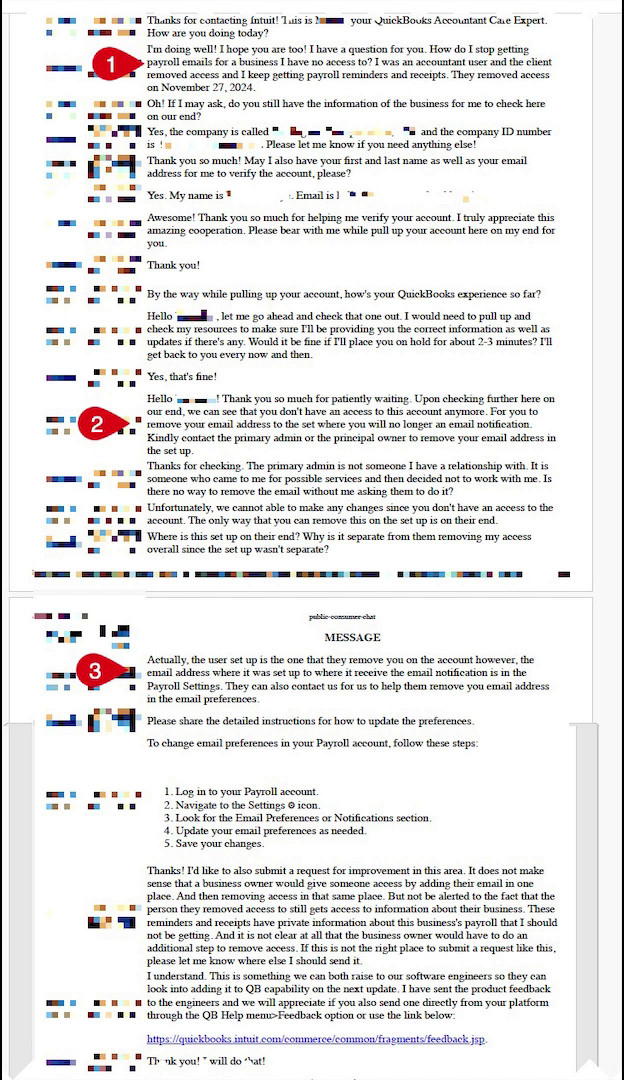

If you’re interested below is a screenshot of the chat transcript. The three markers show relevant parts.

- I explain the problem to support.

- Support let’s me know the business owner has to remove me.

- Instructions on what the business owner has to do.

How to Remove an Accountant from Payroll Emails (Maybe)

According to Intuit’s instructions, here’s what the business owner needs to do:

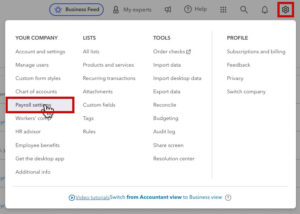

Log in to QuickBooks Online

Click the gear icon in the upper right corner

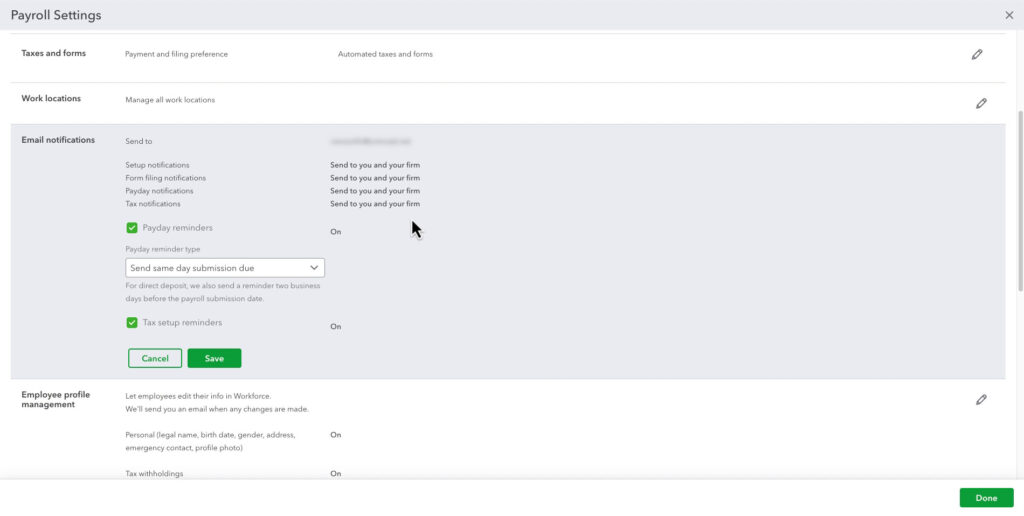

Click the pencil to the right of Email Notifications

You’ll see all the notification options.

The screenshots above are what I saw when I looked at a client’s payroll settings.

I couldn’t find a way to remove the accountant’s email.

However, I was logged in as the accountant. I don’t use QB Payroll, so I can’t see it as the client. Maybe there’s something the client sees that I don’t.

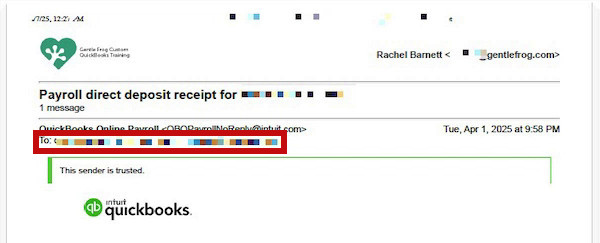

The only way a client would know you’re still getting these emails is by checking the “To:” line in the email itself.

Why This Is a Problem

As accountants, we already deal with a lot of emails. Getting payroll notifications for clients we no longer serve clutters our inboxes and adds confusion.

Even worse, there’s no obvious way to unsubscribe or remove yourself.

If the client forgets to take action, you’re stuck. You can’t manage it on your own, and there’s no setting in your QBO accountant dashboard to control it.

Why I Haven’t Disabled the Emails (Yet)

In files where I do still work with the client, I leave these notifications on, because I don’t want to risk turning them off for the client, too. There’s no way to be sure if changing settings will impact their reminders, so I just delete the emails and move on.

It’s not ideal, but it feels safer than accidentally disrupting their payroll flow.

What I’d Like to See from Intuit

Honestly? When a client removes an accountant from their QBO account, that should apply to everything. Including payroll and merchant services (which, by the way, has similar issues).

We shouldn’t have to rely on the client to go on a scavenger hunt through their settings just to finish removing us.

If you’re in the same boat, I recommend:

Checking any QBO payroll emails you’re getting and confirming if you’re still in the “To” line.

Sending a quick note to the client with instructions (or a link to this post).

Submitting feedback to Intuit requesting a more unified removal process.

Final Thoughts

If you’ve been frustrated by this issue, you’re not alone.

As someone who spends a lot of time in QBO, I just want the tools we use to be clear and consistent.

This situation feels like a gap in the system, and until it gets fixed, the best we can do is help each other stay informed.

Got questions about your QBO setup or payroll notifications? Or maybe you’re just tired of weird QuickBooks surprises? Reach out. I’m always happy to chat or help troubleshoot.