You sent the invoice. Your client paid it. But when you check your bank balance, crickets. No deposit. No explanation.

If you’ve ever had a QuickBooks Payment withheld, you’re not alone.

I recently ran into this exact situation. Despite years of experience with QuickBooks and bookkeeping, the issue caught me off guard, and it wasn’t flagged in any obvious way. Here’s what happened, how I found out, and what you should do if it happens to you.

A Payment Goes Missing

Like many service providers, I regularly send invoices to clients using QuickBooks Payments. When those invoices are paid, the money typically arrives in my bank account quickly.

But this time was different.

I had sent a few invoices to friends for small projects. They paid promptly, but two weeks went by and I noticed the deposits still hadn’t hit my bank account. Something felt off.

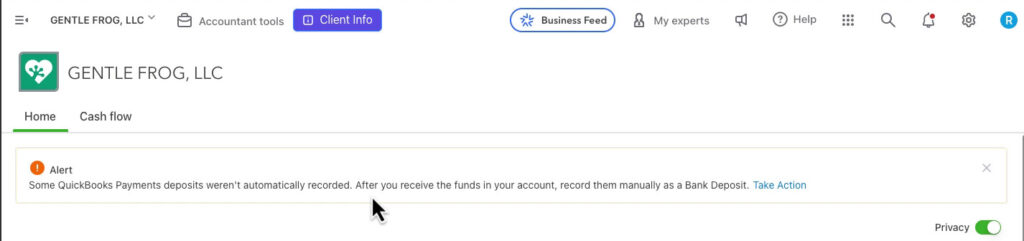

I logged into QuickBooks and saw a familiar (but unrelated) alert:

“Some deposits weren’t automatically recorded after you received the funds. Record them as a bank deposit.”

This alert is relatively common. QuickBooks will sometimes mark an invoice as paid but leave the funds in “Undeposited Funds,” rather than actually posting them as a deposit.

It wasn’t unusual enough to raise red flags.

But after verifying that my clients had indeed paid, and the money still wasn’t in my bank, I decided to dig deeper.

How I Found Out the Payment Was Withheld

If you ever suspect a QuickBooks Payment was withheld, the steps I followed might save you a major headache.

Here’s how to check:

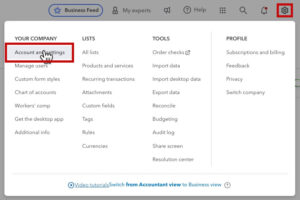

Click the Gear icon in QuickBooks.

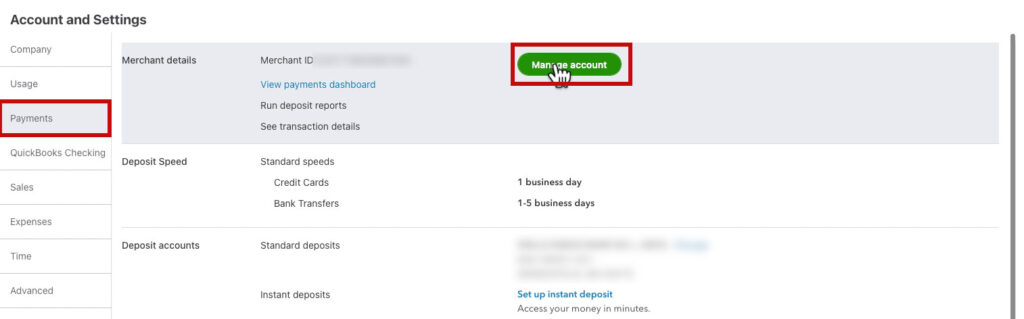

Select Payments from the left menu.

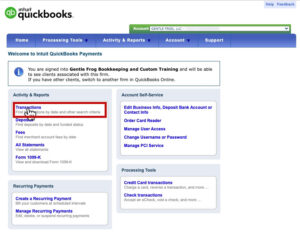

Click Manage Account (this will redirect you to the merchant center).

Filter by date range.

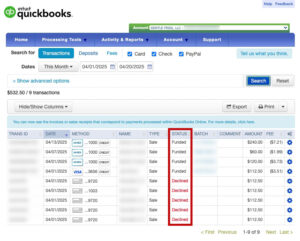

Look at the “Status” column, mine showed “Withheld” instead of “Funded.”

That’s when I knew the problem wasn’t just a delay. The funds had been withheld.

Why Were the Funds Withheld?

Here’s the most frustrating part: I never received a notification.

According to Intuit, if a payment is withheld, you’re supposed to get a notice in the Resolution Center and an email alert. I got neither.

Even when I navigated to the Resolution Center manually (Gear icon > Tools > Resolution Center), it was completely empty.

There was no explanation, no prompt, and no clear reason why the payment was flagged.

The Fix: Call Support (and Be Patient)

Unfortunately, this isn’t something you can fix yourself. I had to call QuickBooks support and spend about an hour on the phone walking them through the issue.

Once they looked into it, they released the funds. Simple in theory, but frustrating in practice.

Moral of the story: If you suspect a QuickBooks Payment is withheld, don’t assume it’ll resolve itself. You may have to take action to get your money released.

How to Avoid Being Caught Off Guard

Even though you can’t prevent QuickBooks from flagging and withholding funds, you can set yourself up to spot issues quickly:

Track your payments: Make it a habit to check the status of recent transactions in your merchant services account.

Know your expected deposit times: If you usually see funds within 1–2 business days, a delay might signal a problem.

Bookmark the Resolution Center: Even if it doesn’t always show alerts, it’s one place QuickBooks might post updates.

Keep your email notifications enabled: Make sure messages from Intuit aren’t going to spam.

And most importantly…

Know When to Pick Up the Phone

My situation was resolved by calling QuickBooks support. While that’s not always a fun way to spend an hour, it was the only way to get answers.

It’s a good reminder that software automation is great, until it’s not. When something’s wrong and no alert shows up, human help is still needed.

What to Remember if a QuickBooks Payment Is Withheld

The issue might not be visible in your normal workflow.

Even experienced QuickBooks users can be blindsided by withheld payments.

You may not receive an email or notification.

Check the merchant services transactions page to verify payment status.

If in doubt, call QuickBooks support.

Final Thoughts: Keep an Eye on Your Cash Flow

A QuickBooks Payment getting withheld can be a frustrating bump in the road, especially if you’re counting on the funds to pay bills or meet payroll. My experience is a helpful reminder for all of us: keep a close eye on your accounts and don’t hesitate to investigate when something feels off.

And if you’re someone who helps clients with their QuickBooks setup, consider walking them through how to check their payment statuses too. It’s a small thing that can prevent a big headache.