In this tutorial, you’ll learn how to find your 1099 vendors using the 1099 Transaction Detail report within QuickBooks Online.

Quick Instructions:

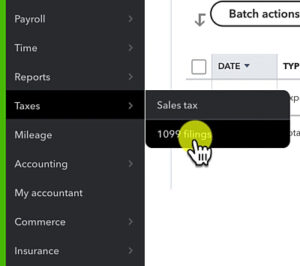

- Click Taxes -> 1099 filings in the left side menu

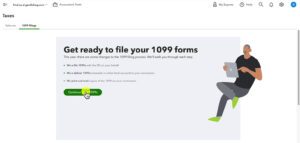

- Click Continue your 1099s

- Double-check your company information and enter your Tax ID

- Click Save

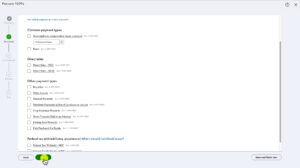

- Check off boxes for what you’d like tracked

- Select the accounts to track from the drop-down that appears

- Click Next

- Click Save and finish later

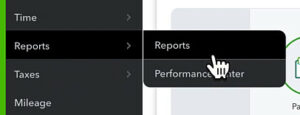

- Click Reports -> Reports in the left side menu

- Search for the 1099 Transaction Detail Report

Keep reading for a complete walkthrough with screenshots:

1099 Filings

You’ll need to follow these steps before QuickBooks will populate the 1099 Transaction Details reports. Even if you’re not going to use QuickBooks to file your 1099s.

Click Taxes in the left side menu and select 1099 filings.

On the next screen click Continue your 1099s.

Make sure your company information is correct, enter your Tax ID and click Save. Then click Next.

On the Categorize payments to contractors step you’ll check off what you’d like to keep track of.

Before going through this step I suggest reading the IRS 1099 instructions so you better understand what all these checkboxes mean.

Go down the list and check off everything applicable to your business.

For this example, I’m just going to check Non-employee compensation.

When you check a box a drop-down will appear where you select the accounts to track for that 1099 box.

When you’re ready click Next.

Step three is reviewing your contractors’ information. You’ll see a list of all contractors whether they meet the 1099 threshold or not.

In my sample QuickBooks, I only have a single contractor. I’m going to click Save and finish later as I’m not actually filing 1099s I just want my report to populate.

Navigate to the Report

To get to this report click Reports in the left-side menu.

On the Reports screen search for 1099 and select the 1099 Transaction Detail Report.

If you navigate to this report before filling out the 1099 filing information it will be blank like this:

After going through the 1099 filing steps your report will be populated:

You now know how to use the 1099 Transaction Detail Report.

This is one method of finding 1099 vendors in QuickBooks Online. Check out my blog for other methods so you make sure you find all your 1099 vendors.

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

Below is a video if you prefer to watch a walkthrough.

If you have any questions about 1099s and QuickBooks Online click the green button below to schedule a free consultation.