As a QBOA user, you may occasionally encounter an incomplete or partially finished bank reconciliation in the QuickBooks Online Accountant (QBOA) Report Tools.

This could be normal or weird like an expense account mislabeled as a bank.

This is what happened to me. I found a client with a partially reconciled “bank account” that was actually an expense account.

While this is an unusual situation, I wanted to walk through the steps to fix it in case anyone else finds this in one of their client’s accounts.

Quick Instructions:

- Find the account in the Chart of accounts

- Click the drop-down under ACTIONS, click Edit

- Change Account type to Bank

- Click Yes on the warning pop-up

- Click Save on the Edit screen

- Click View register for the account

- Click the green Reconcile button

- Click the drop-down next to Save for later

- Click Continue without saving

- Click Continue without saving in the warning pop-up

- Navigate back to the Chart of accounts

- Click the drop-down under ACTIONS, click Edit

- Change Account type to Expenses

- Click Yes on the warning pop-up

- Click Save on the Edit screen

Keep reading for a complete walkthrough with screenshots:

Finding the Problem in Report Tools

You’ll only find this problem if you’re logged in as an Accountant user. You can tell you’re logged in as an Accountant because you’ll see the word Accountant above the left-side menu.

You’ll also have the Accountant Tools menu at the top of the screen.

Click on Accountant Tools. Then, under TOOLS, click Reports options to access the Report Tools screen.

In the Reconciliation Status section, I spotted an account with an incomplete reconciliation that did not look like a bank.

When I clicked on the account, I was taken to the Reconcile screen, where I got an error message saying the account was unreconcilable.

I went to the Chart of accounts and searched for that account, and it’s an Expense.

I’m unsure how or why this happened, but I want that account removed from the Reconciliation Status list.

The Fix

To fix this, you change the account to a bank account, undo the reconciliation, and change it back to an expense.

To do this, in the Chart of accounts click the drop-down in the ACTION column for the account. Click Edit.

In the Account type drop-down, change it from Expenses to Bank.

A pop-up will warn you that changing the account type can affect your accounting/reporting. Click Yes on the pop-up, then click Save in the lower right corner.

Click View register.

Then click the Reconcile button in the upper right.

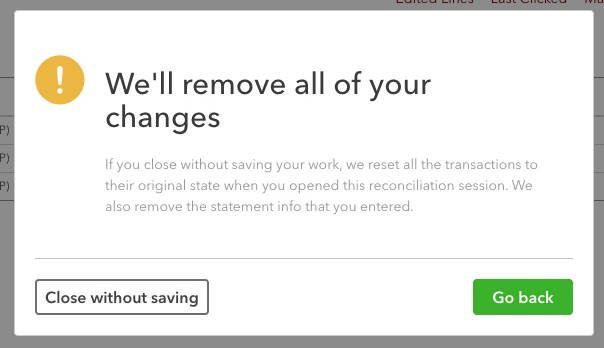

Click the drop-down to the right of Save for later in the upper-right. Select Close without saving.

On the warning pop-up click Close without saving.

Now you can return to the Chart of accounts, edit the account again, and change the Account type back to Expenses.

Now, the account is gone from the Reconciliation Status screen, and everything is right in QuickBooks.

Note: When a regular user looks at their reconciliation summary, they won’t see the incomplete reconciliation. You’ll only see it in the Accountant Report Tools. It does NOT cause any issues within QuickBooks. It bothered me, so I figured out how to fix it.

☕ If you found this helpful, you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

If you have questions about anything weird you find in QuickBooks Online, click the green button below to schedule a free consultation.