Are you thinking about switching from QuickBooks to Xero?

With price hikes and confusing AI updates in QuickBooks Online, more small business owners are giving Xero a serious look. But before you jump in, it’s important to understand the Xero subscription options, what each plan includes, and how to choose the one that fits your needs.

In this post, we’ll walk through the plan tiers, share some setup tips based on firsthand experience, and help you figure out if Xero is the right fit for your business.

Why Xero?

Xero is a cloud-based accounting tool designed for small businesses, freelancers, and solopreneurs.

It’s clean, modern, and easy to use once you get the hang of it.

You can send invoices, track expenses, connect your bank accounts, and view reports from anywhere.

For business owners frustrated with QuickBooks or just ready to explore alternatives, Xero offers a refreshingly straightforward option. It’s not perfect, but for many, it checks the right boxes.

Xero Subscription Options Explained

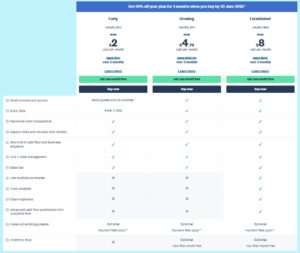

Xero offers three main subscription levels.

Here’s what you need to know about each one.

Early Plan

Send up to 20 invoices and quotes per month

Enter up to 5 bills

Includes bank reconciliation and Hubdoc for receipts

Best for very small businesses or solopreneurs who invoice through other tools

💡 This plan is surprisingly affordable and works well if you don’t run everything through Xero. For example, if you invoice through Stripe or Square but still want clean bookkeeping, this might be all you need.

Growing Plan

Unlimited invoices and bills

Still includes bank connections, Hubdoc, and basic reports

Great for businesses with steady client work and recurring expenses

💡 If you send lots of invoices or handle accounts payable regularly, the Growing plan is likely your best bet.

Established Plan

All features from Growing, plus:

Multi-currency support

Expense claims

Project tracking

Advanced analytics

Ideal for businesses with international clients, employees on the go, or larger projects

💡 Not everyone needs these features, but if you work globally or want detailed insights into job profitability, the Established plan is a smart upgrade.

Setting Up Xero: What It’s Like

I recently set up Xero from scratch for Gentle Frog to test it out for myself. I’ve used it in the past, but it’s been a few years.

As someone who is used to QuickBooks, the experience was refreshing, yet different.

Xero doesn’t try to copy QuickBooks, and that’s a good thing.

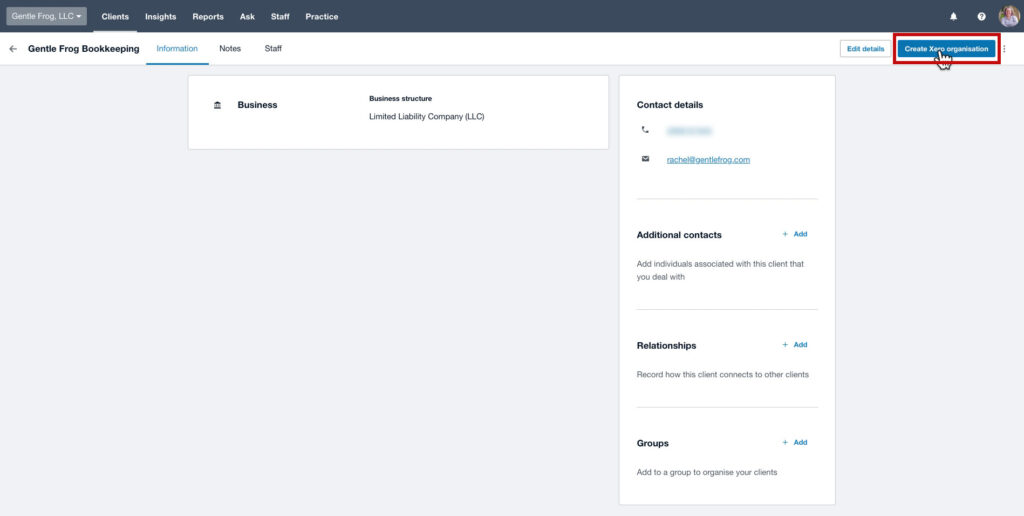

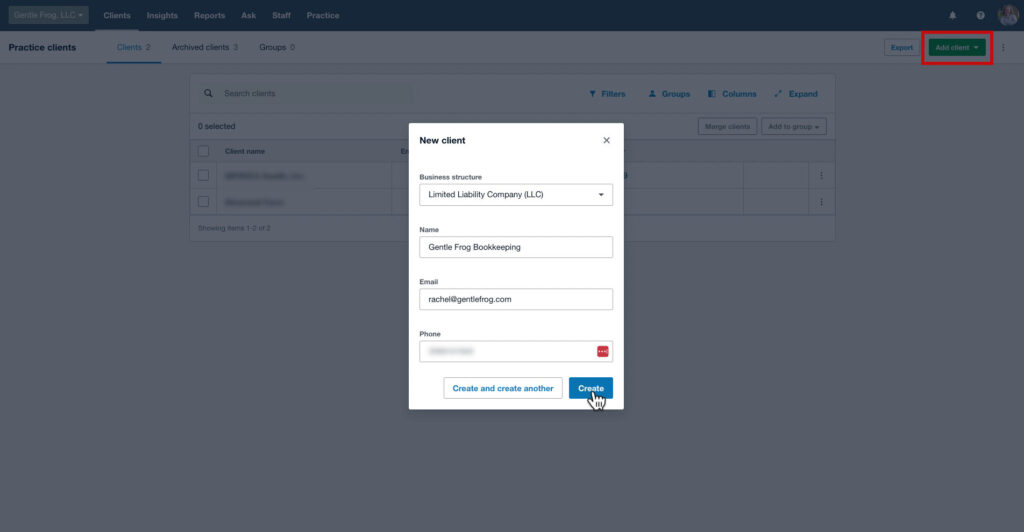

I still have a Xero account as an accountant, so I set Gentle Frog up as a new client.

The creation process is fast. You’ll choose a business type and enter contact details.

That creates the shell, next is creating the Xero organisation.

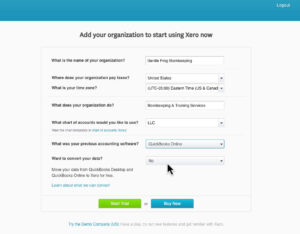

The platform will guide you through, asking questions along the way.

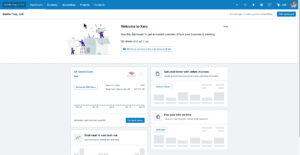

Once you’re in Xero, you’ll land on a clean dashboard. It’s intuitive, but if you’re coming from QuickBooks, it may take a little exploring.

Should You Migrate Data or Start Fresh?

Xero offers a partnership with Jet Convert, a service that transfers your data from QuickBooks to Xero. But it’s not always the best option.

Jet Convert won’t work if your file uses multi-currency

It may skip over payroll data

It costs$220 and up

You’ll need to clean up the data afterward anyway

Unless your QuickBooks file is super clean and simple, you might be better off using the switch as a fresh start.

Rebuilding the chart of accounts, reimporting vendors and customers, and reconnecting bank feeds might feel tedious, but it’s worth it.

What Features Stand Out?

Here are a few standout features you’ll find in Xero:

Hubdoc (included free): Scan and attach receipts directly to expenses

Sales Tax: Easy to set up and track

Bank Reconciliation: Smooth and straightforward

Short-Term Cash Flow: Basic forecasting tools on the dashboard

1099 Prep: Built-in vendor tracking

What to Watch Out For

If you’re coming from different bookkeeping software there are some quirks to watch out for:

Terminology is different – It might say “bills” where you’re used to “expenses,” and “bank recs” look a little different

Some reports aren’t as customizable – Especially compared to QuickBooks Advanced

Inventory and fixed asset tracking – These features exist, but can feel clunky

Still, for many small businesses, these limitations won’t be deal-breakers.

Is Xero Right for You?

If you’re tired of QuickBooks price increases, frustrated by its AI changes, or just want to try something new, exploring the Xero makes a lot of sense.

Just starting out and need basic tracking? Start with the Early plan

Need more invoicing and bill-tracking? Go for Growing

Managing team expenses or working across currencies? Try Established

No matter which plan you pick, Xero gives you 30 days to test-drive the platform. That’s plenty of time to connect a bank, send a few test invoices, and see how it fits your workflow.

Final Thoughts

Switching software is a big decision, but it doesn’t have to be scary.

Xero gives you a clean interface, solid features, and a refreshing approach to bookkeeping. If you’re considering making a change, it’s worth spending an hour or two exploring what Xero has to offer.

I found it easy to set up, flexible enough for real-world needs, and surprisingly intuitive. And if I can make the switch, so can you.

Thinking about making the switch and want some help? Schedule a free discovery call: https://www.gentlefrog.com/discovery-call/