When you run a business, whether it’s a lean operation or a multi-entity structure, understanding your cash flow can feel like trying to navigate in the dark.

One wrong move, and you’re scrambling to pay bills or wondering when a huge invoice will hit your account.

That’s where DryRun comes in.

In this post, we’ll walk through what this cash flow forecasting software does, how it helps, and why it might be the thing you didn’t realize your business needed.

The Problem: Lumpy Cash Flow and Confusing Spreadsheets

Let’s be real: most of us have been there.

Big invoices coming in… big bills going out.

But they rarely line up perfectly.

Maybe you’ve patched together a giant spreadsheet with formulas and tabs galore to model your cash flow. But it’s clunky, time-consuming, and not exactly easy to share or understand.

That’s exactly the problem Blaine Bertsch set out to solve when he co-founded DryRun.

After years of running a creative agency and dealing with the stress of unpredictable cash, he built software that could help businesses get a clear view of their financial future.

What is DryRun?

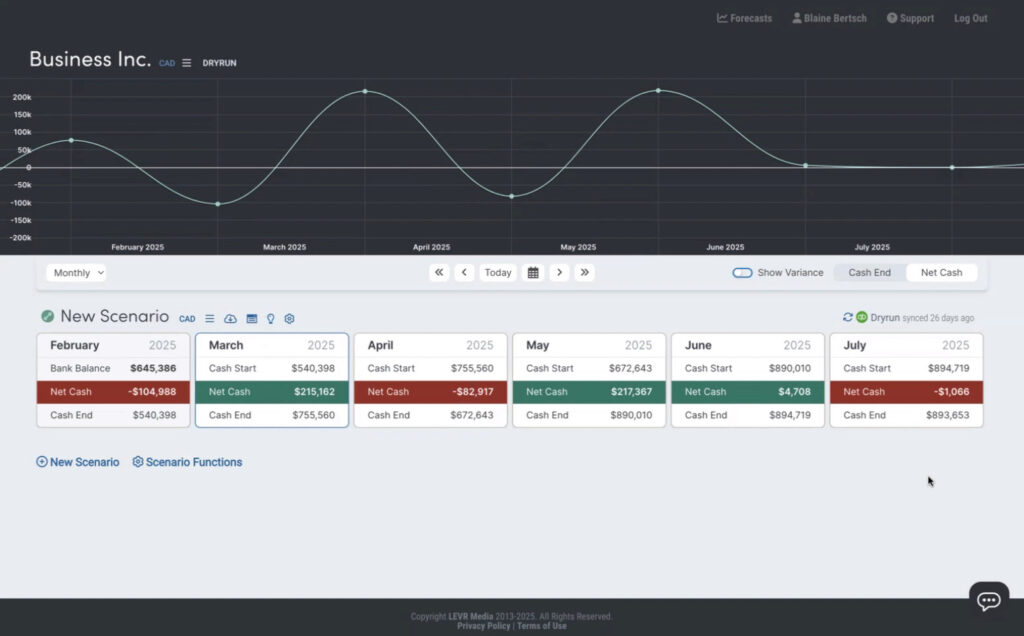

DryRun is a cash flow forecasting software designed for business owners, CFOs, and finance teams that need to see what’s coming.

Both in the short term and long term.

It gives you an at-a-glance look at your cash position, helps you visualize your accounts receivable and accounts payable, and lets you model “what if” scenarios to make smarter decisions.

Three Core Views in DryRun:

Cash In: Forecasts revenue, expected payments, and loans.

Cash Out: Projects your outgoing expenses, including one-time and recurring costs.

Recurring: Tracks your fixed costs like payroll and rent.

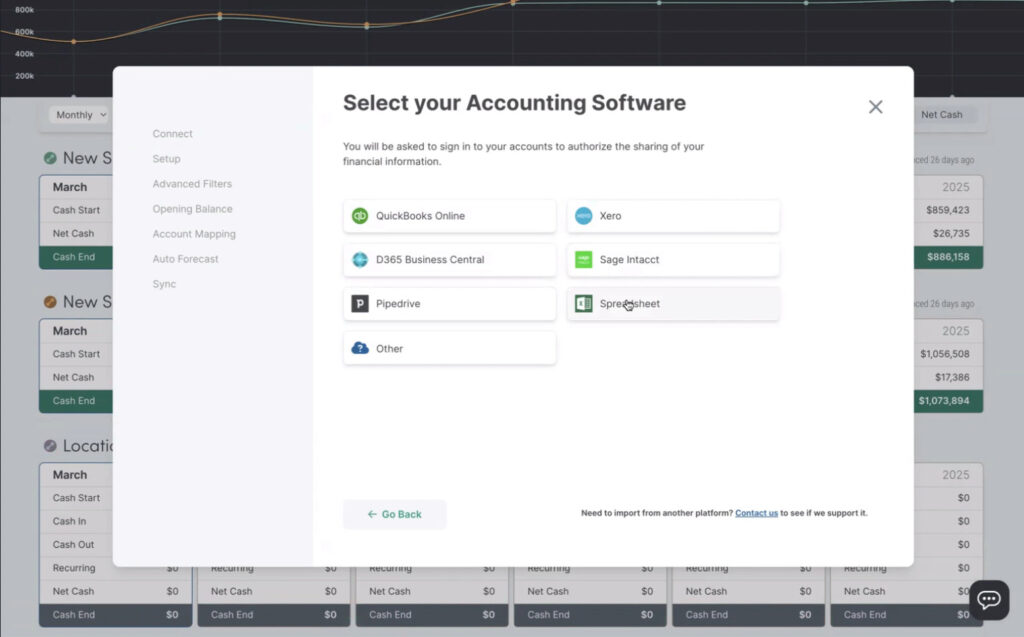

You can connect DryRun directly to accounting platforms like QuickBooks Online, Xero, and more, or upload spreadsheets manually.

Easy-to-Read Dashboards

One of the standout features of DryRun is how visual it is.

Instead of getting lost in rows and rows of data, you get a color-coded, easy-to-read dashboard that shows:

Overdue invoices in red

Forecasted expenses in blue

Actuals in black

You can toggle between monthly, weekly, and even daily views to see what’s coming and when.

This kind of visibility is what sets it apart from your average spreadsheet or built-in reports.

Scenario Modeling: Play Out the “What Ifs”

Need to see what happens if you take out a $500K loan? Or what if sales dip for a few months?

DryRun lets you build side-by-side forecasts so you can compare different outcomes.

And it’s fast.

Duplicate a scenario, adjust the numbers, and immediately see the impact on your cash flow.

This is huge for:

Planning for growth

Preparing for a downturn

Managing seasonal businesses

With just a few clicks, you can model best-case, worst-case, and everything in between.

Multi-Entity and Team Collaboration Features

If you’re managing multiple businesses or departments, DryRun makes consolidation simple.

You can:

Merge data from multiple scenarios or companies

Share specific views with team members or stakeholders

Export graphs and reports for board meetings or lenders

It’s a great fit for businesses that use classes or locations in QuickBooks or work across different currencies.

DryRun even updates currency conversions every 15 minutes if you’re juggling USD, CAD, or others.

Who Should Use DryRun?

According to Blaine, most DryRun users fall into one of three categories:

Businesses with lumpy cash flow – Think large invoices and unpredictable expenses.

Multi-entity businesses – Need to see consolidated and individual performance.

Organizations with strict reporting requirements – Like nonprofits or private equity-backed companies.

Even though many of its users are mid-size businesses or larger, DryRun is flexible enough for smaller businesses that want to grow or reduce financial stress.

Import or Manual: Your Choice

Not everyone wants to connect their accounting software, and DryRun gets that.

You can import data from QBO, Xero, and other tools, or simply enter data manually if your systems are complex or disconnected.

This flexibility is perfect if you want to use the tool primarily for visualization and scenario modeling without overhauling your entire tech stack.

Bonus: Built for Bookkeepers, Accountants, and CFOs

DryRun isn’t just for business owners. It’s also built with finance professionals in mind.

Fractional CFOs can use it with multiple clients.

Internal finance teams can model cash flow for their leadership.

And yes, there’s even a partner program with wholesale pricing if you’re managing forecasts for several businesses.

If you’ve ever struggled with getting your clients to understand the story their numbers are telling, this software can help make those conversations easier.

Watch a Demo

I came across DryRun from listening to Business, Beer & BS with Mike & Blaine.

After dealing with cash flow questions from clients over and over I reached out to Blaine (co-founder of DryRun) and we recorded a demo video, which you can watch below:

From simple overviews to in-depth scenario modeling, DryRun hits that sweet spot of powerful but not overwhelming.

It can replace that 50-tab spreadsheet you dread opening, or supplement your existing tools if you need a better visual.

Try It Out

You can explore more and book a free demo at dryrun.com. They offer:

Free training

Free trials

Clear pricing

No hard sales pitches

Whether you’re an accountant, CFO, or business owner, DryRun can help you understand your cash flow and plan with more confidence.