I want to talk to you about something I wish we didn’t need to worry about, but unfortunately, we do: how to secure your QuickBooks Online account.

This is not a casual suggestion. It’s a big deal.

If you have access to your own QBO account, or worse, to your clients’ files, you need to take security seriously.

I’ve seen too many people get locked out of their accounts, sometimes despite having two-factor authentication and all the usual protections.

So let’s walk through what you can do to reduce your risk and protect your access.

Why Account Security Matters

QuickBooks Online holds everything.

Business financials, customer data, and payment methods are all in there. And once someone gets in, there’s not a lot stopping them.

Here’s the kicker: Intuit doesn’t offer a 24/7 hotline for account recovery.

So if someone hacks your account on a Friday night, you’re stuck waiting until Monday to even try to reclaim access.

That’s why the best defense is prevention.

Start with Your Intuit Account Settings

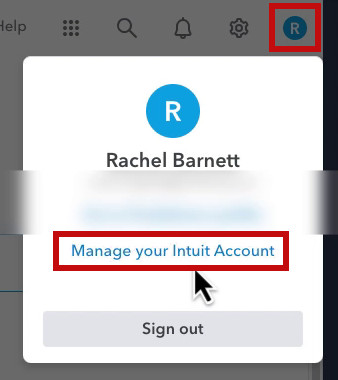

When you’re logged into QBO, click the letter in the top right corner, this is your user profile. You’ll see this whether you’re logged into QBO or QBO Accountant.

![]()

From there, click Manage your Intuit Account.

Now we’re in the right place. You’ll want to navigate to Sign In & security and work through each section, top to bottom.

1. Choose a Non-Guessable User ID

Your user ID should not be your email address. Make it something unique, something no one could easily guess.

💡 Tip: You can still log in with your email, but having a distinct user ID makes it harder for bad actors to access your account.

Think of something simple enough to remember but not something you’d post online or use elsewhere.

2. Use a Separate, Private Email Address

Your login email should not be the same one you share publicly or use on your website. Create a dedicated email address just for logging into QuickBooks.

It doesn’t need to be fancy, but it should be different from anything people could find through a Google search. This is your first layer of protection.

3. Set a Strong, Unique Password

I know this sounds obvious, but too many people still use passwords like “Password1.” Use something complex, and don’t reuse passwords from other sites.

If you need help keeping track, use a password manager. It’s worth it.

4. Add a Phone Number and Enable Two-Factor Authentication

You need a recovery method in case something happens. Add your phone number, but also set up an authenticator app.

Authenticator apps (like Google Authenticator, Microsoft Authenticator, or Authy) are more secure than getting a text message. It’s one more layer of protection that doesn’t rely on your phone carrier.

5. Enable Passkeys

Passkeys are a newer way to sign in securely using biometrics, like your fingerprint or device face scan. They’re easier for you, and harder for hackers.

Here’s how to add a passkey:

Go to the Passkey section under Sign In & Security.

Click Add a Passkey.

Choose where to save it (iCloud Keychain, phone, browser profile, etc.).

Follow the prompts to scan a QR code using your device.

Even if you don’t use passkeys every day, having one set up gives you flexibility.

Don’t Assume You’re Safe Just Because You Have 2FA

Sadly, I’ve seen people lose access to their accounts even with two-factor authentication turned on.

If someone knows your login email and your password, and they manage to intercept or guess your second factor, it’s game over.

That’s why unique user IDs and private login emails are so important.

Intuit, Please Do Better

Let me be blunt. Intuit needs to do more here.

Other financial platforms offer emergency account lockdowns.

For most banks, if your account is compromised, you can call a number at any time and freeze access.

But with QBO? You’re stuck. No emergency line. No real-time support.

I strongly recommend reaching out to Intuit and asking for a 24/7 security hotline. Even if it doesn’t help right away, maybe if enough of us ask, they’ll listen.

If You Feel Overwhelmed, Get Help

Security setup can feel a little intimidating.

If you need a second set of eyes or someone to walk you through it, I recommend Empowered IT Solutions.

They’ve helped me a ton, and they’re great at explaining tech stuff without making you feel dumb.

Final Thoughts

If you only take one thing away from this post, let it be this:

You are responsible for your QuickBooks account security.

Intuit isn’t watching your back the way your bank might.

Set up protections. Be proactive.

Don’t wait until something goes wrong to make changes.

If you’ve already done all of the above, take a moment to review your settings. Make sure your information is up-to-date, and take a screenshot of your current setup for future reference.

And if this all feels like a lot, that’s okay. It is. But it’s worth it.