In this blog post, I’ll show you how you can track expenses/bills/checks by customer in QuickBooks Online.

Quick Instructions:

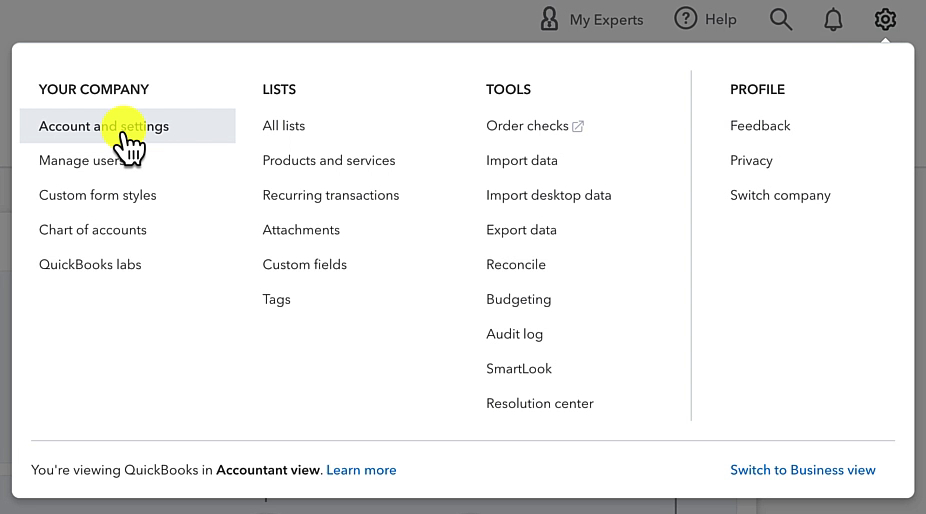

- Click the gear in the upper right corner

- Click Account and settings under YOUR COMPANY

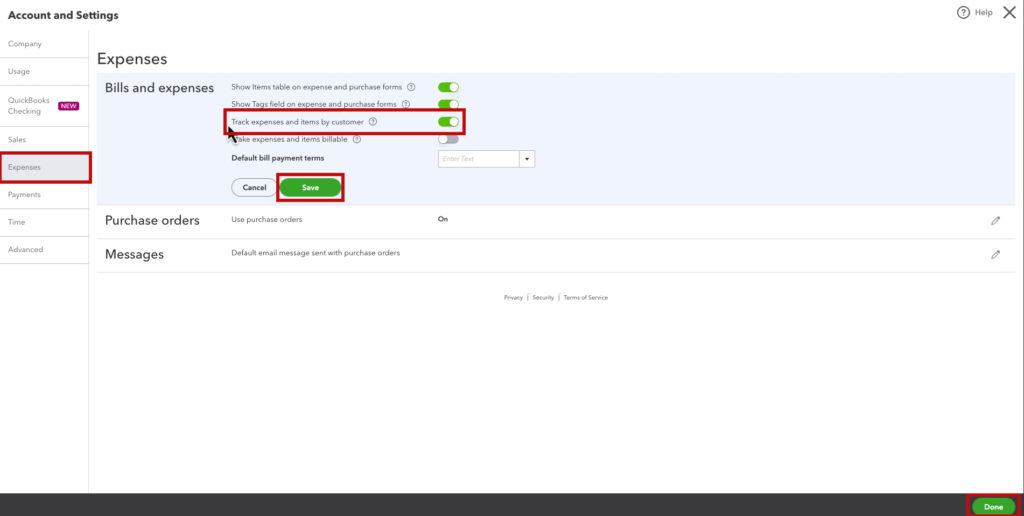

- Click Expenses on the left

- Click the Bills and expenses section

- Turn on”Track expenses and items by customer”

- Click Save

- Click Done

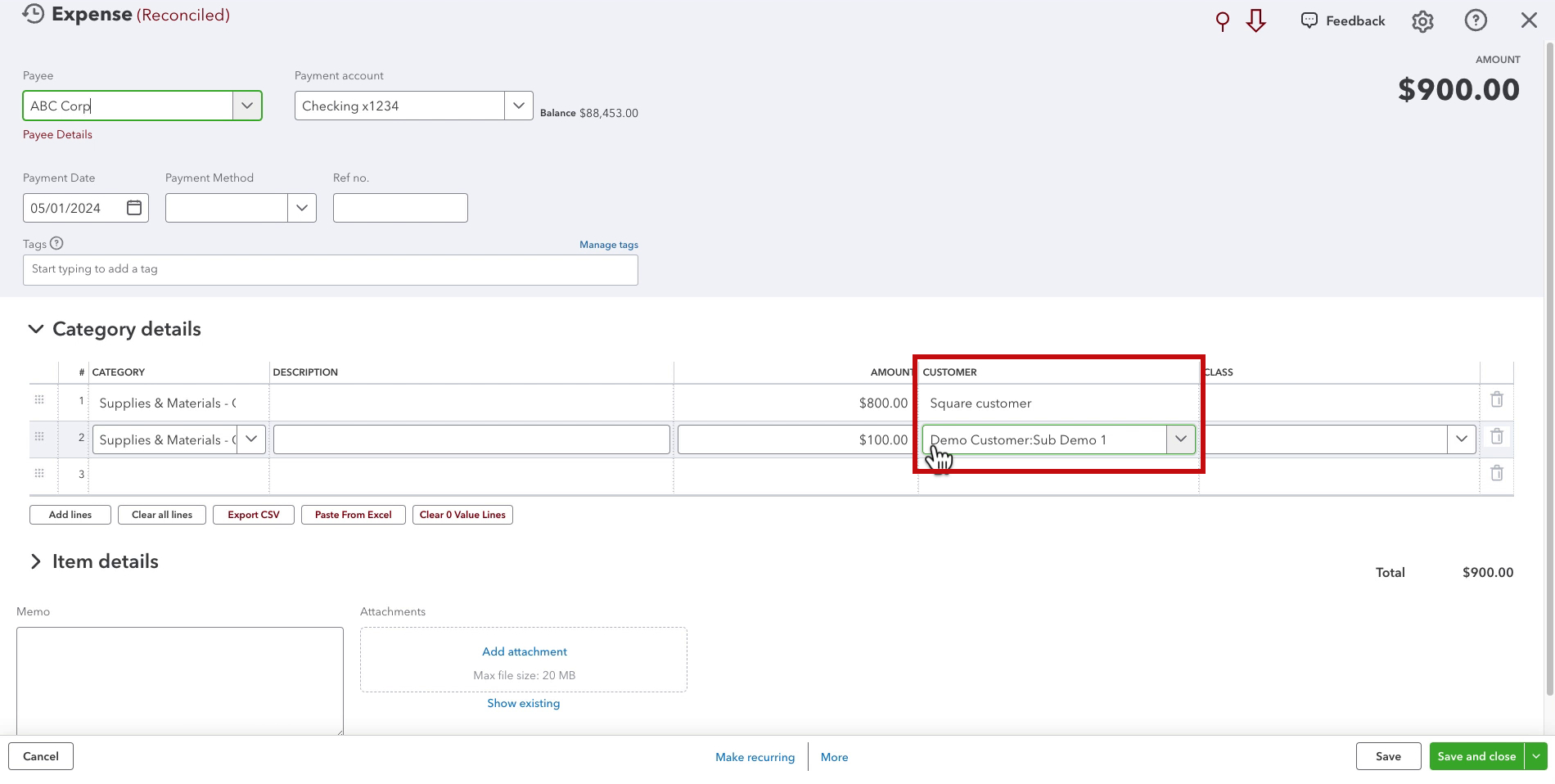

- Create an expense, bill, or check

- Select customers to allocate expenses/items in the CUSTOMER column

Keep reading for a complete walkthrough with screenshots:

Turn On Track Expenses and Items By Customer

To begin, you’ll need to turn on this feature within QuickBooks Online.

Click the gear in the upper right corner and select Account and settings in the YOUR COMPANY column.

In the left side menu, click Expenses.

Click the Bills and expenses section, then click the toggle to the right of “Track expenses and items by customer.”

Click Save. Then click Done in the lower right corner.

Track Expenses By Customer On Expenses/Bills/Checks

When you create an expense, bill, or check, you’ll now see a CUSTOMER column. You can select a customer to associate with an item on the expense/bill/check in this column.

Note: This is for your bookkeeping only. Your customers do not see this.

☕ If you found this helpful, you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

If you have questions about bookkeeping with QuickBooks Online, click the green button below to schedule a free consultation.