In this training, you’ll learn how to record a deposit for a sale made through a processor like Stripe or Paypal. These types of transactions include fees that should be entered into QuickBooks.

Creating a Sales Receipt

In this example I’ll use a hypothetical sale that had a 3% Strip processing fee.

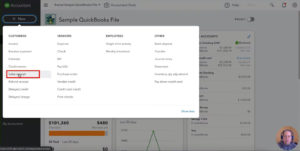

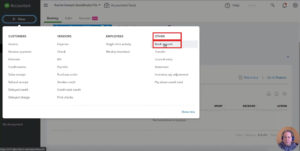

To begin we’ll create a sales receipt by click the “+ New” button in the upper left hand side of the screen.

Under the CUSTOMERS column click Sales Receipt.

For this example, I create a sales receipt for a $200 bathtub sold to “Stripe Customer.”

The most important part of this sales receipt creation is the “Deposit to” field should be an “Undeposited Funds” account. Undeposited Funds is an account used to temporarily hold funds.

Bank Deposit

The second step is to match the sales receipt with the deposit from the bank.

To do this click the “+ New” button in the upper left corner and in the OTHER column select Bank Deposit.

I select the account the sale will be deposited into, a checking account. Then check off the payment to include in the deposit.

QuickBooks still sees this as a deposit of $200.

To add the fee scroll down to the “Add funds to this deposit” section.

Under RECEIVED FROM I’ll enter Stripe. The ACCOUNT is usually where the money is coming from. In this transaction it’s not actually coming from anywhere but instead “going to” the Stripe fee. I’m using an expense account for this called Merchant Service Fees.

Make sure the amount you enter for the fee is negative, my fee is 3% of 200 or -6.00.

The total for this deposit is now the correct amount of $194.00.

Profit & Loss Report

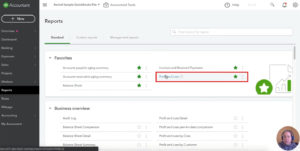

You can verify that this deposit has been processed correctly by checking the Profit and Loss report.

Click Reports in the left hand menu and select Profit and Loss.

You should see the service fee under Expenses.

If I click Services under Income I can see the sales receipt for the $200 bathtub.

You should do this process for any sale that includes a fee that isn’t recorded in the transaction downloaded from your bank.

For example a wire transfer with a $30-$40 fee would also be entered into QuickBooks this way.

You now know how to record deposits with fees into QuickBooks.

☕ If you found this helpful you can say “thanks” by buying me a coffee…

https://www.buymeacoffee.com/gentlefrog

If you’d like you can watch me walk through this process in the video below:

12 Responses

Hi Rachel, I have 2 issues. I have started helping a newly started church who uses QBO. Their bank account linked to QBO so donations received in bank are net of egiving fees. It is now year end I see the fees have not been accounted for all year. The donation and expenses are under reported. Each month has already been reconciled for 2020.

1) What is best way to record the gross fees now at year end and all months have been reconciled?

2) What is best way to handle recording fees going forward keeping in mind the donations are deposited by church (which are batched) are linked/posted in QBO net of fees? The church records and tracks donations by member in a stand alone software (Powerchurch).

Any help would be appreciated.

Hi Sheila, This is more than I can answer via a blog comment, maybe we can meet via Zoom to chat? https://www.gentlefrog.com/meeting/ ~Rachel

Hello and thank you for your assistance with this process. I’ve been away from QB and bookkeeping for several years and am super rusty.

I followed your instructions, entering expenses/fees within the deposit. For my purposes these are (tax deductible) expenses deducted from my gross settlement payment to net the correct deposit amount

Those expenses show up in their respective classes as they should. However, all three negative entries are hung up in Undeposited Funds. How should I rectify this please? I’m using QB Desktop if that matters/helps.

Hi Christine, unfortunately, I’m not sure how you got negative funds into undeposited funds. If you want to schedule a 15-minute meeting with Rachel, https://rachelbarnett.as.me/schedule.php, she can go over this with you and help you figure out what went wrong.

We’ll be adding a version of this video for QBDT to our list of videos to create in the near future. Keep an eye out for that!

Hi, I followed these instructions and although the Merchant Fees are being categorized properly, they are listed as deposits and not expenses. How do I fix this?

Hi Olivia,

If the Merchant Fees are being listed as deposits then they are being categorized as income when they should be categorized as an expense. You will want to create an expense category for them. If you need help with this we’ll be happy to walk you through it, a 15-minute meeting should do it: https://www.gentlefrog.com/meeting/

-Jess

Hello Ms. Barnett, I have spent hours abs hours on this seemingly simple issue. I feel like I understand your process but my question is: how do you clear out the transactions in the banking area. (Categorize, transfer, etc?) Are you just matching them to the sales receipts?

Hi Trina,

Clearing out bank feeds is not a one-size-fits-all process, unfortunately. We do have a blog post & video specifically on this topic, https://www.gentlefrog.com/how-to-code-banking-in-quickbooks-online/

But if you’ve spent hours on it and are still having issues I’d highly suggest scheduling a 30-minute session with Rachel or Erica: https://www.gentlefrog.com/meeting/

They can go through your bank feed with you and show you what to do.

-Jess

Hello Rachel,

New to QB Online and need help. How much are your services by the hour or 1/2 hour?

Hi Vicki,

You can see half-hour and hourly rates and schedule a meeting here: https://www.gentlefrog.com/meeting/

If you’re completely new to QBO Rachel has an excellent beginner QBO course at GoSkills: https://www.goskills.com/Course/Quickbooks-Online

-Jess

What do I do with the balance that is showing in Undeposited Funds if the money I previously received from Square was already deposited into my checking?

Hi Denae,

It sounds like you have duplicate income, this video will walk you through how to find it and fix it: How to Correct Duplicate Income in QuickBooks Online. If you need any help you can schedule a 15-minute meeting and Rachel can walk you through the process: https://www.gentlefrog.com/meeting/

-Jess