The Sales by Customer Summary Report

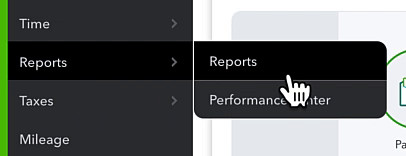

To get to this report click Reports in the left-side menu.

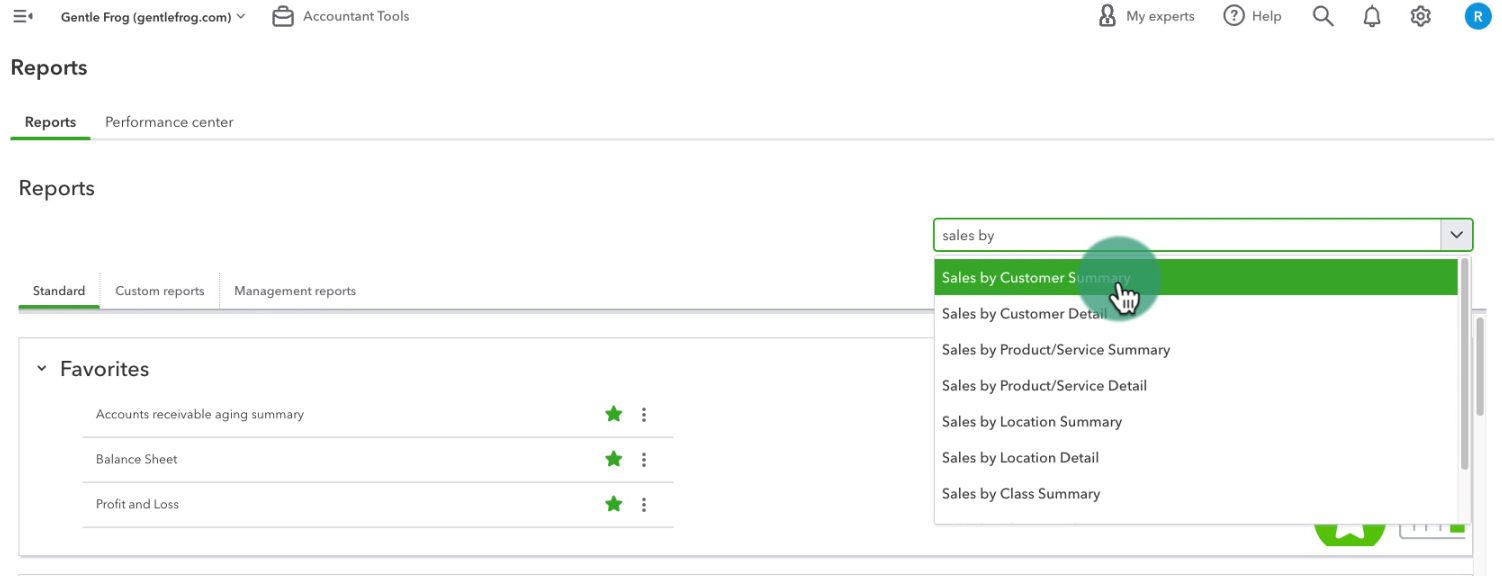

The fastest way to get to the report is to use the search box and search “sales by.”

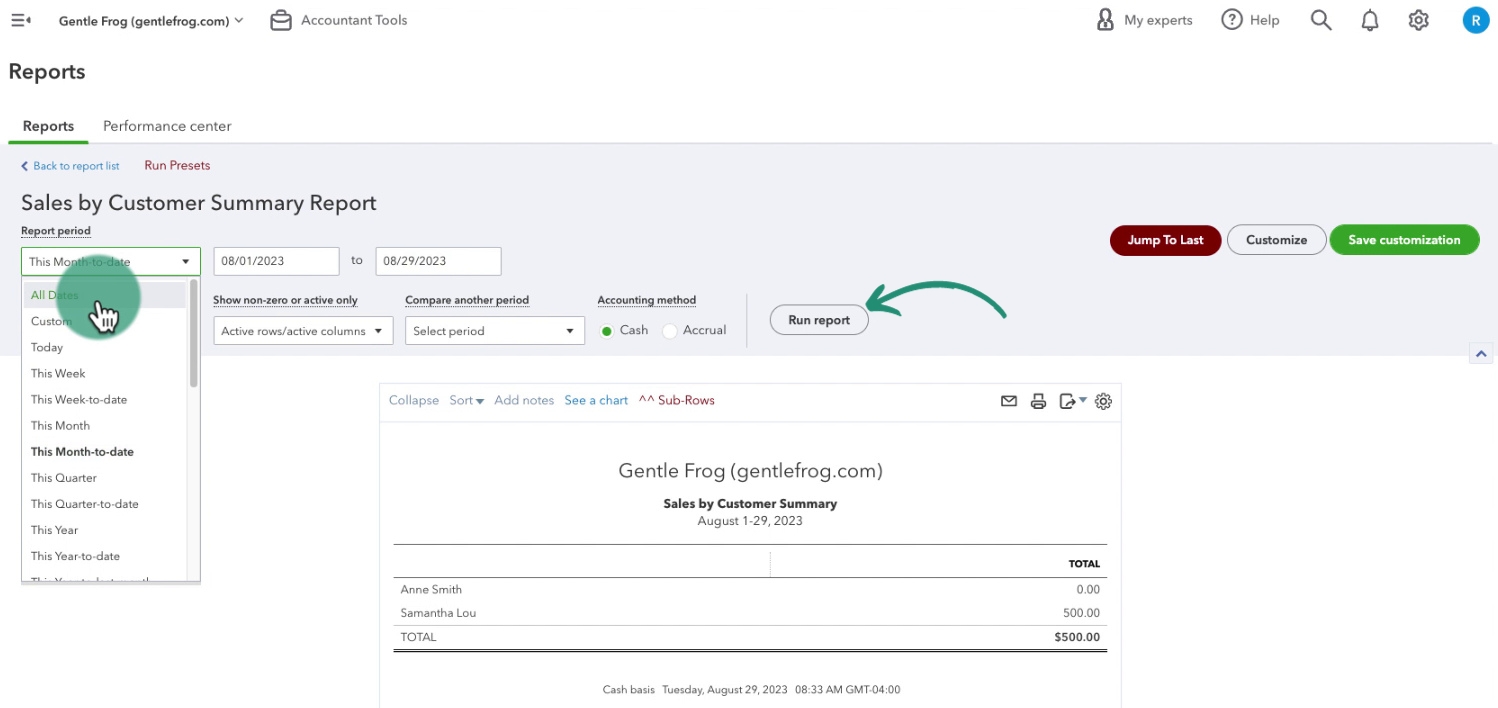

For this demo, I adjust the Report period to All Dates and click the Run report button.

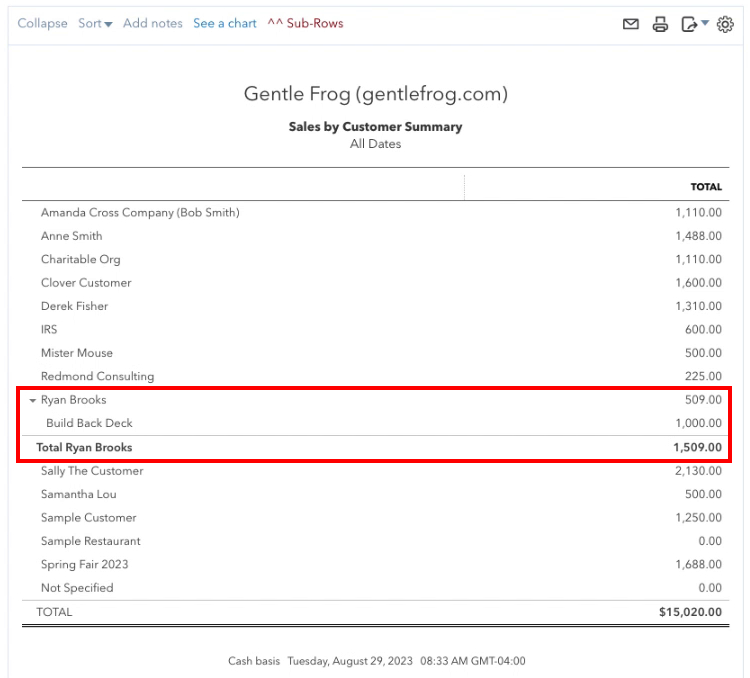

The report is now showing me a list of customers with a total dollar amount to the right.

The report is now showing me a list of customers with a total dollar amount to the right.

Subcustomers & Jobs

When you first run the report it will list any subcustomers or jobs underneath their parent customer.

The parent customer has an arrow to its left which you can click on to collapse it down so it only shows the parent.

Sorting the Report

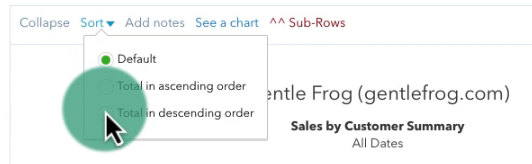

At the top of the report is a Sort drop-down menu. You have the options for

- Default

- Total in ascending order

- Total in descending order

I like to sort the report by Descending so I can see my top-paying customers at the top of the report.

Limitations of the Sales by Customer Summary Report

This report shows you a total of how much you’ve collected from your customers. It uses invoices, sales receipts, credit memos, and refunds.

It DOES NOT account for deposits. If you use a bank deposit to record sales for a customer it will NOT show up on this report.

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

Below is a video if you prefer to watch a walkthrough.

If you have questions about the reports in QuickBooks Online click the green button below to schedule a free consultation.