If you’ve ever changed your email in QuickBooks Online and assumed it would update across all Intuit services… I get it.

I did the same thing. But recently, I learned the hard way that updating your email in your Intuit account does not update it in QuickBooks Payments (aka Merchant Services).

Here’s what happened, and what you need to do to avoid the same headache.

Why This Matters: A Quick Personal Story

A few weeks ago, I had a frustrating phone call with Intuit Merchant Services. They were withholding my funds, and I couldn’t figure out why.

Turns out, they’d sent notifications, just not to the email I was checking.

I had updated my email in QuickBooks Online, thinking that would take care of everything. But nope.

My Intuit Merchant Services account still had the old email. Even though I still had access to both emails, I missed important notices because I didn’t realize I needed to update the email address separately.

Let’s walk through how you can avoid this.

Step-by-Step: How to Update Your Email in Intuit Merchant Services

If you’ve recently changed your email, or you’re thinking about doing it, take a moment to double-check your merchant account settings. Here’s how to update it:

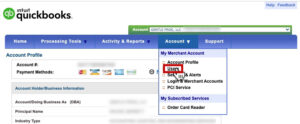

Log in to Intuit’s Merchant Service Center: https://merchantcenter.intuit.com

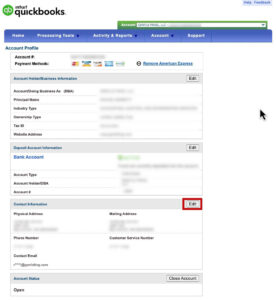

In the Account Self-Service box, click on Edit Business info, Deposit Bank Account, or Contact info

Click Edit on the Contact Information box

Enter your updated email address and save

Does This Sync to Other Intuit Products?

According to the support person I spoke to, updating your email here should update it everywhere else in your Intuit ecosystem.

But, and this is a big but, I don’t 100% trust that. I’ve had too many weird experiences with Intuit services not syncing as expected.

So here’s what I recommend:

If you’re updating your email in one place, update it everywhere. That includes:

Your main Intuit account

QuickBooks Online user settings

Merchant Services

Any connected payroll or third-party apps

Bonus Tip: Check Who Has Access to Your Merchant Account

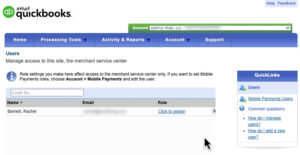

While you’re in your Merchant Service Center, take a minute to review who has access. I’m not being dramatic when I say this can be eye-opening.

Here’s what to do:

- Click on Click to assign in the Roles column to edit a users access

When I did this, I found all kinds of people still listed. People I hadn’t worked with in years. Some hadn’t had access to my QuickBooks in a decade, but they still had merchant account permissions.

Removing someone from QuickBooks doesn’t automatically remove them from your merchant account. That’s a big deal, especially if you handle sensitive transactions.

If someone no longer needs access, remove them.

This helps keep your business information secure and avoids accidental issues (or worse, intentional misuse).

Final Thoughts

This might seem like a small detail, just an email address, right? But as I’ve learned, small details in the Intuit ecosystem can have big consequences.

If you’re updating your contact info, don’t forget about your merchant account. And while you’re at it, clean up your user list. It’ll save you a lot of frustration down the road.

Need Help?

If you’ve run into similar issues or just need someone to walk you through managing your QuickBooks accounts, I can help. Book a one-on-one session and we’ll make sure everything’s set up properly and securely.