In this blog post, I’ll show you how to reconcile a credit card in QuickBooks Online. Specifically a credit card with sub accounts.

I’ll be using a fake bank account and fake statements so some things might look a little weird. But the instructions are valid.

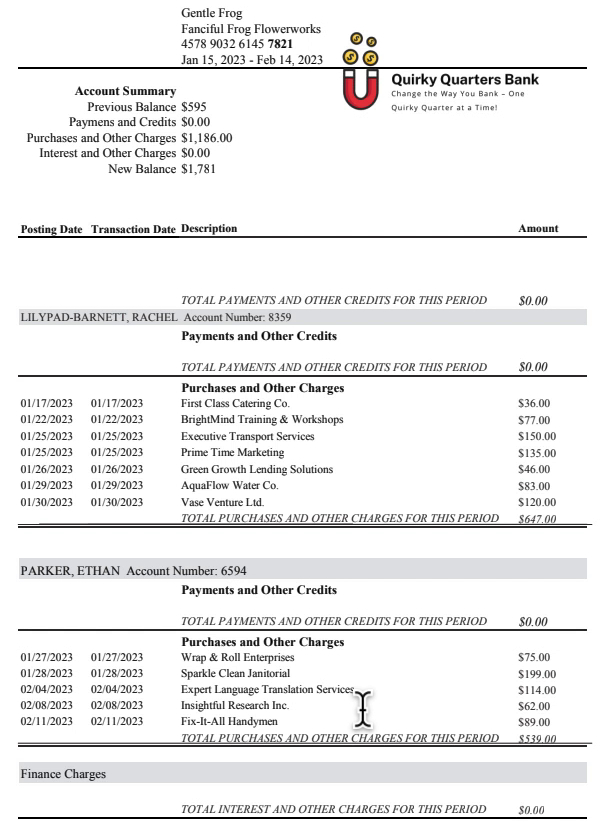

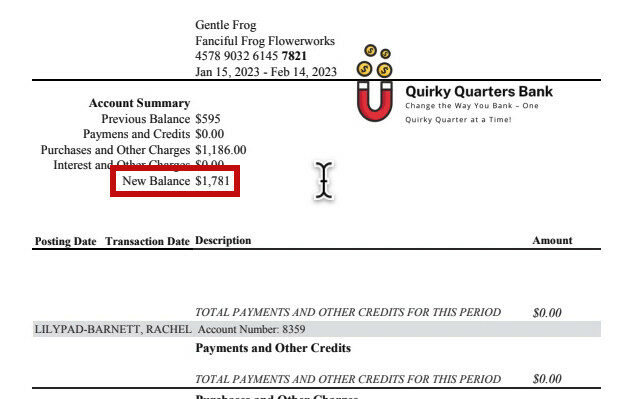

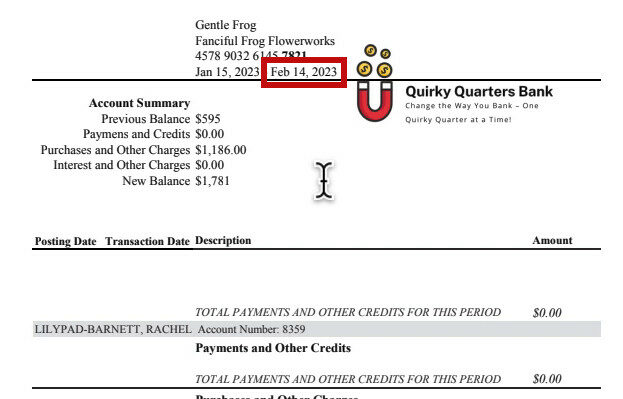

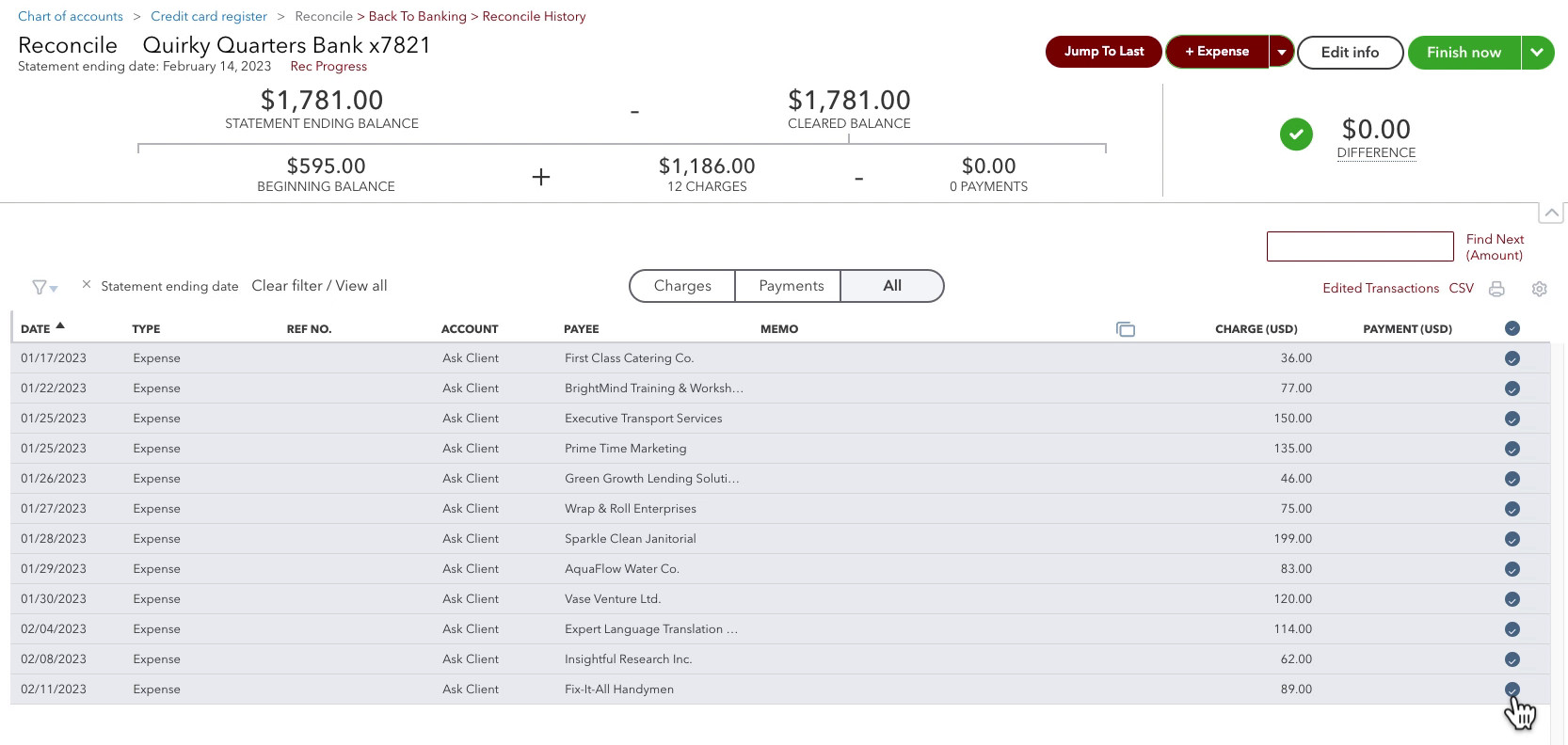

Here is the statement I’m working from. It’s a parent account x7821, with two sub accounts, x8359 and x6549.

Quick Instructions:

- Click Transactions -> Reconcile in the left side menu

- In the Account drop-down select the parent account

- Enter the Ending balance and Ending date on the statement

- Click Start reconciling

- Go down the list of transactions for each sub account, checking them off in QB as you go

- The difference should be $0.00, click the Finish now button

Keep reading for a complete walkthrough with screenshots:

Reconcile

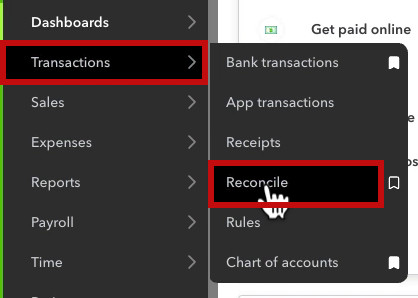

To get to the Reconcile screen in QuickBooks Online click Transactions in the left side menu. Then click Reconcile.

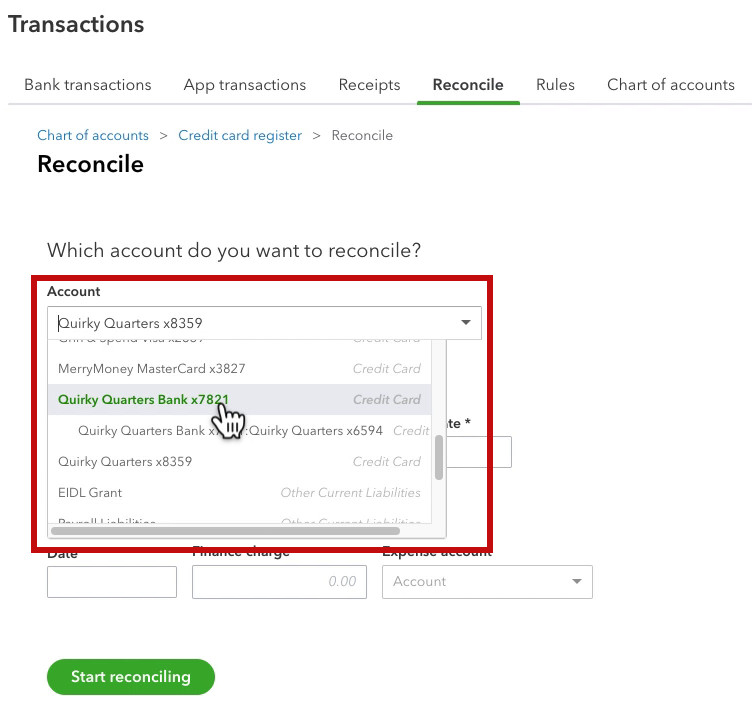

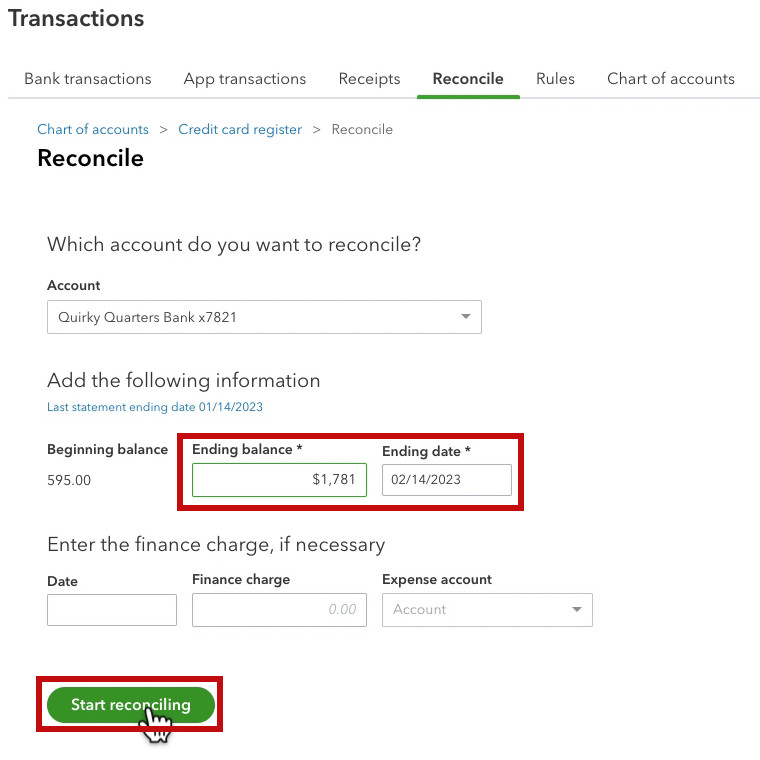

From the Account drop-down menu select the account to reconcile.

I’m selecting the parent account, not the sub account.

Fill in the Ending balance and Ending date from your statement.

In my example statement, the Ending balance, $1,781, is in the Account Summary section of the statement.

In my example statement the ending date, 2/14/2023, is found at the top of the statement.

When the Ending balance and Ending date are filled in select the Start reconciling button.

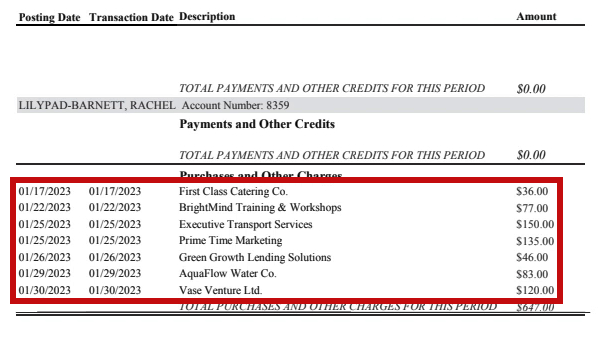

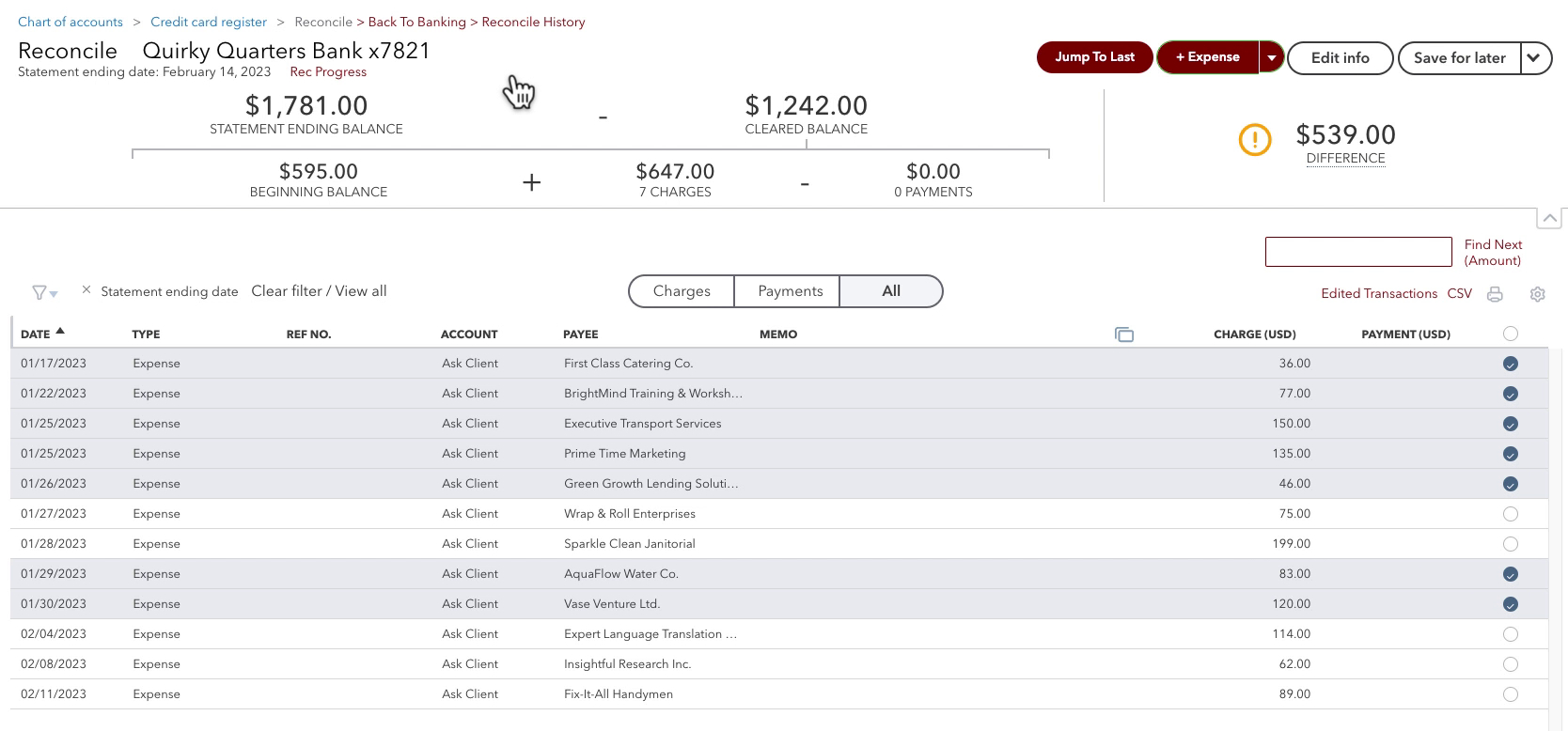

I’m going to look at the list of charges on the statement for the first credit card, x8159, and check them off on the Reconciling screen.

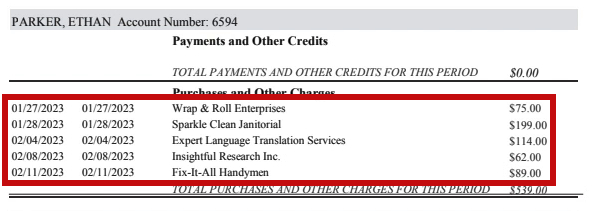

Now I’ll look at the list of charges on the statement for the next credit card, x6594, and check those off on the Reconciling screen.

The DIFFERENCE is now $0.00 so I can click the Finish now button in the upper right corner.

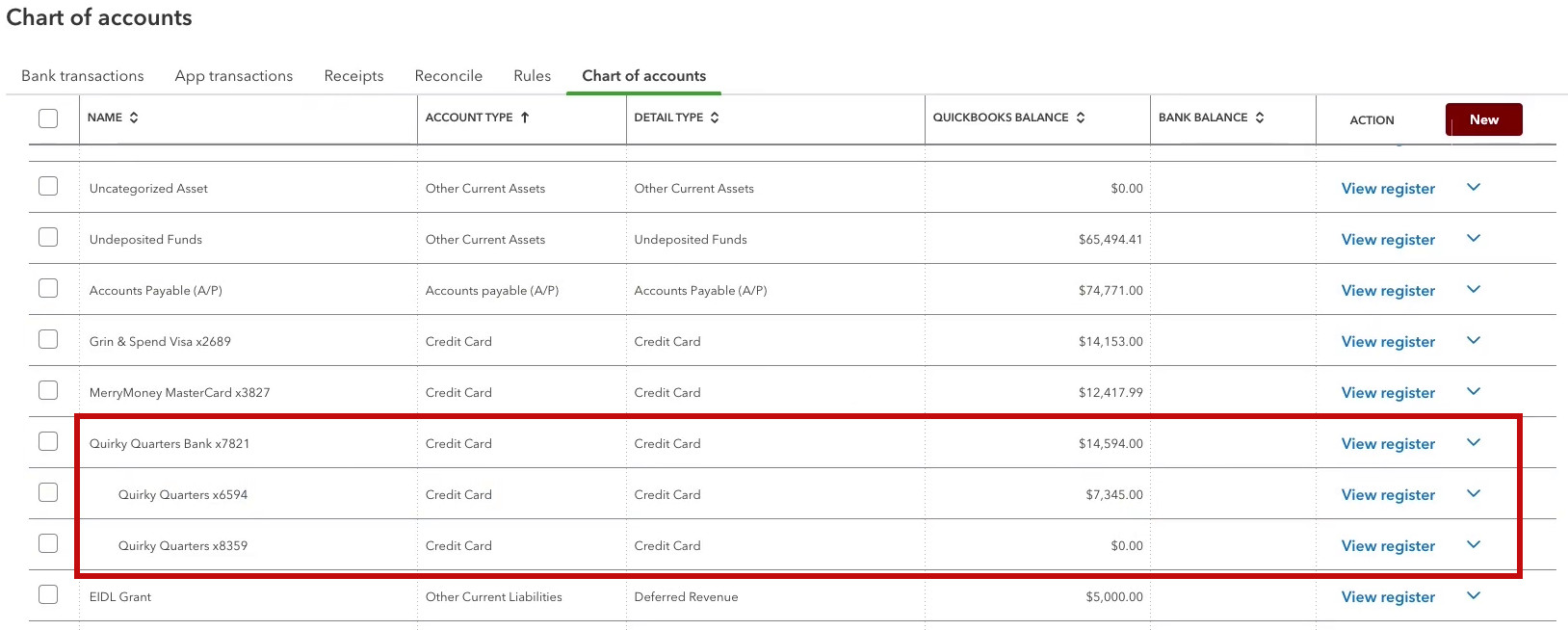

Chart of Accounts

On the Chart of Accounts the sub accounts will appear below the parent account and slightly indented.

When you view the register for each of the sub accounts they will show the charges for that account.

If you view the register for the parent account, it will show the charges for ALL the sub accounts.

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

If you have questions about setting up sales tax in QuickBooks Online click the green button below to schedule a free consultation.