Correcting Income Recorded Twice in QuickBooks Desktop

(once as a sale receipt/invoice and once as a deposit into the register)

Identify the sales recorded in the register as income (and not as a sales receipt or invoice payment). There are multiple approaches to this, I’m going to show you one.

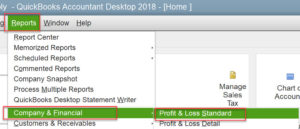

1: Generate the profit and loss report (Reports → Company & Financial → Profit and Loss Standard)

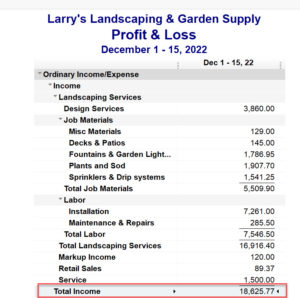

2: Double click the number (dollar amount) for the line called Total Income, this generates a list of all of the transactions in a given period of time that were posted to the income account. If you are also recording your sales as sales receipts or invoices, these will duplicate (increase) your income.

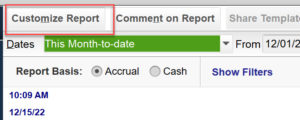

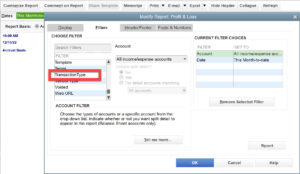

3: Click the customize report button (upper left corner)

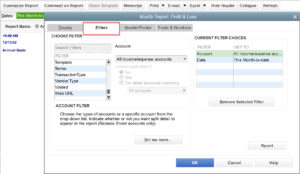

4: Click on the tab labeled filters

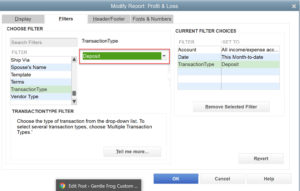

5: Scroll down for the filter called transaction type

6: To the right of this where it says all, replace all with deposit

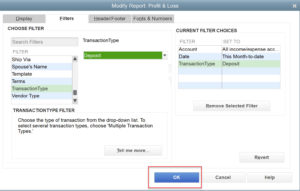

7: Click OK

Link the deposit with a previously recorded sale that is pending in undeposited funds.

1: Click on any deposit in the list you generated above.

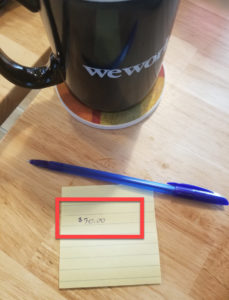

2: On a piece of scratch paper, write down the amount of this deposit

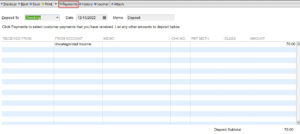

3: Click on the icon that says payments

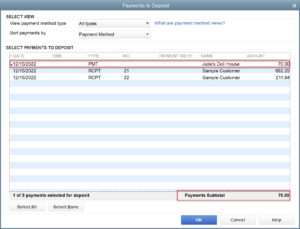

4: Click on the payment(s) that equal the deposit previously recorded

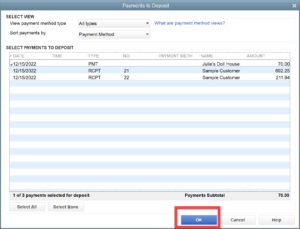

5: Click OK

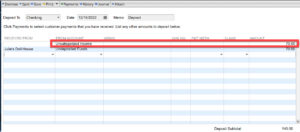

6: Click on the line that does not say “undeposited funds” for the account, this is likely to be the first line in the list. Delete all text from this line — the account, the amount, etc.

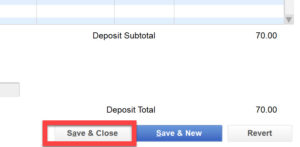

7: Confirm your deposit equals the amount you wrote down on step 2.

8: Click save and close

9: A message will appear “you have changed the transaction. Do you want to record your changes?”, click yes.

10: Repeat until no more deposits appear in the report you generated in the above set of steps.

☕ If you found this helpful you can say “thanks” by buying me a coffee…

https://www.buymeacoffee.com/gentlefrog